Moody’s lowers outlook on several major Chinese lenders, in lockstep with its earlier cut on China’s rating outlook

Government reports this week may show exports growth stalled in November, while consumer and producer prices shrank

Hong Kong stocks slipped, revisiting a 13-month low, before an official report that may show China’s exports growth stalled last month. Chinese banks dropped after Moody’s lowered the outlook on major players, in lockstep with its recent cut on the nation’s rating outlook.

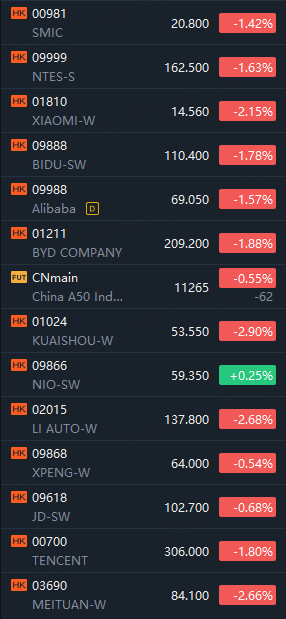

The Hang Seng Index retreated 1.76 per cent to 16,172.97 at 10:52am local time, heading for the lowest close since November last year. The Tech Index dropped 1.88 per cent.

Elsewhere, Alibaba Group slid 1.6 per cent to HK$69 and Tencent lost 1.8 per cent to HK$306.

Bank stocks have suffered a beating in recent months amid concerns Beijing is heaping pressure on them to help ease a liquidity crisis faced by the nation’s property developers, putting their asset quality at risk. Goldman Sachs downgraded ICBC, Agricultural Bank of China and Industrial Bank in July on dividend pressure.

Meanwhile, China will release its external trade data for November today. Overseas shipments probably showed no growth, after six straight months of contraction, according to economists tracked by Bloomberg. Consumer and producer prices likely fell again last month, other reports over the weekend may show.

The Hang Seng Index has dropped 18 per cent this year, making it the worst performer among the world’s key benchmarks this year, erasing about US$630 billion of market value through this week. The sell-offs have led to a slew of stock buy-back plans from Meituan, WuXi Biologics and Swire Pacific to help stem the rout.

Other major Asian markets all fell. Japan’s Nikkei 225 slipped 1.1 per cent, while South Korea’s Kospi retreated 0.4 per cent and Australia’s S&P/ASX 200 lost 0.2 per cent.

Comments