Summary

- Visa stock is in a downtrend in the last month.

- Fintech competition and valuations in question.

- Negative sentiment temporary.

After peaking at over $250, Visa (V) fell sharply when markets started paying attention to Fed Chair J. Powell’s tapering talk. Tapering and higher interest rates to combat growing inflationary risks sent the credit card giant to a downtrend. Mastercard (MA) did not fare any better. Since both firms have similar valuations and sizes, this article will focus primarily on Visa’s prospects.

Readers can get the two quick take points on why V and MA stock are performing poorly. Both stocks trade at a premium and Fintech is coming to challenge the incumbent credit card firms.

Valuation

Seeking Alpha’s quant score highlights the over-valuation risks in Visa. The stock scores an “F” on value. In return for buying the stock at unfavorable levels, investors get a highly profitable credit card giant. The stock scores an A+ on profitability.

Mastercard’s quant score is nearly identical to that of Visa stock. MA stock is slightly ahead in a growth score comparison. Since V stock trades at a price-to-earnings of 38.7 times, compared to 41.8 times for MA stock, Visa is worth a closer look instead.

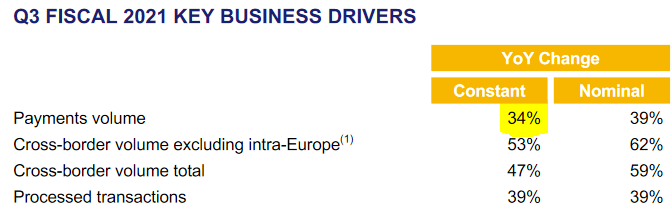

In the third quarter, Visa posted revenue growing by 26.7% Y/Y to $6.13 billion. Payment volume growth of 34% easily surpassed the 26.2% consensus estimate.

CEO Alfred F. Kelly, Jr. said Visa posted strong quarterly results because of:

credit and face-to-face spending bouncing back while debt and eCommerce volumes remained robust from accelerated cash digitization sparked by the pandemic.

Though this is historically an expensive stock, Visa continues to validate its worth. Markets are over-thinking the easing post-pandemic lockdown and discounting eCommerce volume growth. Yet cross-border travel spending is rebounding. Higher vaccination rates are allowing more border re-openings. This will accelerate Visa’s cross-border volume, lift transactions, and increase its revenues.

Growing Competition

SPACs (special purpose acquisition companies) allowed companies like SoFi (SOFI) to access public market funding sooner. Even though SoFi posted a 74.2% Y/Y growth in revenue, it still lost 48 cents a share. SoFi is a fintech that offers an all-in-one solution for customers. Visa relies on transaction growth for its revenue. SoFi is one of many examples of Fintech offerings that are a long way from challenging Visa’s market.

Digital transaction incumbents including PayPal (PYPL) and Square (SQ) also offer merchants and consumers alternatives to Visa. Neither firm is a direct competitor to Visa. In fact, Visa highlighted its co-branded relationship with PayPal in Australia on its conference call. PayPal announced instant transfers that enable merchants to settle transactions through Visa Direct in Australia. The more this service grows, the more it benefits Visa.

Digitization Risks Exaggerated

Investors should think of debit as the engine of cash digitization. As Vice Chairman and Chief Financial Officer Vasant Prabhu said, “structurally, debit is benefiting from cash digitization picking up, as well as the move to e-commerce.” Credit is accelerating, resulting in the biggest quarter-over-quarter recovery. Still, the return of the affluent customer to retail thanks to the reopening is a risk factor. The Covid-19 delta variant will undermine countries having too low a full vaccination level.

Fortunately, CFO Prabhu thinks that the credit market has a few more quarters of recovery left.

In Europe, open banking is an opportunity for Visa. The open banking platform is in 18 markets. It allows developers access to financial data. Visa announced that it acquired Tink in June to harness the connectivity around 3,400 banks and financial institutions, along with around 10,000 developers in Europe. Tink will accelerate Visa’s adoption of open banking in Europe. After that, it could expand globally to regions like Asia and CEMEA (Central and Eastern Europe, Middle East, and Africa).

Risk

Visa’s stock chart currently indicates a negative sentiment risk. Markets decided to sell off financial institution and credit services stocks ahead of growing inflationary pressures. Chances remain very low that the Fed will increase rates soon. Should Visa stock continue to fall at close to the 200-day moving average of around $220, investors should consider building a position.

Your Takeaway

Visa traded at premium valuations for many years. This time is no different. The month-long sell-off looks ugly on the chart. As it has in the past, the bearishness will end as the stock bounces back from key moving averages. Investors looking for a Fintech play should consider starting with buying Visa stock first.

Comments