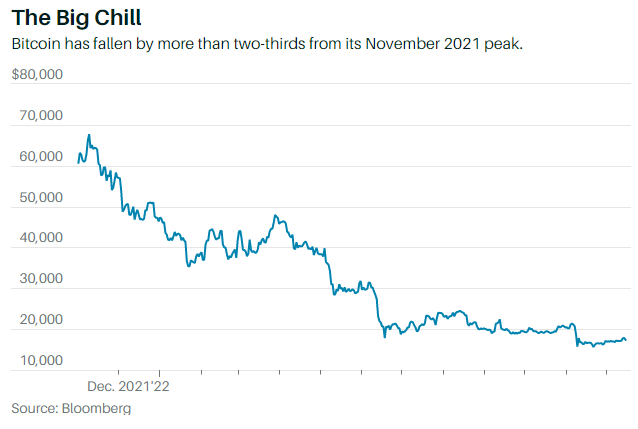

For crypto investors, the only thing to celebrate about 2022 is that it is almost over. The industry is fighting for its life amid a cascade of scandals, bankruptcies, and fury in Washington over its freewheeling, if not fraudulent, ways. Bitcoin has lost 67% since late 2021. The token market is down by $2 trillion in the same span—one of the biggest financial bubbles to burst in history.

The carnage may continue. The bankruptcy of FTX and the criminal indictment of its founder, Sam Bankman-Fried, is likely to continue causing aftershocks well into 2023. Several crypto companies have frozen customer deposits due to exposure to FTX.BitcoinBTCUSD-2.10%has been rising lately as inflation appears to be easing, giving so-called risk assets a boost. But the macro forces that have pressured crypto all year—including higher interest rates and tighter global money supply—aren’t going away.

“We’re not out of the woods,” says Katie Talati, director of research at digital-asset investment firm Arca. “Crypto has never been alive in an environment like this.”

Industry backers say this is just a cyclical downturn that will set the stage for a recovery to new heights. It occurred in 2018 when a “crypto winter” took Bitcoin down more than 75%, followed by gains of more than 2,000%.

Indeed, there is a bull case that goes like this: A year from now, the industry’s bad actors, dodgy tokens, and shady companies will have been flushed out. Embarrassed and outraged over FTX’s collapse, Washington will establish sweeping rules that will bring investors back in. Once more heavily regulated, U.S.-based exchanges and companies, including firms likeCoinbase GlobalCOIN-5.50%(ticker: COIN), will emerge as winners, building out diverse revenue streams in retail and institutional services.

Blockchain technology will also step up, proponents claim. Apps and services built on those networks will prove their merit for things like cross-border transactions, digital-asset rights, videogaming, and decentralized financial, or DeFi, services. Bitcoin will revive as its supply issuance declines with another “halving” event, scheduled for March 2024, according to its software rules.

“It’s so infuriating because nothing that happened with FTX had anything to do with blockchain and crypto other than the fact that they happened to be crypto assets,” says Denelle Dixon, CEO of the Stellar Development Foundation, which supports a decentralized payments protocol.

Yet for this narrative to take hold, crypto will have to overcome steep hurdles. Indeed, while some call the recent downturn another crypto winter, the more appropriate metaphor may be an ice age.

One looming challenge: reputational damage from FTX that won’t be mended soon.

The U.S. attorney leading the prosecution of FTX, Damian Williams, described the collapse as “one of the biggest frauds in American history.” Gary Gensler, chair of the Securities and Exchange Commission, called FTX a “house of cards.” John Ray, the CEO of FTX overseeing its liquidation, described it as“old-fashioned embezzlement.”Bankman-Fried, now in jail in the Bahamas and fighting extradition to the U.S., has said he didn’t knowingly defraud anyone.

In addition to criminal charges, Bankman-Fried is beingsued by the SECand the Commodity Futures Trading Commission.

Making matters worse is that FTX was the culmination of several crypto companies collapsing and leaving a trail of destruction. Swaths of the industry unraveled in 2022, including thehedge fund Three Arrows Capital, the Terra/Luna stablecoin, and crypto lendersVoyager Digital, Celsius Network, and BlockFi—the last three all now in bankruptcy.

