$NVDA$

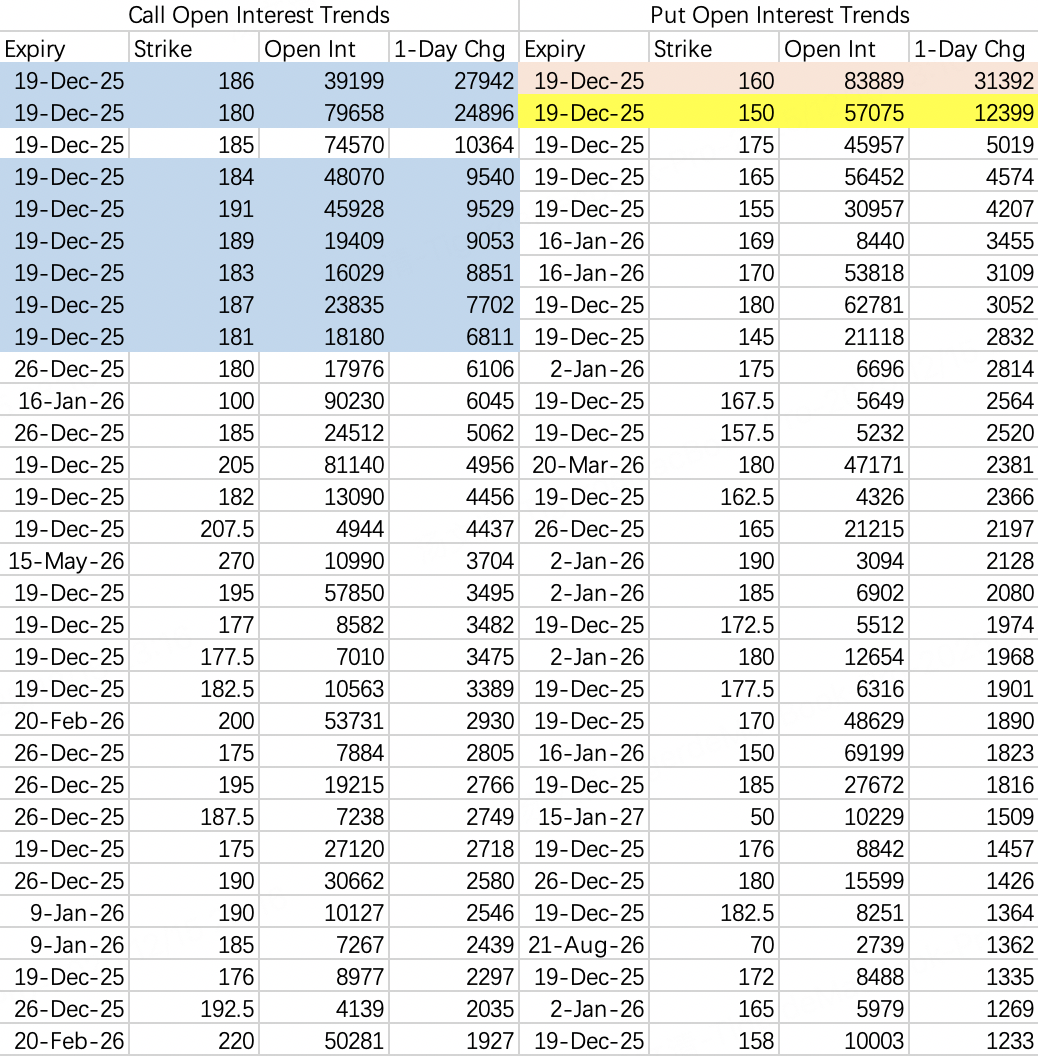

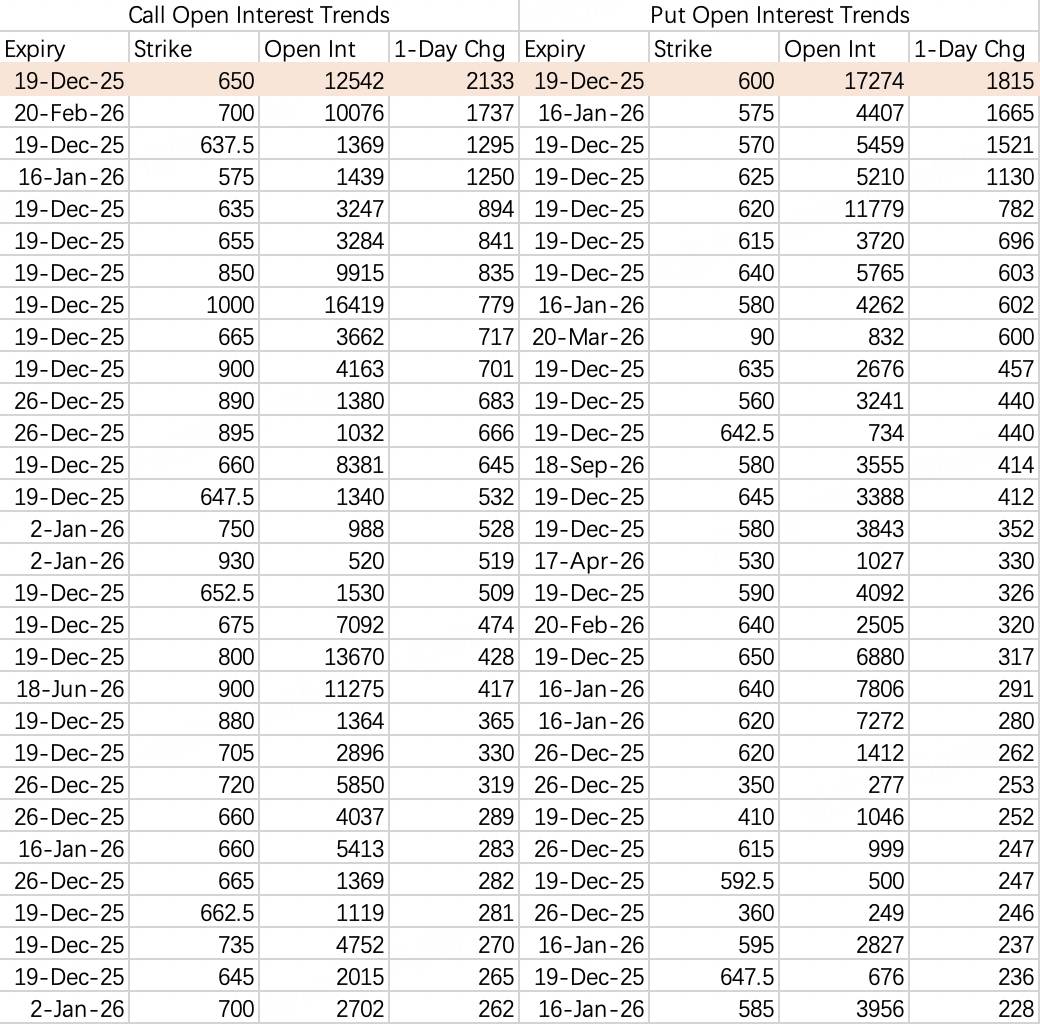

Institutions are highly confident in this week's downward trend, having filled out spreads across the entire $181–191 strike range. As a result, unless NVDA stays suppressed below $179 this week, there's a low probability of a significant short squeeze rally back to $185.

The more likely scenario is a pullback to $170 first, potentially even below, followed by a rebound. After all, this is triple witching week, with $170 and $160 puts as key targets for expiration pressure. The drop presents an excellent opportunity to sell puts, with strikes at $170 or $165: $NVDA 20251219 170.0 PUT$ $NVDA 20251219 165.0 PUT$ .

