Recently, major rights issue events have been reported in the capital market one after another. On the evening of March 27th,$NIO (NIO) $Announced that it plans to place up to approximately 119 million Class A common shares to raise funds for the research and development of core technologies and new products of smart electric vehicles, while strengthening cash reserves and balance sheets; On March 25, Xiaomi Group announced the placement of approximately 800 million existing shares at a price of HK $53.25 per share, a discount of approximately 6.6% compared to the previous day's closing price of HK $57.$Xiaomi Group-W (01810) $After the news of the placement was announced, the stock price fell sharply at the opening that day, and finally closed at HK $53.4, a drop of about 6.32%, setting one of the largest lightning placement financing in history. These events undoubtedly have a great impact on market sentiment and individual stock trends, and how to protect the investment portfolio in such events has become the focus of investors' attention.

Rights Issue and Its Market Impact

Xiaomi's placement involves about 800 million shares, accounting for 3.2% of the company's existing issued share capital, with a discount of 6.6%. The differentiation of investor sentiment caused by rights issue financing is obvious: some investors choose to sell because they are worried about the dilution effect of rights issue and valuation reconstruction, resulting in a sharp drop in Xiaomi's stock price; Some investors also believe that low-level participation in financing can be bargain-hunting, but the overall market still has risks in valuation differences caused by discount financing. In addition, judging from historical experience, similar large-scale placements are often easy to trigger market panic. For example, in 2020, Xiaomi's stock price once fell by more than 10% due to rights issue and convertible bond financing.

In contrast, Nio's rights issue emphasizes that the raised funds will be used for core technology research and development and enhancing the company's liquidity, with the aim of providing sufficient support for long-term business growth. However, the allotment of shares itself will inevitably bring about the effect of equity dilution, which may bring downward pressure on the stock price in the short term. There are differences in market expectations for the company's future profitability and use of funds, and investors also face high uncertainty.

Collar Option Strategy

Collar Strategy is a combination strategy of holding the underlying asset, buying put options, and selling call options at the same time. Its core idea lies in:

Put Protection: Buying put options can set a minimum selling price for the stock held. When the market falls, investors can sell the stock at the preset price to avoid excessive losses.

Call Option Financing: By selling the call option, the cost of the put option can be partially or fully offset, but it will also limit the upside gains of the stock in the future.

This strategy forms a "neckline"-within a certain price range, investors can not only enjoy the normal returns of stocks, but also get effective protection when the market falls.

The Application of Strategy in the Situation of Allotment

In the allotment event, the allotment financing of listed companies often brings equity dilution effect, which leads to downward pressure on the stock price. If investors build a collar option strategy in advance, they can buy put options before the allotment news is announced, thus locking in a falling floor price. When the market moves lower due to dilution expectations of rights issue, the value of put options rises, which can hedge some of the stock losses. At the same time, by selling call options, investors can also reduce option costs and make the overall protection cost cheaper.

For example, in Xiaomi's case, if investors construct a collar option strategy before the allotment news and set a reasonable put option exercise price, they can be protected when Xiaomi's stock price falls due to the allotment discount, reducing the risk of investment portfolio volatility. The same is true for Nio. The rights issue plan disclosed in its announcement may cause market concerns. Adopting a collar option strategy in advance can alleviate the downward pressure to a certain extent.

Taking Xiaomi as an example, suppose investors hold Xiaomi shares and are worried about the risk of stock price decline that may be caused by rights issue financing, so they decide to build a collar option strategy to hedge the risks. The specific parameters are as follows:

