$ORCL$

If OpenAI's commercialization capabilities were truly outstanding, Oracle's stock would likely tell a very different story with the same earnings data. That's the takeaway from this earnings report.

Therefore, whether Oracle is a dip-buying candidate depends heavily on the progress of OpenAI's commercialization, or the emergence of another giant with a killer product that declares current server capacity utterly insufficient, capturing market imagination as a potential future Oracle customer replacing OpenAI.

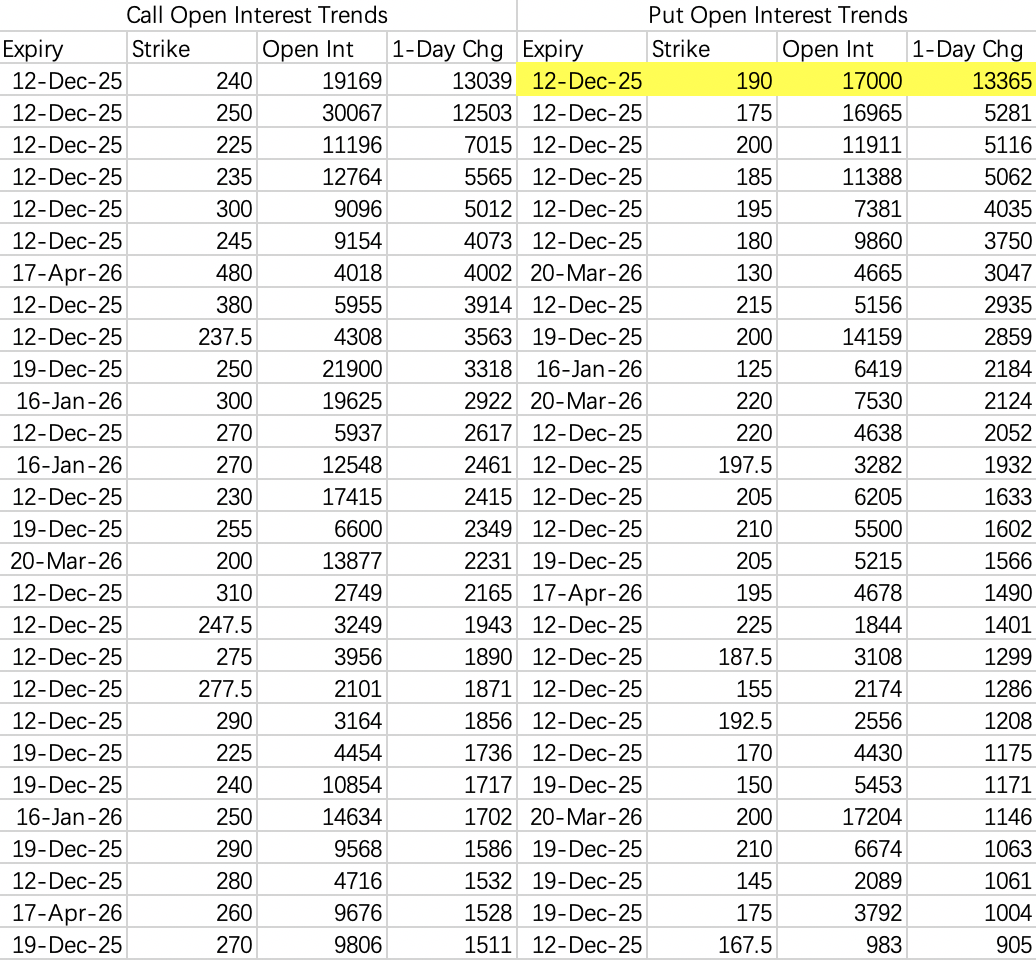