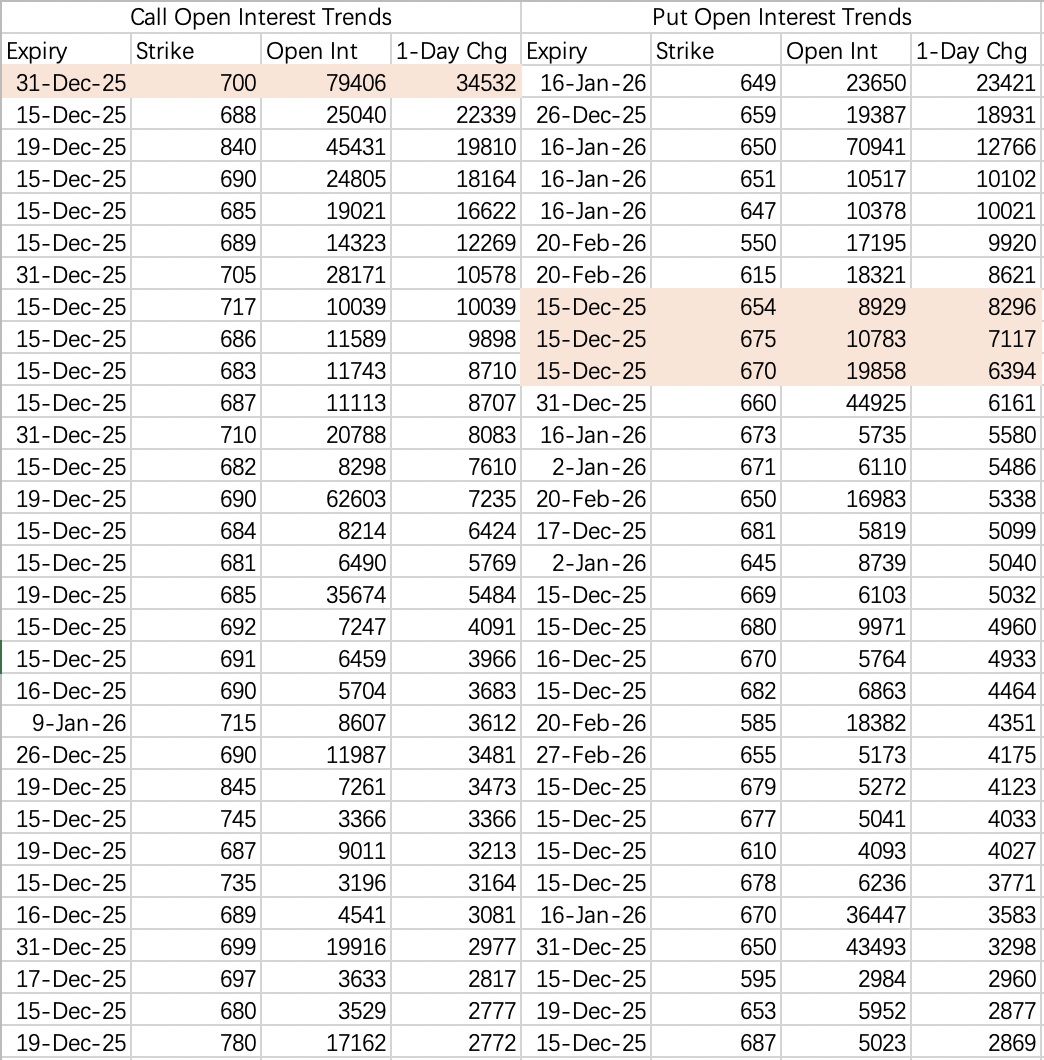

$SPY$

SPY is set to follow a pattern of initial pullback this week, then a rebound to new highs.

$AVGO$

Friday saw a large put opening, targeting $310 $AVGO 20260220 310.0 PUT$ , with a premium value of $3.6 million.

Hold off on considering a dip-buy until it approaches $310.