The interconnectedness of crypto has also proved to be problematic. As FTX imploded, Genesis Global, a prime brokerage and lending company, paused withdrawals at its lending unit. That, in turn, caused Gemini, a brokerage and lender, to freeze redemptions on its “earn” platform. Both companies say they’re working on solutions to resume normal operations.

Some observers say the entire industry is fatally flawed, comparing it to a multilevel marketing or Ponzi scheme. “I see it as a Ponzi because it depends on new influxes of cash to sustain itself,” says John Reed Stark, former chief of the SEC’s Office of Internet Enforcement. “As soon as there’s a bank run, there’s never enough cash to meet withdrawal requests.”

The argument that crypto could now be saved by a regulatory push from Washington has become a compelling narrative, but it isn’t without holes. FTX’s collapse is catalyzing momentum in Congress to establish meaningful rules to protect investors and consumers. Several bills have been drafted and could come up for votes in 2023, including measures to safeguard customer assets at exchanges, define some tokens as securities, and require issuers of stablecoins—tokens pegged to a dollar—to maintain 100% cash reserves and banklike insurance for the products.

Also up for debate is who will ultimately regulate crypto—the SEC or the CFTC, the latter viewed as far more friendly to the industry.

Either way, the SEC is likely to continue regulating the industry by enforcement—charging companies with violating existing securities laws. The agency has prevailed in more than 100 actions against crypto companies so far, winning nearly every case. It has several actions under way that could result in settled case law establishing rules if Congress doesn’t write new ones.

“Ultimately, the SEC has got to bring contested enforcement cases and do its best to enforce the law,” says Tyler Gellasch, a former SEC counsel who now heads Healthy Markets, an institutional investor trade group.

Yet while the industry supports regulation in principle, it has a history of opposing rules and regulatory actions. It tried to block aspects of new Internal Revenue Service tax-reporting requirements for individual transactions. Industry groups also opposed the Treasury Department’s designation of a coin “mixer” calledTornado Cashas a criminally sanctioned entity, arguing that the government was setting a dangerous precedent by trying to ban autonomous software code.

“Whenever they get a new regulation, they fight it,” says Stark, who doesn’t expect meaningful Congressional action on crypto in the next year.

Some industry insiders say it’s important to keep in mind what FTX was—and wasn’t. It was primarily an offshore-based exchange that handled derivatives, a highly complex area that’s very different from the spot markets where most retail investors transact. FTX’s collapse doesn’t have any bearing on the merits of blockchain technology, including development of “programmable money” and DeFi systems for trading, lending, and other services, says Matt Hougan, chief investment officer of Bitwise Asset Management, a crypto index fund and asset manager.

“It doesn’t disrupt how disruptive crypto is and could be as a new technology,” he says. FTX’s collapse could accelerate crypto’s long-term adoption by bringing more regulation into the space, he adds, “which is something that true believers in crypto welcome.”

The Outlook for Bitcoin and Crypto Stocks

The first place to look for signs of a recovery is in Bitcoin. The token is like the iPhone of crypto, its largest and most recognizable product. While other blockchains and tokens have emerged, notablyEthereumETHUSD-4.05%, Bitcoin is still the standard-bearer, and its recovery will be necessary to lift revenue across exchanges and companies built around it.

Bitcoin has had a rough year, however, partly because its rationales for existence have taken blows. Its price collapsed while inflation surged, undermining the argument that it’s a solid store of value against fiat currencies being devalued. The idea that it can’t be confiscated by governments has held up. But many investors own Bitcoin through a brokerage, exchange, or lending platform, several of which have frozen withdrawals or gone into bankruptcy, forcing customers to line up as creditors.

Bitcoin has also become more vulnerable to macroeconomic forces, undermining arguments for owning it as an alternative asset. Bitcoin’s correlation to stocks grew tighter over the past year. When Federal Reserve Chairman Jerome Powell gave a speech in August vowing to slay inflation, for instance, theS&P 500SPX-2.49%index plunged 3.3% in a day, while Bitcoin dove 6.2%. Conversely, it had rallied lately on signs of monetary easing.

“You have to assume it’s going to trade with most risk assets for the foreseeable future,” Talati says.