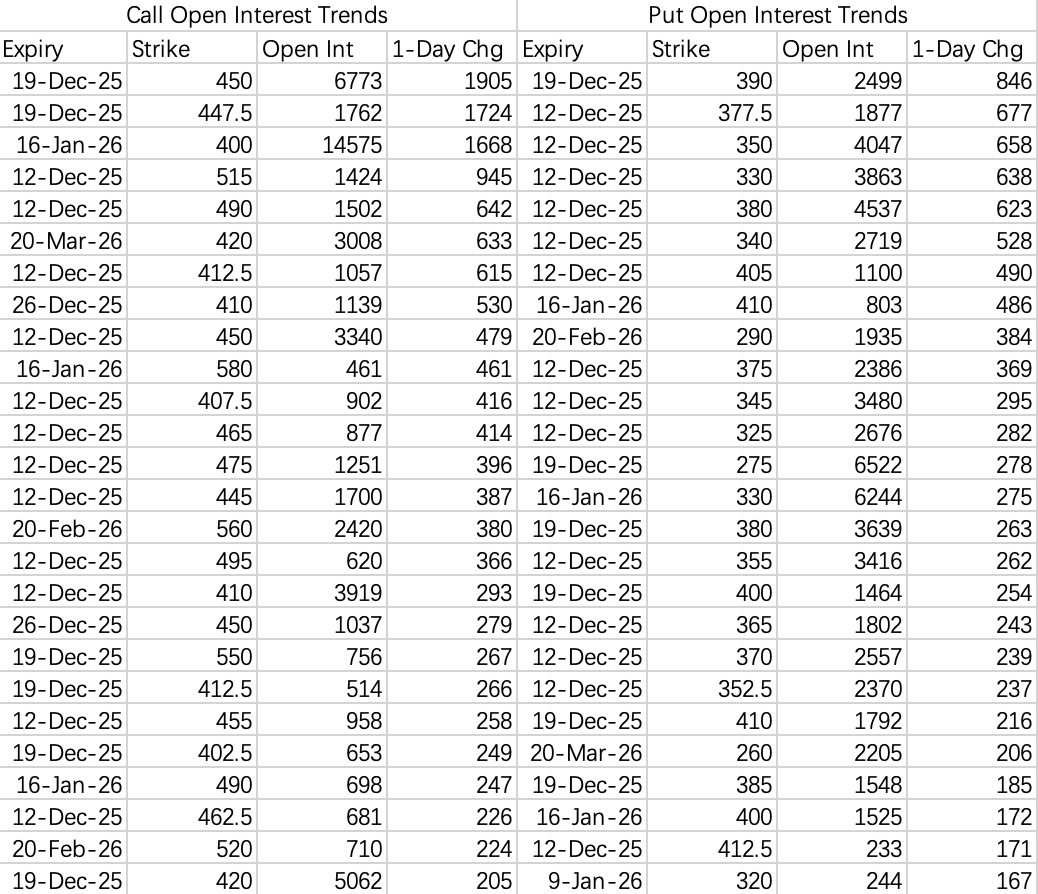

On Thursday's open, someone bought 10,000 contracts of the weekly 190 call $ORCL 20251212 190.0 PUT$ , with timing precision that is astonishing.

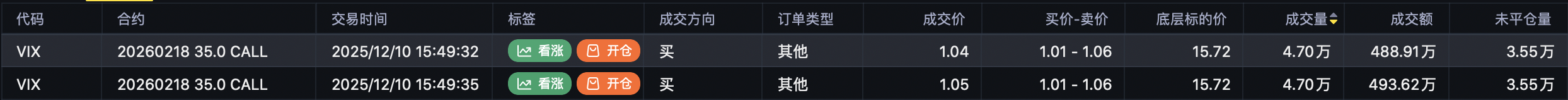

Additionally, just before Wednesday's close, a buyer picked up 100,000 contracts of the VIX Feb '26 35 call $VIX 20260218 35.0 CALL$ , for a total premium of approximately $10 million. This suggests potential near-term market weakness.

The reason for a possible pullback? Given Oracle's earnings state, the AI sector looks primed to lead any decline.

