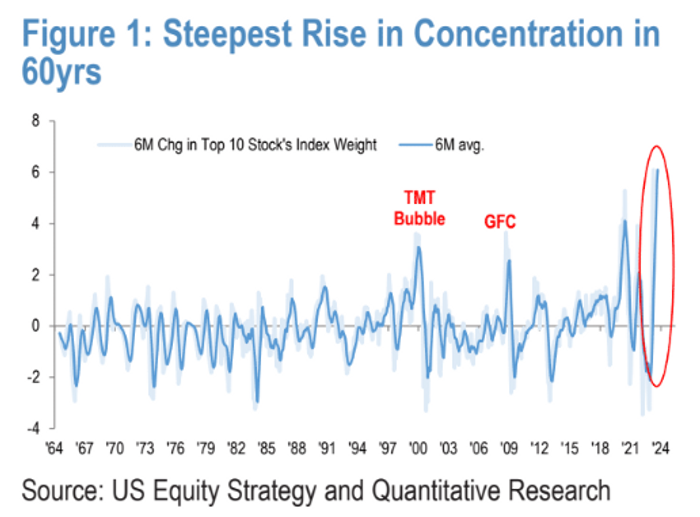

The U.S. stock market is seeing its dependence on a handful of megacap names increase at the fastest pace in 60 years, which could spell trouble ahead, according to a team of JPMorgan Chase & Co. equity analysts.

In the past, periods where the market became heavily slanted toward an elite group of ultra-valuable stocks have often ended badly, according to a Monday report from a team led by JPMorgan Chief Global Markets Strategist Marko Kolanovic.

And right now, concentration is increasing at the steepest pace since the 1960s, surpassing what was seen during the dot-com bubble, which peaked in March 2000, according to FactSet data.

To establish the extreme divergence between the largest U.S.-listed companies and the rest of the market, the JPM team compared the six-month change in the index weighting of the ten largest stocks in the S&P 500 with that of the next 40.

The team found that over the past six months, the S&P 500 has seen that divergence widen in favor of the biggest companies at the fastest pace since the days of the “Nifty 50,” a group of large-cap stocks that were heavily favored by investors during the 1960s.

What’s more, crowding in growth stocks included in the S&P 500 has reached the 97th percentile on a historical basis, the highest since the dot-com bubble days.

While the JPMorgan team offered plenty of data and analysis to back up their claims about the dangers of overconcentration, they were less concrete about what it might portend for the market.

In short, a selloff is likely coming, but exactly when is more difficult to say. Whatever the catalyst might be — the team listed off a few possibilities, including a deep recession or a sudden resurgence of inflationary pressures — it will likely mark the end of the artificial-intelligence frenzy that has helped drive this year’s sharp dispersion in equity performance.

“The peak in this concentration episode should coincide with a diminishing interest in [the generative AI/large-language model] theme from investors or as more rationalization is applied post the initial AI frenzy,” the team said.

Later in the note, the team addressed Monday’s special rebalancing of the Nasdaq-100, which they said could help to lessen the concentration risk by potentially helping to ease the outperformance of megacap technology stocks like Apple Inc., Microsoft Corp., Nvidia Corp., and Alphabet Inc. that have been the biggest beneficiaries of the AI boom.

Investors looking to trade on this view can do so by betting that call options tied to the S&P 500 equal-weighted index will outperform calls tied to the S&P 500 by 2.5% over the next three or six months, the JPM team recommended.

Signs are already emerging that the overconcentration problem highlighted here by JPMorgan is already beginning to ease. Over the last month, the S&P 500 equal-weighted index has outperformed its market-cap weighted sibling by 2 percentage points, FactSet data show.

U.S. stocks finished higher on Monday, with the Dow Jones Industrial Average DJIA, +0.52% booking its 11th straight daily gain, its longest winning streak in nearly six years. The blue-chip gauge’s outperformance since the beginning of July is another example of how market laggards like the value-heavy Dow are beginning to pick up once again, while megacap tech’s torrid year-to-date rally has stalled, according to FactSet data.

Comments