With the midterm elections underway today, investors are eyeing if Republicans could win back control of government and more effectively stop any and all legislation that could rattle markets.

"Gridlock, you've seen, has been pretty good for the markets," Maslansky and Partners president Lee Carter on Yahoo Finance Live. "I think people are predicting that at least that's the direction we're going to go. And when we've talked to Republicans who are running, ... what we're going to do from between now and 2024 is just stopping Biden's agenda."

Recently, stocks are trading as if the Republicans — usually seen as pro business and markets —will make substantial progress.

The S&P 500 has climbed nearly 5% in the past month despite a flurry of downbeat earnings reports from the likes of Amazon, Meta and many others.

Investors may be right to be on the bullish side of the ledger.

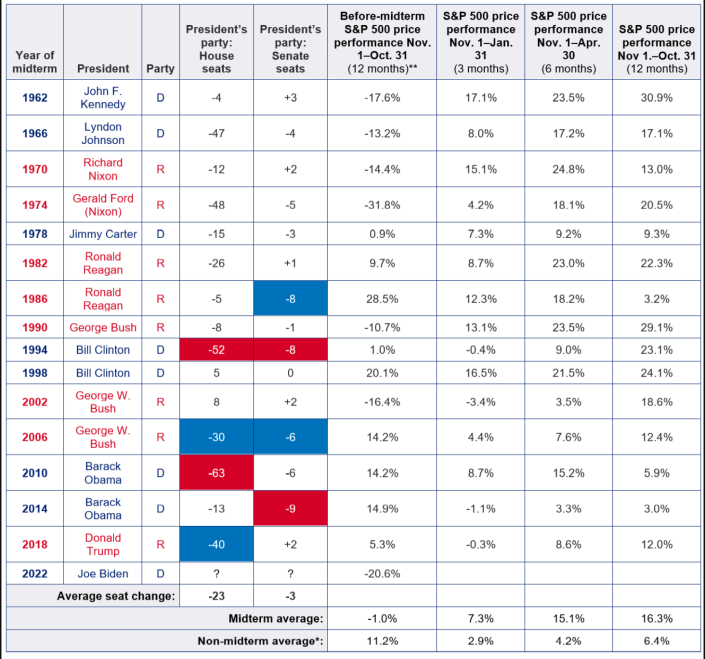

The S&P 500 has historically outperformed the market in the 12-month period after a midterm election, with an average return of 16.3% per data from US Bank. This is especially the case for the one and three month periods following the midterm elections, as the below graphic shows.

Comments