Recently, Jonathan Guthrie, corporate editor of the Financial Times, wrote an article stating that,$SPDR Gold ETF (GLD) $Is the real "Trump put option". This view is not only symbolic, but also has profound market logic. In the current political and economic environment, gold is becoming an important tool for investors to hedge risks. So, how do we use options strategies to go long gold efficiently?

Market uncertainty and gold's safe-haven attributes in the Trump era

Investors generally believed that Trump's policy would cover the stock market when the market fell, forming a "Trump put option". However, the reality is that the S&P 500 has fallen 6% since November last year, and the market's confidence in Trump's support is weakening. Instead, the price of gold soared more than 25% during this period and broke through an all-time high of $3,000 per ounce.

Needless to say, the safe-haven function of gold. Against the backdrop of rising global political and economic uncertainty, central banks have increased their holdings of gold, investors have poured into gold ETFs, and even retail investors have bought gold coins and bars. There are various signs that gold is becoming the preferred asset for safe haven in the market.

Options Strategy: Using Put Options to Go Long Gold

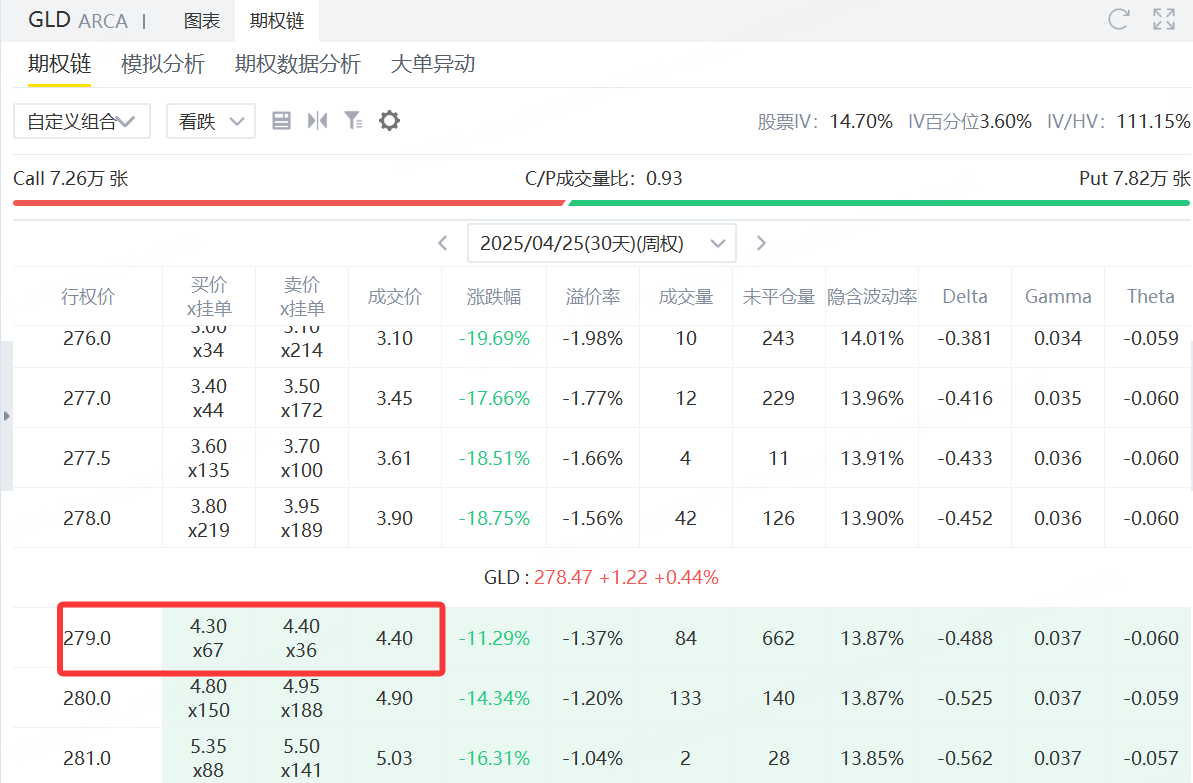

In the face of the strong trend of gold, we can use the option strategy to make efficient long trading. The current gold price is$278, we can sellExpires April 25, 2025, exercise price $279, premium $440Put Option to go long gold. This strategy can not only make profits when gold rises, but even if gold prices move sideways or fall slightly, you can still rely on premium to earn gains.

Policy analysis:

Sell put at $279 strike price, collect $440 premium

If the gold price is higher than $279 at expiration, the option will be invalid, and the $440 premium will all be a profit.

If the price of gold is lower than $279, we need to fulfill our obligation and buy gold at $279. However, since premium of $440 has been obtained, the actual cost of holding a position is reduced to$274.6(279-4.4)。

Profit and loss analysis:

Maximum profit: $440 (when gold rises or trades sideways)

Breakeven: $274.6 (i.e. 279-4.4)

Risk: Gold has fallen sharply, which may lead to being forced to receive gold, but because the cost of holding positions has been reduced, the risk is still manageable.

Why choose to sell put options?

Compared with buying gold or gold ETFs directly, selling put options has the following advantages:

Improve winning percentage: Gold prices can profit from premium if they trade sideways or even fall slightly.

Reduce costs: Even if gold falls, the actual position cost is lower than the current price of US $278, increasing the margin of safety.

Time value decay: As the option expires, the time value decreases, making it easier for the seller to make a profit.

sum up

In the face of Trump's aggressive policies, the unstable global situation, and the overweight of central banks, gold has become a real safe haven tool. Using the options market, we can efficiently go long gold while controlling risks through the strategy of selling put options. This is not only a smart way of trading, but also a sound investment choice that conforms to market trends.

Comments