$NVDA$

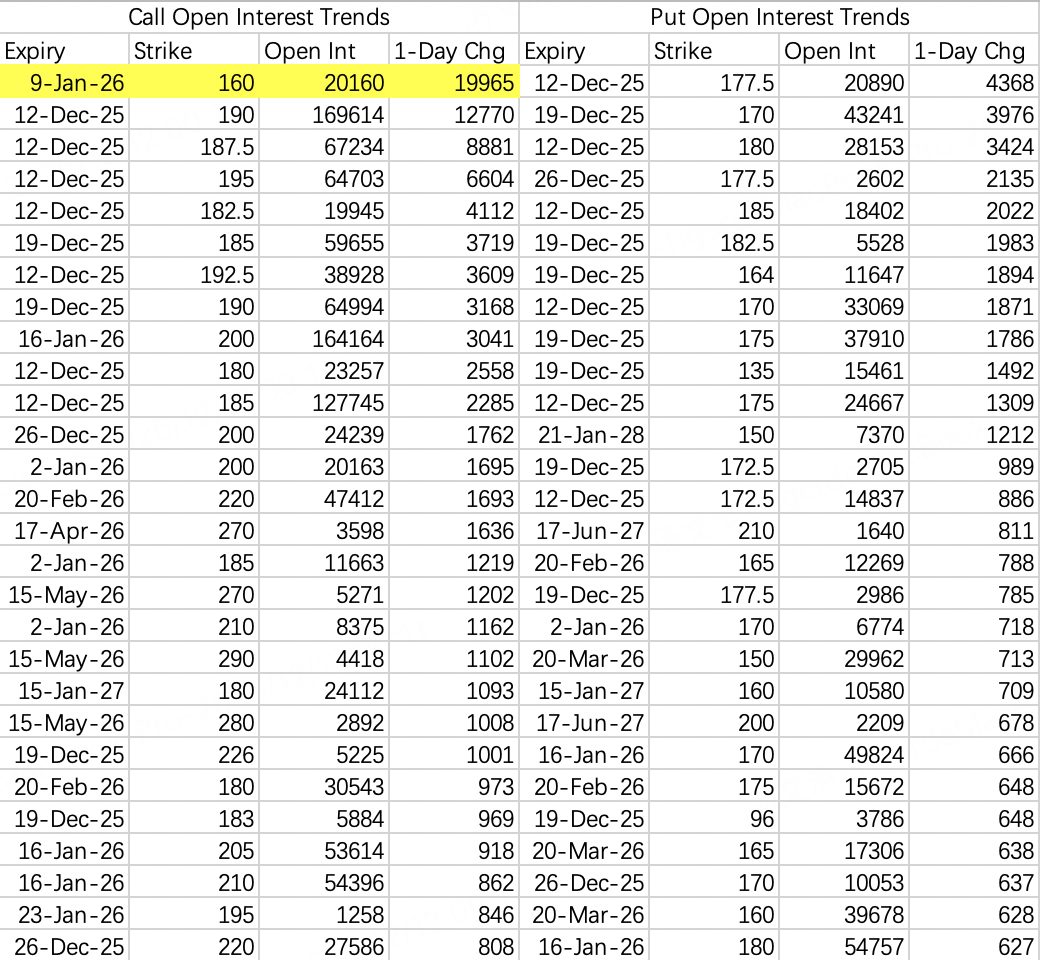

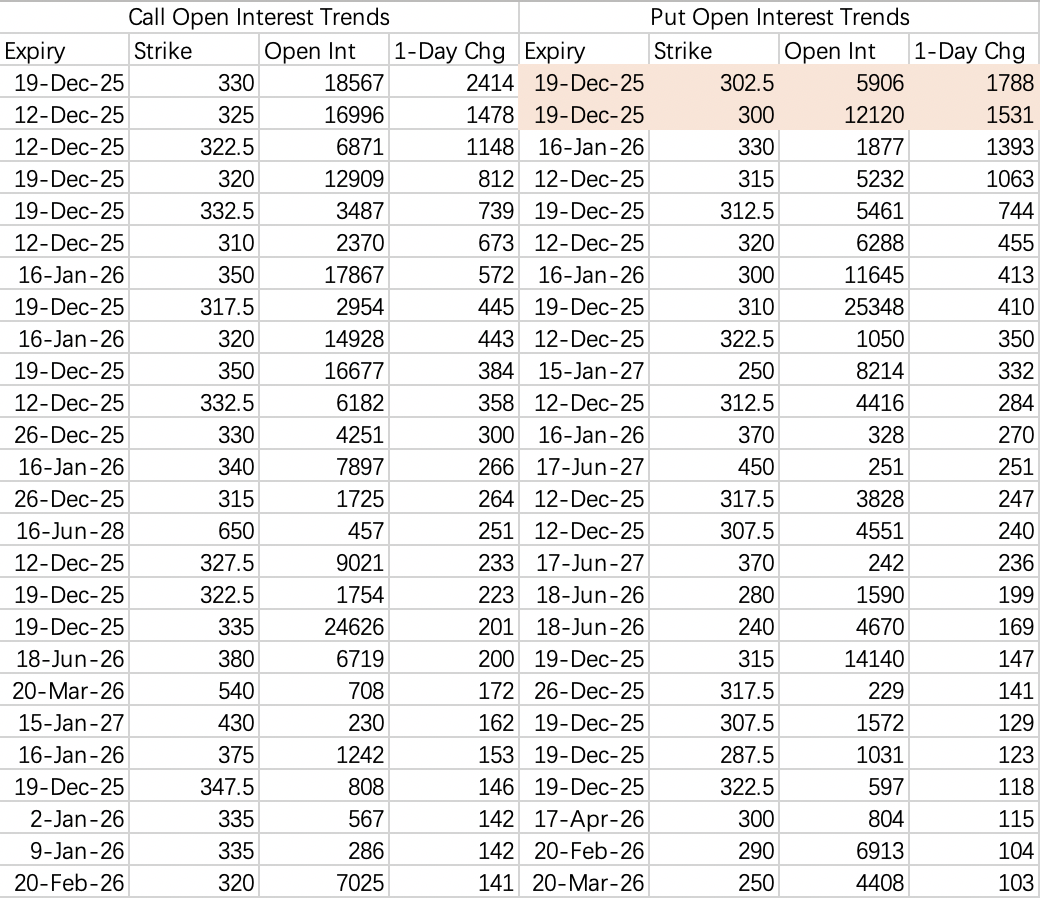

On Wednesday evening, NVDA saw a sizable bearish call block: the 160 call $NVDA 20260109 160.0 CALL$ , with over $50 million in premium and ~20,000 contracts opened.

Conventional thinking might label a $50 million block as very bullish—why call it bearish? Experience suggests that large in-the-money call openings are often followed by sideways or even downward price action, regardless of the dollar amount.

Of course, the $160 strike price isn't a bet on the stock going to zero; the trader can simply exercise the option.

