After selling the puts of Tencent and Nvidia one after another, Duan Yongping had "a lot of cash" in his hands because the buyers did not exercise their rights. He was thinking about full positions and preparing to attack TSMC again.

In his view, TSMC is a good company, but he is worried that it is an asset-heavy company, and he has never made a move. It is a hindsight. Fortunately, the premium of this good company selling put is quite good now.

Duan Yongping: After many puts expired in January, a lot of cash (cash) was vacated.

U.S. stocks are so expensive, and there are still people who are tossing so much. The interest rate of t-bill (note: U.S. short-term Treasury Bond) has also dropped, which is a bit difficult to handle. Start thinking about TSM (Taiwan Semiconductor Manufacturing Company).

Thirty-five years ago, I knew TSM was a very powerful company. But I haven't done it since I started investing, because I think it is a very asset-heavy company. Now start paying attention.

It's a pleasant thing to be able to fill a full position, but a short position is somewhat uncomfortable.

The highest annualized return also reached 23%, which is passable.

Tracking Duan Yongping's investment with bullish spread strategy

For the average investor, buying these stocks outright may be costly or risky. But byCall Spread Strategy, can participate in the potential upside of these stocks at a lower cost while controlling risk.

Call spreadThe operations include:

Buy a lower strike Call Option (Call Option), obtain the right to rise in the stock in the future;

Sell a call with a higher strike price, recycling some premium while limiting potential revenue.

For example: If you are bullish on TSMC, which Duan Yongping increased, you can construct the following strategies:

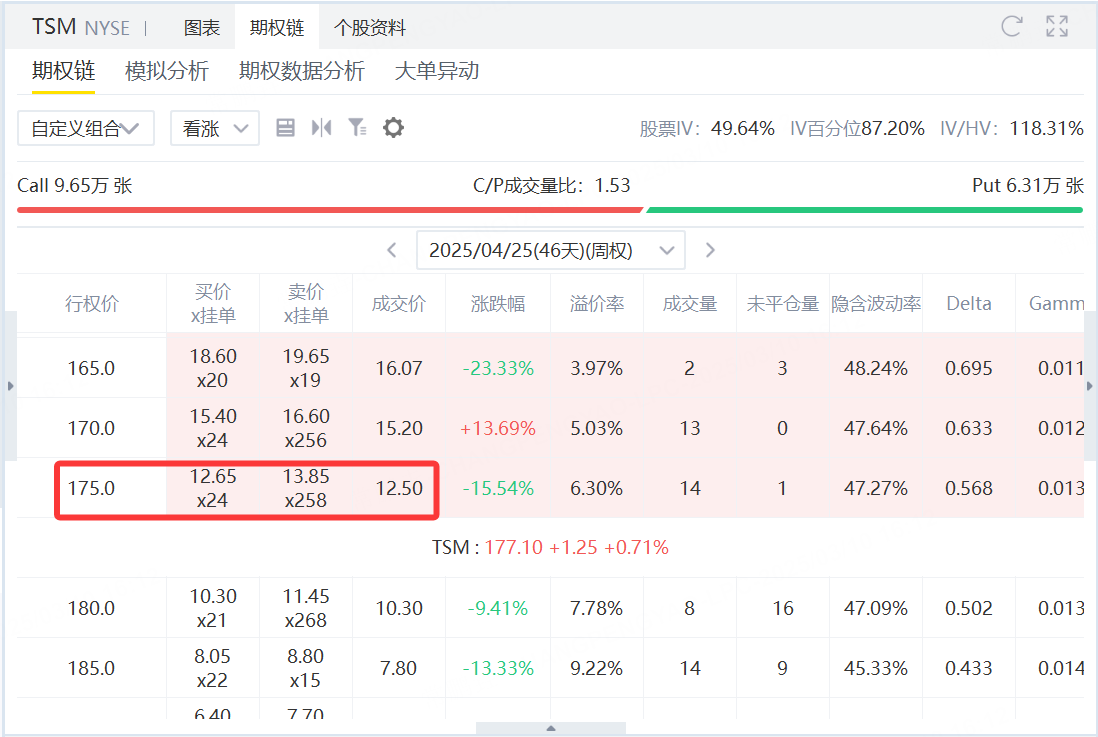

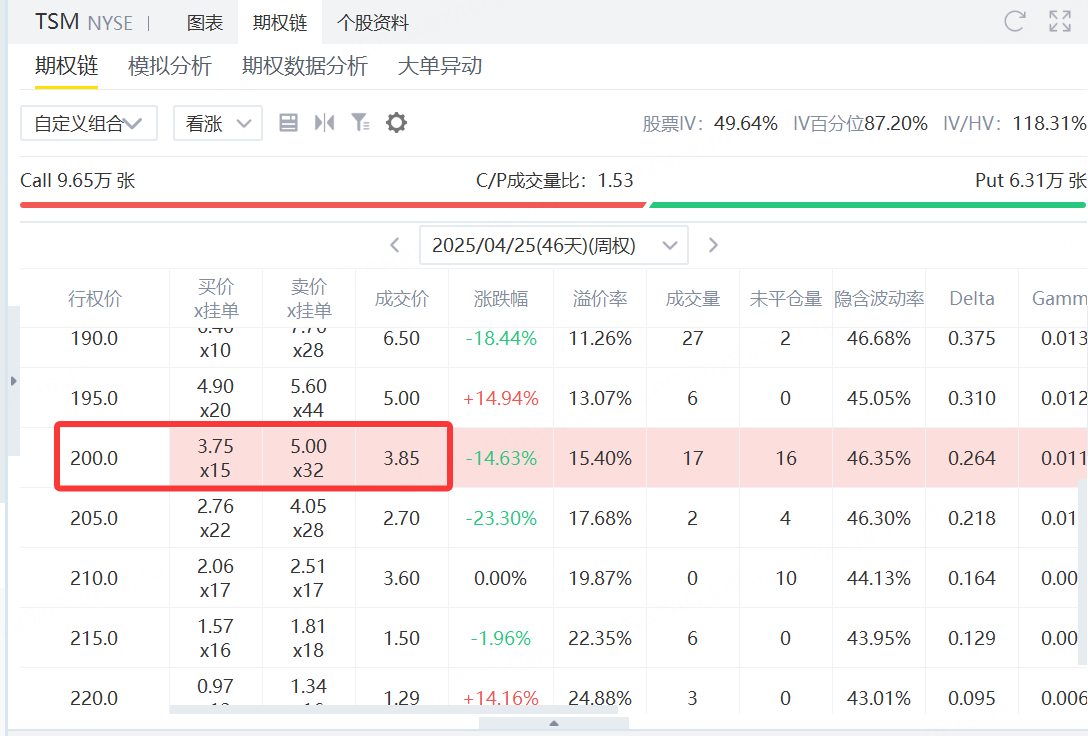

Buy a call option expiring April 25 with a $175 strike price;

Sell a call option expiring April 25 with a $200 strike price。

If TSMC's shares rise above $175, the strategy will pay off. On the contrary, if the stock price fails to rise, the maximum loss is limited to the net premium paid.

Advantages of Call Spread Strategies

In volatile markets, a call spread strategy has the following advantages:

Low capital requirements:Compared with buying stocks directly, it requires less funds;

The risks and benefits are clear:The maximum loss is the net premium paid, and the maximum gain is the difference between the two strike prices minus the net premium;

Volatility Impact Less:Since there are both call and put options in the strategy, it is less sensitive to changes in implied volatility.

Summary

Duan Yongping's recent investment actions remind us to seize opportunities during market downturns and maintain a long-term investment perspective. For ordinary investors, with the help of the bullish spread strategy, they can not only track Duan Yongping's investment at low cost, but also effectively manage risks. You might as well learn from Duan Yongping's reverse thinking and use smart strategies to add value to your investment portfolio.

Comments