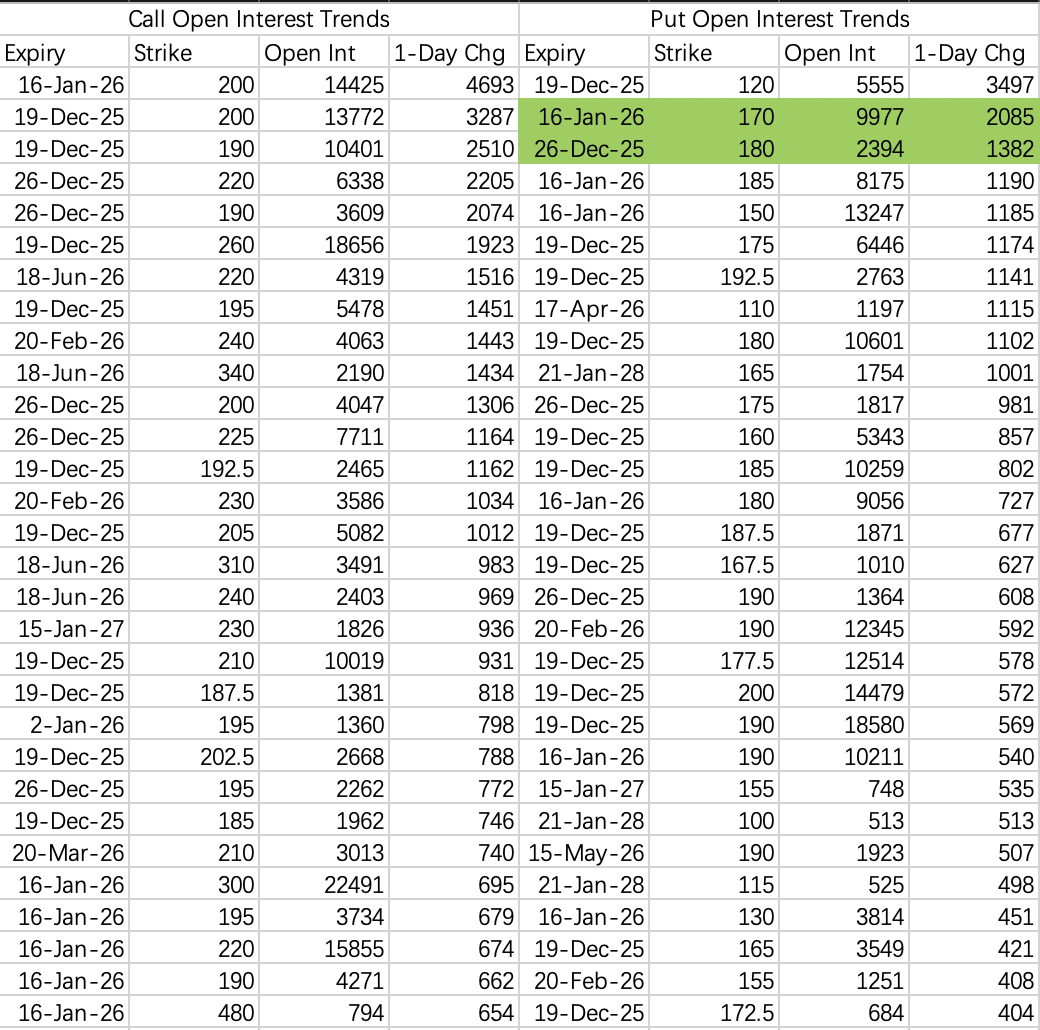

$ORCL$

There is monthly chart support at $180, leading to sell put openings at both $180 and $170 $ORCL 20251226 180.0 PUT$ $ORCL 20260116 170.0 PUT$ . However, the safest approach is still to wait and see if it can reach $160.

