Summary

- Coinbase is a leading cryptocurrency exchange with an attractive business model, however, the near-term risks outweigh the rewards.

- As crypto enters a bear market, trading volume is falling off, making consensus estimates difficult to meet.

- Over the long term, competition should significantly reduce the company's trading fees.

Coinbase Global (COIN) is a high-risk, high-reward investment, with near-term risks skewing negatively. This is because we are in a crypto bear market, which should dampen trading activity. However, consensus estimates remain elevated, although there is little visibility in Coinbase's business model. While I am bullish on cryptocurrencies over the long term, Coinbase may see its high fees competed away by large centralized exchanges such as Binance, startups, and decentralized finance.

This article will discuss COIN's business, financials, trading & valuation, and risks so readers could reach their own informed decision.

(Note: Unless otherwise noted, all forecasted financials refers to consensus estimates and all historical financial data comes from the company.)

Business

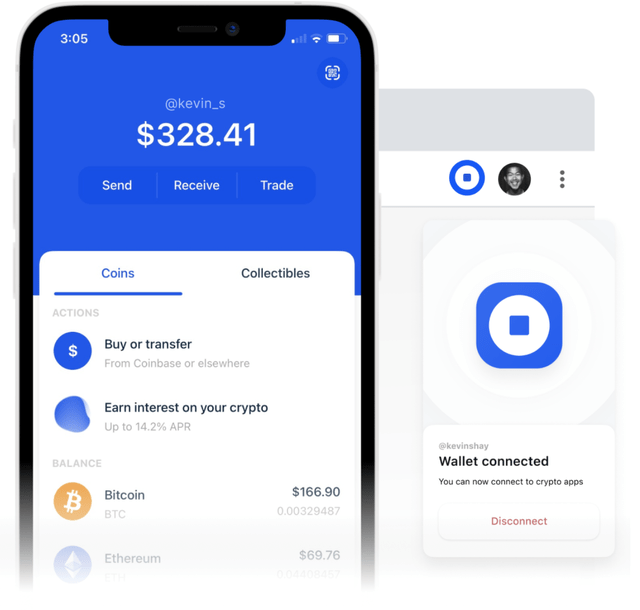

The company is the fifth-largest cryptocurrency exchange by traded volumes globally, and the preeminent trading platform for cryptocurrencies in the U.S. As one of the first successful movers in the industry, the firm has established itself as a trusted leader in the crypto-economy. The company serves as an online broker, exchange, and custodian for cryptocurrency trading through its Coinbase, Coinbase Pro, Coinbase Wallet, and other products.

As a broker, Coinbase provides accounts for retail and institutional clients to deposit fiat or cryptocurrencies. Coinbase securely custodies these crypto-assets, including protection of private keys, which could control the flow of these assets. Clients could then trade on its exchange for cryptocurrencies or fiat.

While the company is aggressively diversifying its business, over 85% of its revenue comes from trading commissions. Coinbase facilities trading in around 65 different cryptocurrencies around the clock, which means nervous investors could panic sell Bitcoin (BTC-USD) and most of the major cryptocurrencies at 2 am on Christmas.

Historically, trading commissions are highly correlated with the price of Bitcoin. For example, in Q1 2018, the quarter when the last Bitcoin bubble popped, $56 billion wastradedon the Coinbase platform. By Q1 2019, only $7 billion was traded on the platform, a nearly 90% decline.

Trouble is brewing ahead for Coinbase. After topping out in April 2021 at around $64,000, Bitcoin fell below $35,000 in May and traded below that level for most of the past 30 days. Any asset that got cut in half and is trading in a down channel is in a bear market. While we are experiencing a small rally currently, the positive momentum will have to persist to attract incremental capital again. According tothecryptoblock.com, Coinbase's 7-day average trading volume has fallen from a peak of around $9 billion in May 2021 to around $1.5 billion as of July 25, 2021 - a decline of over 80%.

The volatility and valuation of cryptocurrencies make for volatile exchange revenue. This is why Coinbase is diversifying to other products and services. These new revenue streams are reported as new products and services and generated $56 million of sales in Q1 2021 (out of $1.8 billion total revenue).

Diversification also supports COIN's goal of becoming the primary financial account of the crypto-economy for users. One way to become the primary financial account is through Coinbase Wallet, its sub-custody product that allows for controlling customers' own cryptocurrencies with access to the private key. The company can monetize this product by helping users route trades to exchanges that offer the best prices while taking a fee on top of any such trades. Crypto wallet MetaMasks recently did exactlythisand is already run-rating $100,000 of revenue per day.

The Coinbase Wallet could also connect with third-party applications such as those in decentralized finance (or "defi"). More integrations mean stickier customers and assets in the Coinbase ecosystem, as it increases the switching cost.

