Equity markets may be rallying after weeks of dismal performance, but that hasn’t stopped investors from exiting the largest U.S.-listed ETF.

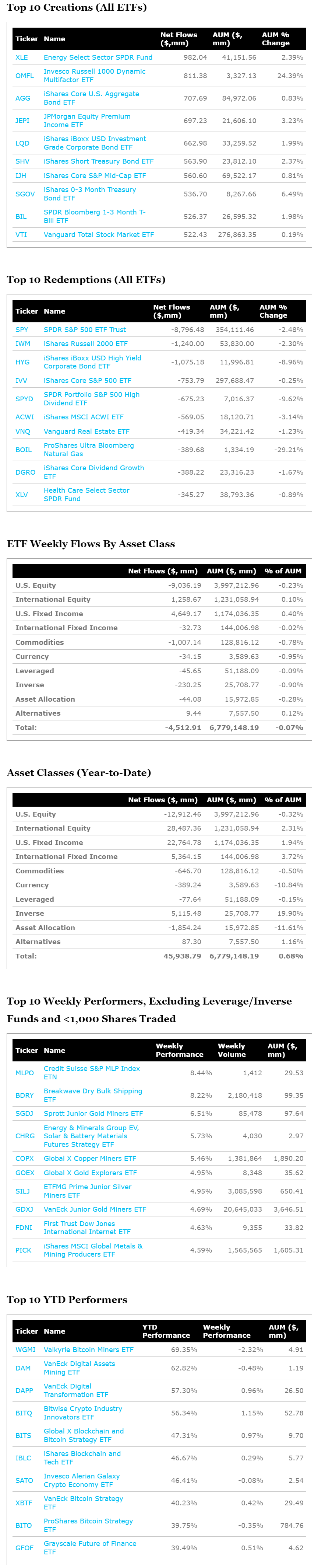

Almost $8.8 billion escaped the SPDR S&P 500 ETF Trust (SPY) last week, despite the ETF’s underlying index notching 1.5% in gains. That’s the largest outflow from the $360 billion fund since September 2020, according to Bloomberg data. Year to date, the oldest U.S.-listed ETF has lost $17.1 billion, according to ETF.com data.

The losses are also reflected in U.S. equity ETFs overall, which saw $9 billion exit in the week ending March 3, according to ETF.com data. That’s compared with the $6.2 billion in outflows the asset class saw the week prior. Other top shedders include the iShares Russell 2000 ETF (IWM)iShares Core S&P 500 ETF (IVV).

On the other side of the ledger, U.S. fixed income ETFs pulled in $4.6 billion, up 13.5% from the asset class’ $4.1 billion gain the week prior. Top gainers included the iShares Core U.S. Aggregate Bond ETF (AGG),iShares iBoxx USD Investment Grade Corporate Bond ETF (LQD)iShares Short Treasury Bond ETF (SHV).

The inflows come as Treasury yields retreated after hitting their highest point in years, some in more than a decade. The yield on key Treasury notes, such as the 10-year and two-year, hit 3.98% and 4.89%, respectively. Yields rise as prices fall.

For a full list of last week’s top inflows and outflows, see the tables below:

Comments