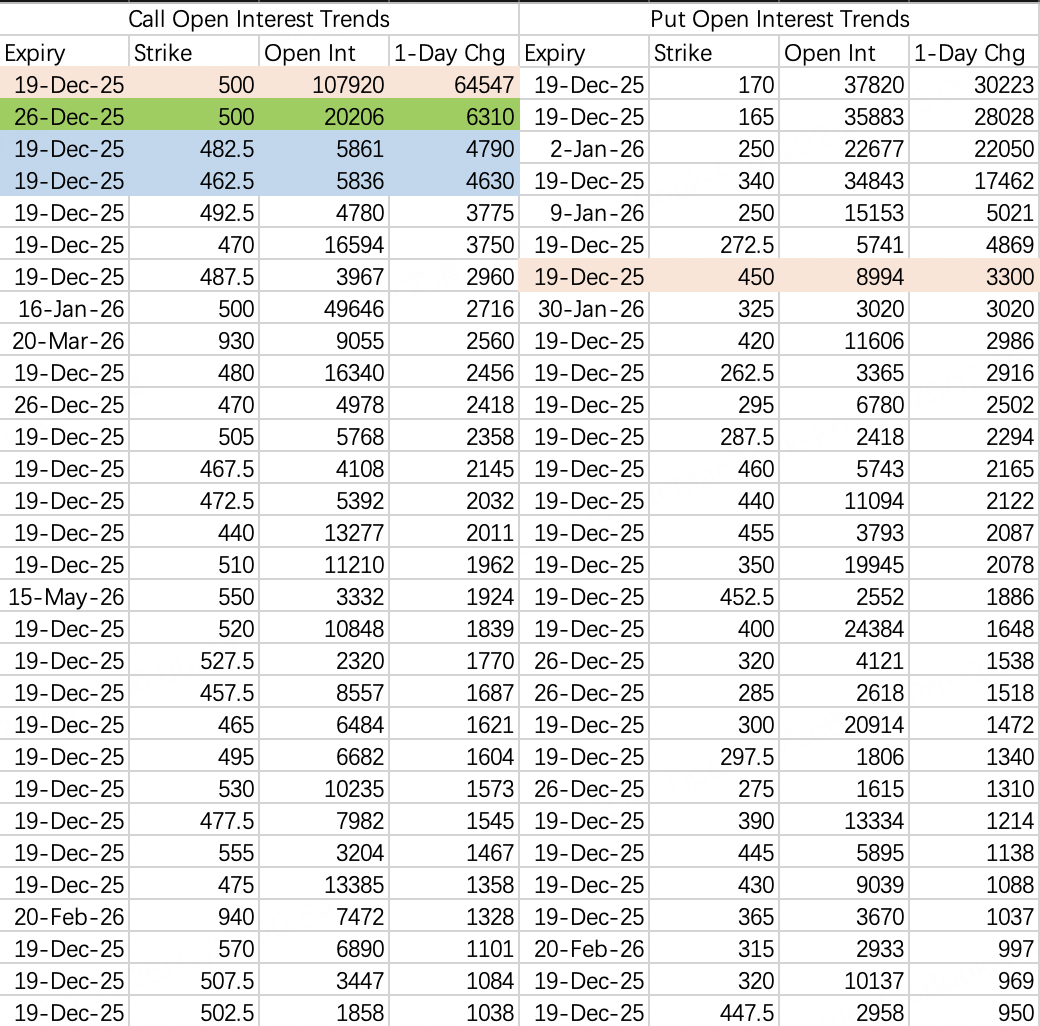

$TSLA$

Monday's action in Tesla was intense, primarily driven by the opening of 64.5k contracts of the weekly 500 call $TSLA 20251219 500.0 CALL$ , pushing total open interest to a significant 107.9k contracts. This move effectively blew up the institutional call spread for the week: selling the $TSLA 20251219 462.5 CALL$ and buying the $TSLA 20251219 482.5 CALL$ .

Judging by volume, those 60k contracts may have been closed. Consider selling the 520 call: $TSLA 20251219 520.0 CALL$ .

The pullback target is $420–450. Consider selling puts if it reaches that zone.

$META$

Meta could be a candidate for selling the 600 put $META 20251226 600.0 PUT$ . While it carries lower risk compared to other high-valuation stocks, it's wise to be cautious this week.