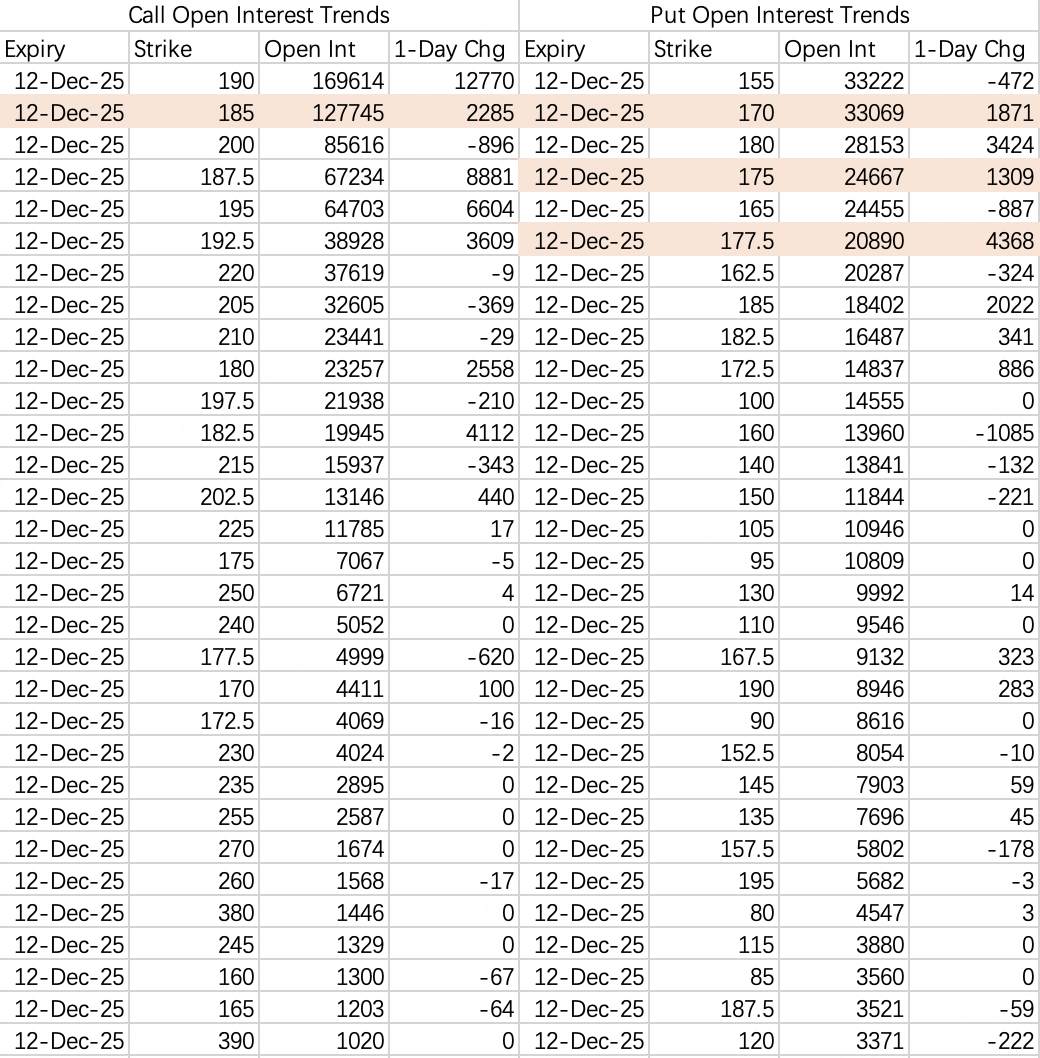

Theoretically, a close above $180 by Friday would be appropriate. After being dragged down by Oracle's earnings, that outcome is now in question.

Whether AVGO's earnings are good or bad isn't great news for NVDA. Good earnings could be seen as market share taken from NVIDIA; bad earnings might signal Google's business hitting a bottleneck, posing downside risk for the broader AI sector.

Still, the worst-case expectation likely holds above $170.

$AVGO$

The earnings report held no surprises, but the stock reaction is full of suspense. Revenue, profit, and cash flow are expected to beat market expectations across the board.

However, no one has a clear read on post-earnings price action. The good news: no large bearish blocks tonight. The bad news: no large bullish blocks either. The market seems to have priced in the 18% rally over the past three weeks as discounting the earnings beat.

Judging by Google's options flow, Google is expected to trade between $300–325 this week. Its earnings likely won't be terrible, but a major upside surprise seems unlikely, with a probable range of $370–430.

$GOOG$ $GOOGL$

Google is expected to trade between $300–325 this week. Therefore, AVGO's post-earnings price movement is likely to be contained within its implied volatility range.

Comments