Hougan argues that as the macro climate normalizes, it will provide an “enormous tailwind” for all risk assets, including crypto. “Once you see money move back into risk assets, crypto has huge potential,” he says.

For now, though, there are no signs of it easing as central banks worldwide continue to raise interest rates, albeit at a slower pace than earlier in 2022.

Against that backdrop, the outlook for crypto stocks looks rocky. Coinbase, for instance, has proved to be highly correlated to Bitcoin—it needs the token to revive, encouraging more retail investors to dip into the crypto ecosystem, open accounts, and trade. Without strength in Bitcoin, Coinbase’s revenue has fallen. The firm last month said revenue from trading fell 44% in the third quarter, compared with the second quarter. The company expects overall revenue this year to be less than half that of 2021.

More than two-thirds of analysts now rate Coinbase a Hold or Sell. They aren’t just bearish because of Bitcoin. “The vast majority of revenue that Coinbase earns today is via charging relatively high fees on retail users,” says Mizuho analyst Ryan Coyne, who downgraded the stock in December to Underperform. “As their costs stand now, they’re losing money every day.”

Coinbase’s bondholders also appear bearish. The company’s debt issues have fallen below 60 cents on the dollar since FTX collapsed. A bond maturing in June 2026 yields 17%, a distressed-debt level and a sign that bond owners are growing more concerned about a default or a credit-rating downgrade.

Coinbase didn’t respond to requests for comment.

Bitcoin “miners,” which process transactions on the network, have also been hit. Shares ofMARA-8.05%Marathon Digital Holdings(MARA) andRiot Blockchain(RIOT) have collapsed more than 75%.Core Scientific(CORZ), another miner, now trades as a penny stock, following the company’s warning of a possible bankruptcy.

D.A. Davidson analyst Chris Brendler, who has Buy ratings on Marathon and Riot, argues that the shakeout in the industry will leave fewer miners competing to process transactions on the network, providing more revenue for survivors like Marathon and Riot. For now, they are posting heavy losses: Marathon is expected to lose $276 million, or $2.60 a share, this year, according to consensus estimates. Riot is expected to lose $372 million, or $2.82 a share.

In the near term, there may be an enforcement blitz from the SEC, which recently issued guidelines for companies todisclose more information about crypto exposure, saying that “companies should consider the need to address crypto asset market developments in their filings.”

Some analysts say regulatory risk may only increase, highlighting the potential for companies to pay fines or shut down operations if they’re caught violating rules. “The concern is that new regulations could be very strict, limit a lot of products, and impact crypto stocks negatively,” says Needham analyst John Todaro.

The long-term question remains: Will the technology eventually form the basis for a new digital-asset class—covering everything from trading stocks to transferring real estate, playing videogames, and sending money across borders?

There’s still plenty of development on blockchain networks, notably Ethereum. The network is a base layer for other cryptos. It’s attracting developers and apps, who use it for things like minting and transacting stablecoins, running DeFi protocols, and creating nonfungible tokens, or NFTs. Ethereum now runs on a transaction processing system that reduced its carbon emissions by 99% from its original “proof of work” system. Aside from Bitcoin, most other blockchains now run on similarly energy-efficient networks.

Hougan says he’s “incredibly bullish” on Ether. The token should benefit from upgrades to the Ethereum network, he says, along with new software rules that will slow down its supply growth. The network has the most robust third-party software development, helping it scale up for more uses. As more apps and services layer on, transaction fees should come down, improving the outlook for things like micropayments, cross-border money transfers, and trading.

“All the things are lining up in Ethreum’s favor for 2023,” he says.

Some big banks and brokerages aren’t giving up on crypto.

Goldman Sachs Group(GS) executives said after FTX’s crash that they still see potential in blockchain technology and plan to invest in the space. Fidelity Investments says it’s buildingretail brokerage services in cryptoand plans to offer Bitcoin to 401(k) plan administrators, though it has faced opposition from the Department of Labor.

The message, crypto advocates say, is that the destruction of one prominent firm, FTX, shouldn’t destroy the entire industry. “The technology is being dragged down with it,” says Dixon of Stellar, which calls itself an “open network for moving money.” Whether that would be an improvement over existing networks is a key question as crypto tries, once again, to revive itself from ashes of its own making.

Comments