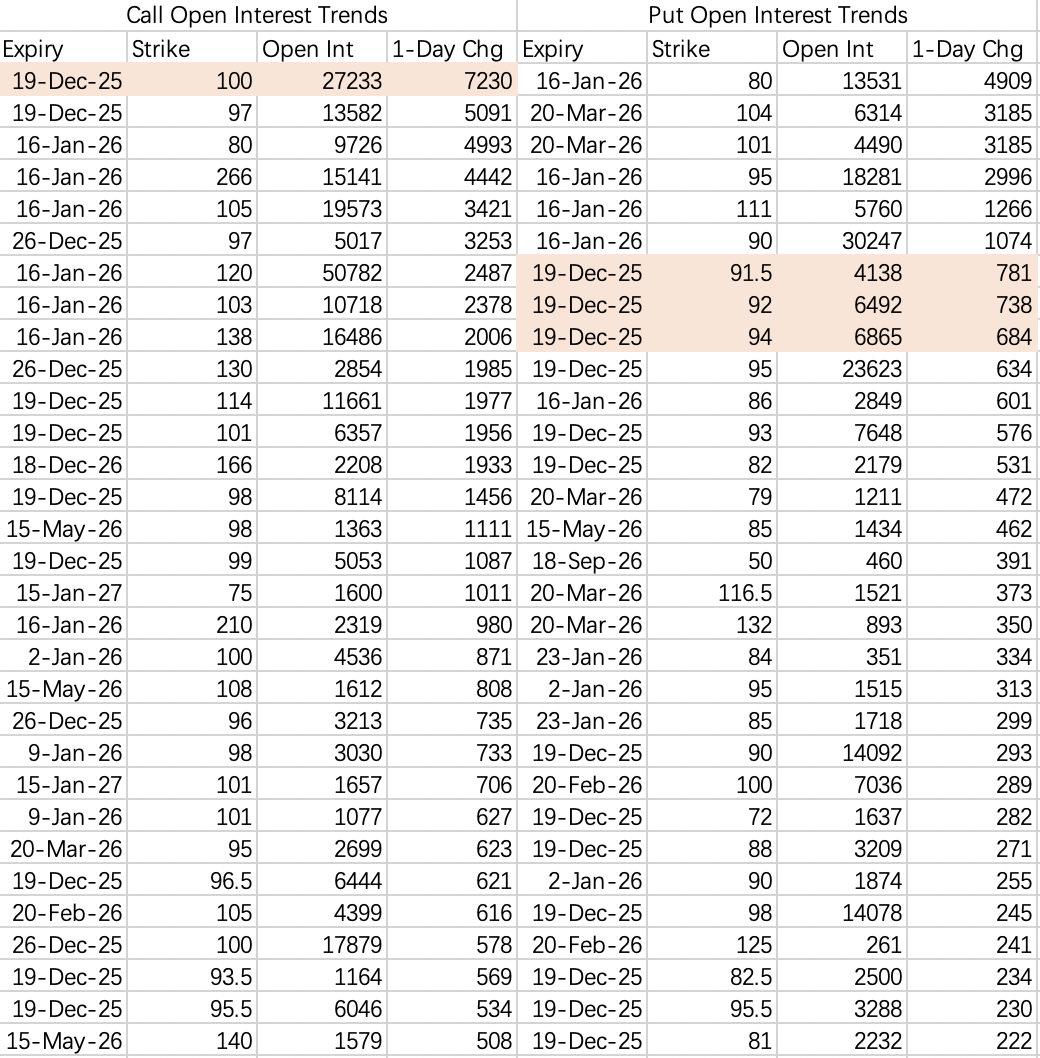

$NFLX$

Netflix's options flow shows signs of bottoming, with the stock likely to oscillate between $90–100. Consider selling puts on dips: $NFLX 20251219 90.0 PUT$ .

