Duan Yongping, a famous investor, once shared his operation case of Nvidia stock on the Xueqiu platform, providing us with a vivid example of Buy Write strategy. Briefly, he bought 100,000 Nvidia shares at a price of US $116.76, and at the same time sold the corresponding 1,000 call options, each receiving a premium of US $2,427. The option exercise price was US $120, and the expiration date was set March 20, 2026. He himself vividly described this operation as "92.5 to buy NVDA, but the delivery will be delayed by one year." This strategy enabled him to lock in part of the income while reducing the cost of holding positions, becoming a typical case of long-term stable investment.

Tesla Buy Write Strategy and Profit and Loss Analysis

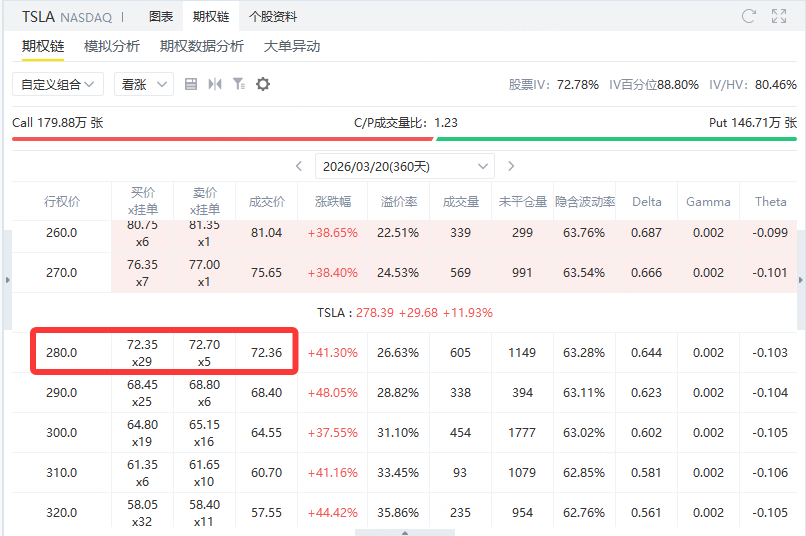

In options trading, the Buy Write strategy (buying stocks while selling corresponding call options) is a robust strategy that can not only reduce the cost of holding positions, but also lock in some returns when the stock price rises moderately. Below we will take Tesla's current data as an example for detailed analysis:

Tesla Current Price:$278.39

Call option strike price:$280 (due: March 20, 2026)

Options premium:$7236/share (assuming each option corresponds to 100 shares)

Note:The premium of each option here is US $7,236. Calculated based on 100 shares of the conventional option contract, each share is allocated US $72.36 (7,236 ÷ 100), which has a greater impact on the cost of holding positions.

Investors who adopt the Buy Write strategy need to perform these two steps simultaneously:

Buy Tesla Stock:Buy Tesla stock at the current market price of $278.39.

Sell a call option:Sell call options with an expiration date of March 20, 2026 and an exercise price of $280, and each premium is $7,236 (corresponding to 100 shares), thereby obtaining premium income.

This combined trading structure allows investors to use the option premium to reduce the actual shareholding cost.

PROFIT AND LOSS

(1) Reduction of final shareholding cost

Due to the premium gained by selling call options, the actual cost of holding shares can be reduced:

Premium is allocated to each share:$7236 ÷ 100 = $72.36

Effective bid price:US $278.39 − US $72.36 ≈ US $206.03

This means that after subsidizing the option premium, the actual buying cost for investors drops to about $206.03 per share.

(2) Profit and loss scenario analysis

① The stock price is lower than $206.03 (loss situation)

If Tesla's stock price falls below $206.03, investors will face losses when the book value of the stock is lower than the actual cost.

While premium provides a certain downside buffer for holdings, the risk of losses remains if the stock price falls sharply.

② The stock price is between $206.03 and $280 (profitable but not exercised)

When the stock price is between $206.03 and $280, the floating gain from the stock price increase can cover the original buying cost.

Options are usually not exercised at this stage, and investors can enjoy both stock appreciation and locked-in premium income.

③ The stock price is higher than $280 (income capped, exercised)

If Tesla's stock price exceeds $280, the option buyer may choose to exercise, forcing investors to sell the stock at $280.

Maximum benefit calculation:Earnings per share = $280 − $206.03 ≈ $73.97 This is the upper earnings limit of the strategy, at which the ultimate earnings will be fixed regardless of how the stock price continues to climb.

Strategy pros and cons

Reduce position holding costs:The premium obtained by selling the call option reduces the actual bid price from $278.39 to about $206.03, which is equivalent to a "discount buy".

Stable source of income:Even if Tesla's stock price does not fluctuate much in the short term, the obtained premium can still provide investors with stable cash flow.

Adapt to shocks or moderate rising prices:Stock appreciation combined with premium revenue can deliver decent overall returns when the market is sideways or slightly higher.

inferior position

Earnings Cap:If Tesla's stock price rises sharply, investors can only sell the stock at $280 because the option is exercised, missing the opportunity for higher returns.

Downside risks remain:Although premium has reduced the cost of buying, if the stock price goes down sharply, investors will still face the risk of losing money, but the loss rate is relatively small.

The core of Tesla's Buy Write strategy is to use the call option premium to subsidize the purchase cost, thereby achieving the effect of "discount buying". This strategy is particularly useful in the following situations:

Investors who are bullish on stock performance in the long term:Investors think Tesla has upside potential in the future, but want to enter the market at a lower cost.

The market is expected to fluctuate or rise moderately:In this market environment, the stock price usually does not exceed the option exercise price, and the option is not easy to be exercised. Investors can enjoy the dual benefits of stock appreciation and premium.

Investors with higher risk control needs:The option premium provides a certain degree of downside protection, making losses relatively limited when the market fluctuates.

Comments