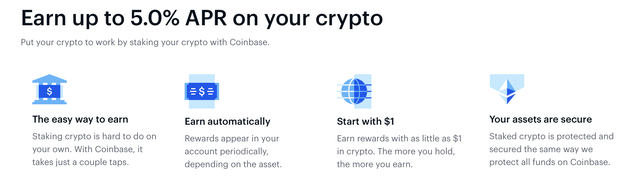

Another important new product is staking, with over 1 million customers already participating. The value proposition for staking is that customers could get much higher yields staking their cryptos than they could with traditional savings instruments like CDs, and Coinbase makes the process easy for retail investors. A big catalyst for staking is the coming launch of Ethereum 2.0, which would enable ether (ETH-USD) holders to earn a return. There is currently awaitlistof customers at Coinbase eager to do so.

Other interesting revenue opportunities include charging institutional investors for custodial services and license revenue from Coinbase Analytics.

Financials, Trading & Valuation

Sell-side consensus is forecasting revenues to grow by 384.3% this fiscal year, reaching $6.2 billion, and to contract by 9.2% the following fiscal year, reaching $5.6 billion. A big driver of this dynamic is the explosive growth in users and trading volume through Q1 2021 as the crypto market peaked. Q1's revenue of $1.8 billion is more than 2020's entire year revenue of $1.3 billion. However, we are currently in a crypto bear market, and comps will be tough, making continued growth difficult in the near term. In addition, I believe that 2021 estimates are way too high, given the large drop in trading volume.

Consensus is forecasting EBIT margin to expand by 923 basis points this fiscal year to 41.2% and contract by 879 basis points the following fiscal year to 32.5%. The company plans to significantly ramp up sales and marketing to 12-15 of revenue, up from around 5% historically. If trading commission drops due to the bear market, the company is unlikely to meet consensus forecast of expanding margins this year.

Going forward, consensus is forecasting EPS to increase by 414.4% to $8.11 this fiscal year and decrease by 34.4% to $5.32 the following fiscal year. Again, meeting this estimate will largely depend on the company's trading commissions.

The company is in excellent financial condition with nearly $2 billion in cash and no debt. Note: the company has crypto borrowings but is offset by crypto assets.

The stock does not pay a dividend compared to a dividend yield of 1.3% for the S&P 500.

Going public on 4/14/2021, the stock has been trading for less than one year, and trading sentiment has been poor. The stock is trading 11.5% below its 200-day moving average, 48% below its 52-week high of $429.54, and 8% above its 52-week low of $208.00 per share. Short interest is moderate at 3.6% but rising rapidly.

For a stock expected to grow EPS by over 400% in 2021, the stock is only trading at 34 times earnings. However, given the crypto bear market, consensus estimates may be difficult to achieve. Given the incredible volatility of Coinbase's earnings, valuation metrics may fluctuate wildly.

Risks

Competition is fierce, which could result in material fee pressures as the industry matures. For example, Robinhood offers free crypto trading, whereas Coinbase charges retail investors nearly 1.5% on average. (Note: you can't move your cryptos off of Robinhood for self-custody unless you are an accredited investor.)

Although Coinbase is a giant among US crypto investors, Coinbase is a relatively small player globally. For example, centralized exchange leader Binance is doing approximately 10x Coinbase's dailyvolume. In addition, there is an emerging threat from decentralized exchanges such as Uniswap and Sushiswap. Uniswap's daily volume is ~ 2/3 that of Coinbase, and the gap is closing rapidly.

Centralized exchanges like Coinbase threatens one of the important functions of cryptocurrencies: giving people a decentralization, permissionless, self-custodied internet of value. Coinbase is more like a traditional financial institution that serves as a middle man collecting rents on the crypto-economy while fully complying with governments who issue the fiats that crypto is trying to disrupt.

Besides being good on and off-ramp for fiat, centralized exchanges like Coinbase may not be an attractive option for crypto purists. Decentralized exchanges like Uniswap execute trades through smart contracts on the blockchain and embody cryptocurrencies' true vision. In addition, Uniswap offers very attractive swap fees, which can be as low as 0.05% for popular pair trades such as ETH and USDC (USDC-USD).

Another major risk is the uncertain regulatory environment. Recently, China has aggressively crackdown on cryptocurrency activities, especially mining, while most major countries plan to introduce more regulation to tame the industry. However, Coinbase enjoys an advantage here by having a strong relationship with regulators, which gives them a role in shaping the regulatory environment. In particular, Coinbase has a competitive regulatory advantage in the Anglo-sphere, where the US andUKhave cracked down on its biggest competitor, Binance.

Takeaway

Trading volumes have dropped precipitously, making it difficult for the company to meet elevated consensus estimates. In the long-term, competition will likely pressure the company's high fees.

I look forward to discussing COIN with you in the comment section below. Thank you for reading!

Comments