$MU$

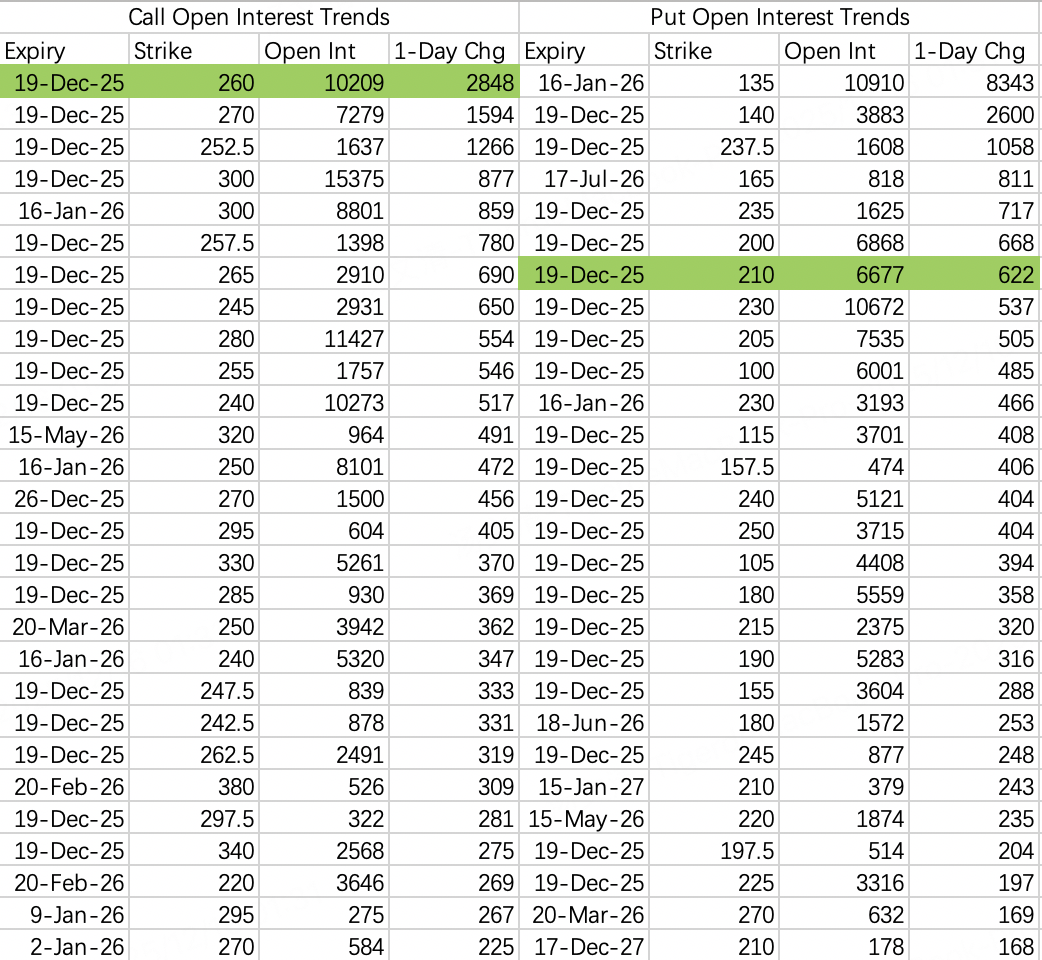

Earnings are after the close on Wednesday. Expectations are good, but the market's reaction is uncertain.

Some option combinations on Friday suggested a weekly range of $210–260, which aligns with the implied volatility range of $215–265. For earnings, consider a short strangle: selling the 280 call $MU 20251219 280.0 CALL$ and the 210 put $MU 20251219 210.0 PUT$ . Both legs should be closed at the open after earnings, as the closing price is unpredictable.

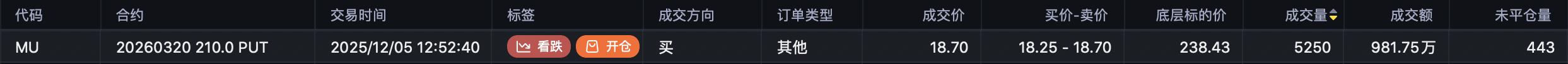

The short put leg might be optional. Last week, a large block bought 5,250 contracts of the 210 put $MU 20260320 210.0 PUT$ for ~$9.81 million, suggesting Micron might also face selling pressure post-earnings.

Comments