On Monday, Tesla shares closed down more than 15%, their worst intraday performance since September 2020。 Monday was Tesla's seventh worst trading day on record. At the same time, amid concerns about a U.S. economic recession, the Nasdaq fell nearly 5% intraday and closed down 4%.

As of the close, Tesla has fallen by more than 54% from its record high set in December last year, more than halved, and its market value has evaporated by about 800 billion US dollars.

After the U.S. stock market closed on Monday, Musk said he was running his business with "great difficulty."

In an interview with Fox Business Channel, host Larry Kudlow mentioned that after Musk became the director of the Department of Government Efficiency (DOGE), he sacrificed his time in other businesses and asked: "How do you manage other companies now?"

"Very difficult," Musk smiled wryly. Then, he sighed and said, "I just want to make the government more efficient now and eliminate waste and fraud. At present, our savings have exceeded $4 billion a day, and the progress is actually pretty good."

Musk also revealed that the DOGE team currently has more than 100 members and may expand to 200 in the future. "Unless someone stops us, we will achieve $1 trillion in savings."

Protectvie Put Options Strategy

Among the option strategies, there happens to be a strategy suitable for the current situation of "bargain hunting:" called Protectvie Put. This strategy can help investors incur limited losses even in the situation of "bargain hunting halfway up the mountain", allowing investors to bargain hunting boldly with confidence. The method is very simple. When buying stocks, buy the corresponding Put option (Put), that is, Long stock + long Put.

Investors typically choose protective put strategies for two different reasons;

1. Limit risk when buying stocks for the first time.

2. Protect previously bought stocks when the short-term forecast is bearish but the long-term forecast is bullish.

Tesla Options Strategy

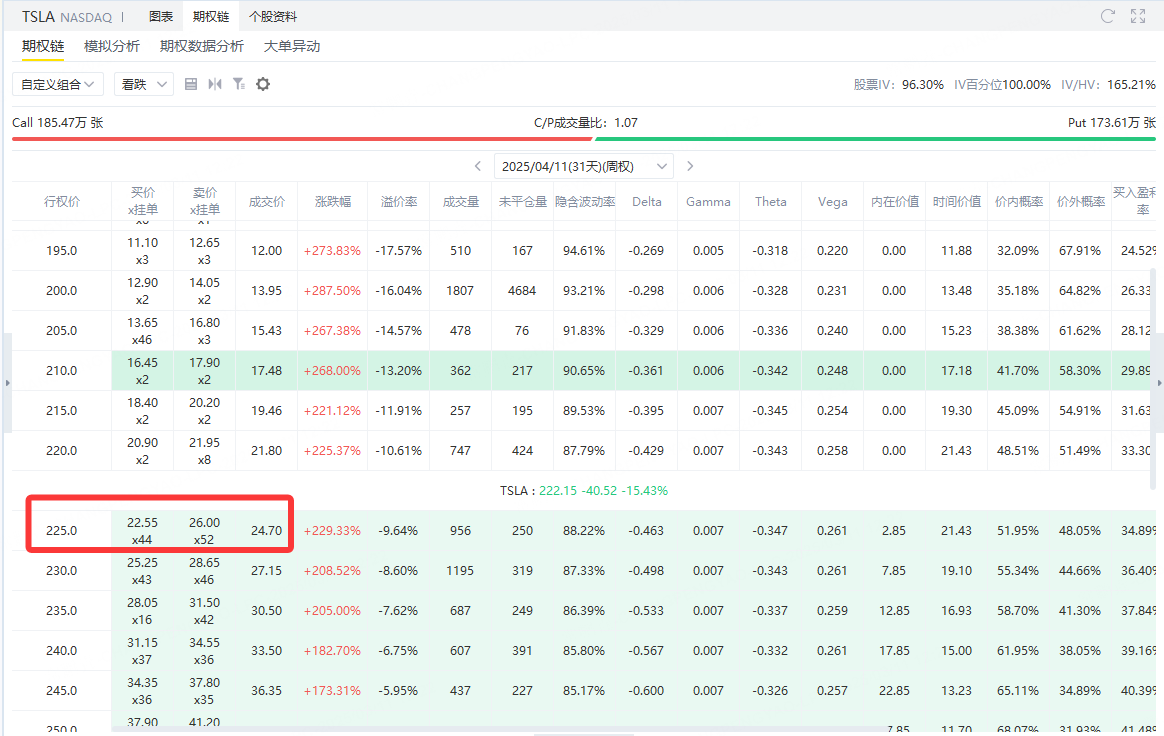

Investors bought 100 shares of Tesla, each worth $222. Investors believe that stock prices will rise in the future. However, investors want to hedge against the risk of unexpected price declines. Therefore, the investor decides to buy a protective put contract with a strike price of $225 (one put contract contains 100 shares), and the protective put costs $2,470.

Costing

Buy Tesla Stock

100 shares × $222 =$22,200

Buy a Protective Put

Premium cost =$2,470

Total investment cost= 22,200 + 2,470 =US $24,670

PROFIT AND LOSS

Stock Price Rise (Earnings Situation)

When Tesla stock priceUp to $225When, the put option will becomeWorthless(returning to zero).

Total Earnings = Stock Earnings-Option Cost

For example, if Tesla rises to$250:

Stock market value = 100 × 250 =US $25,000

Option worthless (loss of $2,470)

Total profit and loss = 25,000-24,670 =+330 USD

Stock price between 222-225

Options remain worthless, and stock prices are either slightly higher or flat.

For example, stock price = $224:

Stock market value = 100 × 224 =$22,400

Total profit and loss = 22,400-24,670 =-$2,270

Stock price drops to $225 or less (trigger protection)

Options go into the money, investors canSell stock for $225, regardless of market price.

If stock price = $200:

The option is exercised and the stock is sold at $225:

Get Cash = 100 × 225 =$22,500

Total profit and loss = 22,500-24,670 =-$2,170

Even if the stock price plummets, the maximum loss is limited to $2,170.

Profit and Loss Summary

Breakeven Point (BEP):

Since the option cost is $24.70/share, the stock price has to rise to at least222 + 24.70 = $246.70To start making a profit.

Maximum loss:

No matter how Tesla stock plummets,Maximum loss of $2,170, safer than the non-hedging situation (which may fall indefinitely).

Maximum benefit:

Unlimited (gains from rising stock prices).

Comments