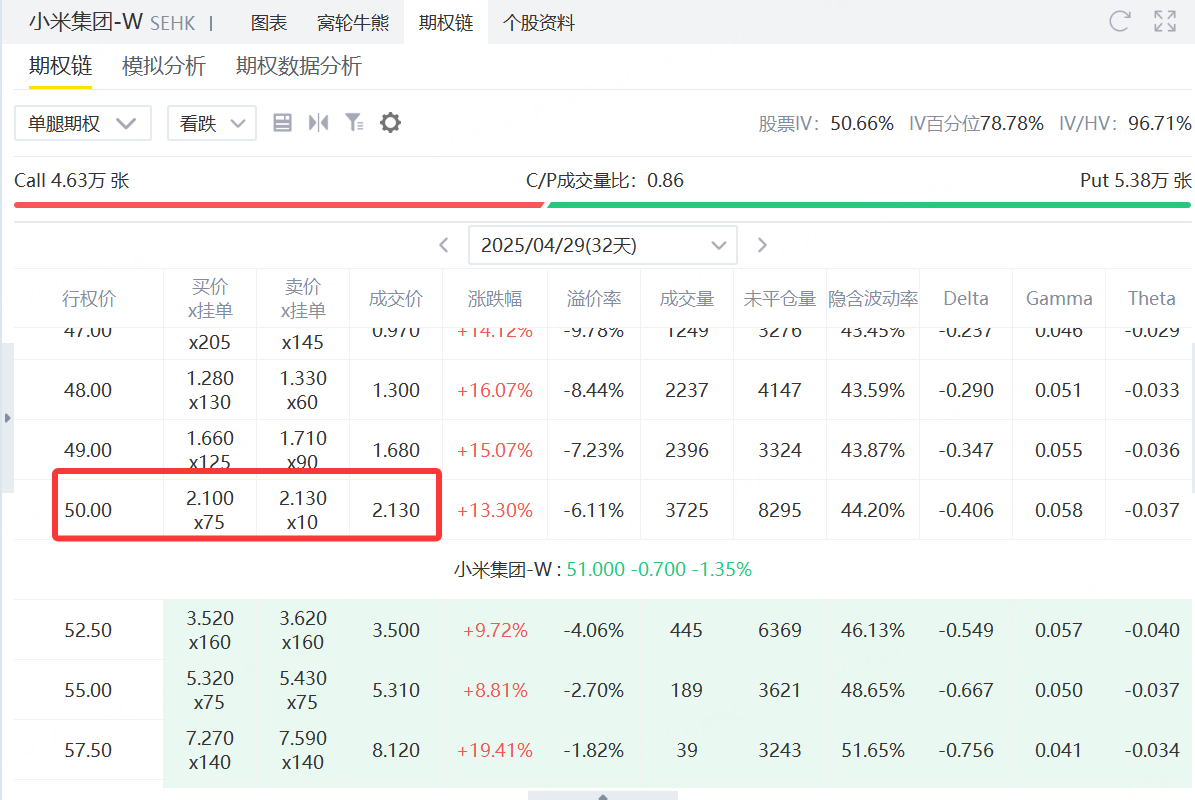

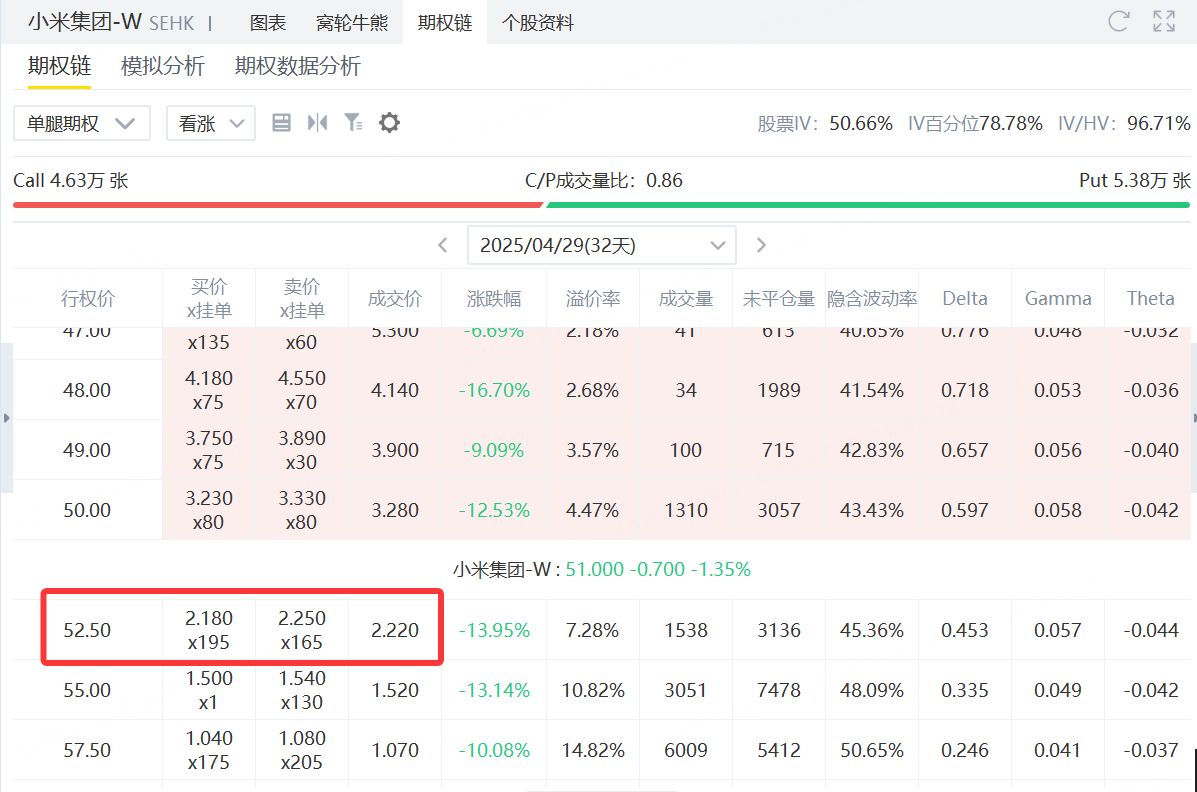

Expiry date: 29 April 2024

Call Options: Exercise price of HK $52.5, premium of HK $227

Put Options: Exercise price of HK $50, premium of HK $207

Strategy Construction and Capital Flow

Buying a put option:

Investors buy a put option with a premium of HK $207. When Xiaomi's stock price falls, this put option can sell the stock at a price of HK $50, providing investors with downside protection.Sell a call option:

At the same time, investors sold a call option with a premium of HK $227, which set the upper limit of the stock's upward return, with an exercise price of HK $52.5. Premium from selling a call option can partially (or even fully) offset the cost of buying a put option.Net premium:

In this case, the net premium is: HK $207 (bearish premium cost) minus HK $227 (bullish premium income) =-HK $20。

A negative value indicates that investors actually earned a net income of HK $20 per share, reducing the overall strategy cost.

Effects of strategies in different market situations

Stock price decline:

If Xiaomi's stock price falls below HK $50 due to factors such as rights issue, the put option will gain intrinsic value, allowing investors to sell the stock at HK $50, thus limiting the maximum loss. Net income of HK $20 further alleviated the loss pressure.Stock price moves sideways or moderately:

When the stock price is between HK $50 and HK $52.5, the options may not be valid. Investors still hold the stocks and at the same time get a net premium income of HK $20, hedging part of the downside risks.Stock price rise:

If the stock price breaks through HK $52.5, the call option sold will be exercised, and the investor needs to sell the stock at HK $52.5. Although the upside income has been restricted, it has also obtained a net income of HK $20 to make up for part of the loss of income.

conclusion

The recent rights issue between Xiaomi and Nio highlights the uncertainty of market sentiment and stock price fluctuations during the company's major capital operations. Faced with the risk of stock price decline that may be caused by rights issue financing, investors can use the collar option strategy to build downside protection by buying put options, and at the same time use selling call options to reduce costs and achieve a balance between risk and return. Although this strategy will limit upward returns, it is especially suitable for use in market environments with high uncertainty such as rights issue from the perspective of protecting asset value and preventing risks.

Generally speaking, the collar option strategy provides investors with an effective risk management tool. Before major financing events occur, by pre-constructing such strategies, you can not only keep the chassis when the market falls, but also participate in future earnings growth to a certain extent. In actual operations, investors need to reasonably design strategic parameters according to specific market conditions, stock characteristics and their own risk preferences to achieve the best protective effect.

Comments