Since generative AI became mainstream, Nvidia$Nvidia (NVDA) $It has been a market darling for nearly two years. Since its low in late 2022, the stock has surged more than 1000%.

Now, however, it looks like the stock is falling out of favor, having fallen nearly 7% after announcing a double beat in its fourth-quarter earnings call.

Nvidia faces significant headwinds, such as declining margins, poorer ability to convert earnings into cash flow, and more importantly, trade restrictions (import tariffs) already in effect and possible export restrictions on the company's products. Furthermore, its latest generation has performed disappointingly. Technical analysis also suggests that the downside risk of the stock outweighs the upside potential.

Performance is no longer "surprising"

Nvidia reported earnings after the market closed on February 26, 2025, and announced a double beat, meaning it beat estimates on both revenue and EPS. Nvidia's revenue for the fourth quarter of fiscal 2025 was $39.33 billion, compared to expectations of $38.05 billion. The company reported earnings of $0.89 per share, beating estimates of $0.84 by about 5%.

While double beats are undoubtedly positive in itself, a trend over the past few quarters has been that earnings per share beats are shrinking. In 2023, Nvidia has consistently beaten EPS estimates by 18-20%, and over the past few quarters, EPS beats have shrunk from 18-20% in 2023 to 8% in November 2024 and 5% in February 2025. This improvement means future earnings growth will be better reflected in the share price.

Investors may argue that Nvidia's guidance is responsible for its share price falling after earnings. The company's top line only beat estimates by about 2%, but its gross margin guidance, and the resulting slide in operating margins from recent highs, could be a big disappointment.

Investors who are uncertain about Nvidia's prospects at this time had better use options to buy insurance for themselves and preserve the fruits of victory.

Lock in losses at low cost and beat downtrend (leading strategy case)

In the face of a falling market, investors usually want to buy put options to "insure" stocks, but usually the insurance cost is too high. Using the Collar option strategy, you can obtain insurance at "zero cost" or even "negative cost". It's so simple to control risks.

To protect the downside risk of stocks, there is a strategy of buying put options (Protective Put), and to reduce the cost of holding stocks, you can sell Covered Call options (Covered Call). In order to take care of both, Collar options-this new strategy was born.

The operation method of collar option is to buy an out-of-the-money put option as insurance on the premise of holding stocks, and at the same time sell an out-of-the-money call option to pay the cost of insurance. This is equivalent to putting a Collar on the stock, and the income of the stock is locked in it, hence the name of the Collar option. The collar option is in fact a combination of Protective Put and Covered Call, which limits the risk of downside at the expense of removing some of the possibility of upside profit.

Nvidia Collar Options Strategy Case

Suppose an investor holds 100 shares of Nvidia with a current price of $116. The investor is not sure how the price will change in the near future and wants to buy an insurance policy for his position. You can use the collar strategy.

In the first step, investors can sell a call option with an exercise price of $139 and an expiration date of April 11 at a price of $10.7, earning $1.82.

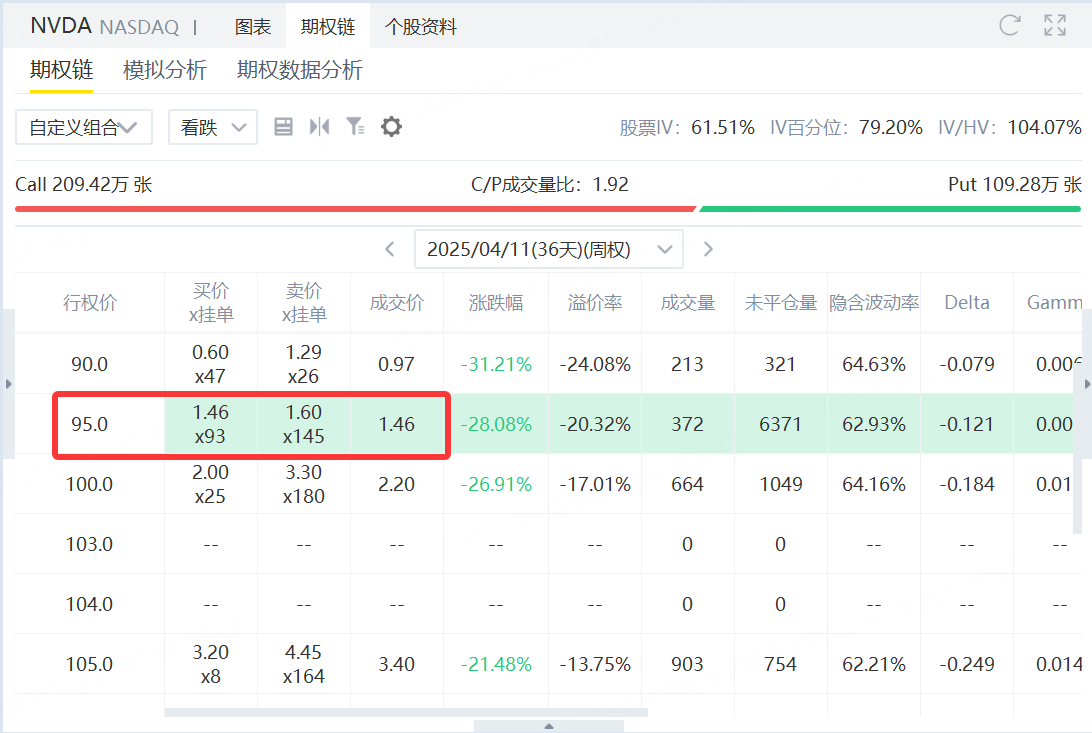

In the second step, you can also buy a put option with an exercise price of $95 and an expiration date of April 11 at a price of $1.46 (costing $146).

Collar Strategy Profit and Loss Analysis

Strategy OverviewInvestor holdings100 Shares of Nvidia (NVDA), current stock price$116。 To protect their positions, investors takeCollar Strategy:

Sell call option with strike price of $139, received$1.82/Share(gross income of $182).

Buy a put with a strike price of $95, payment$1.46/Share(total cost $146).

PROFIT AND LOSS

Maximum benefit

If at expiryStock price ≥ $139:

Stock appreciation: 139 − 116 = $23/share (total earnings of $2,300)

Options section:

Sold call option is exercised, must start with$139Selling Stock

Put Option Void

Net option income: 1.82 − 1.46 = $0.36/share (total gain $36)

Max Gain = 2300 + 36 = $2336

Maximum loss

If at expiryStock price ≤ $95:

Stock loss: 95 − 116 = − $21/share (total loss of $2100)

Options section:

The put option was exercised, to$95Sell stocks to avoid further losses

Call options sold are voided

Net income from options is still $36

Max Loss =-2100 + 36 =-$2064

Comments