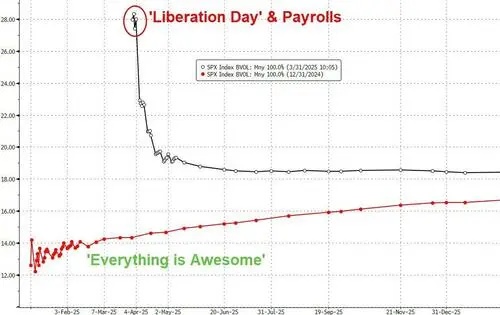

This Wednesday (April 2nd), the global financial market will usher in the test of the so-called "Liberation Day" in the mouth of US President Trump-Trump has threatened to liberate the United States from the "unfair trading system" on this day. With the landing of the U.S. government's big trade moves such as "reciprocal tariffs", all kinds of assets will undoubtedly usher in a new round of baptism of huge waves...

In response, JPMorgan Chase released a trading guide for April 2 this week. For many investors who are still confused about how to trade on this day, there is no doubt that they can learn a thing or two.

In the report, the JPMorgan trading team led by Andrew Tyler reiterated at the beginning that they still hold a "tactically bearish" position on U.S. stocks. JPMorgan said that policy uncertainty is already the dominant factor currently affecting the market, and neither "Trump put option" nor "Fed put option" will be activated in the short term--In other words, no matter how U.S. stocks fall, the White House and the Federal Reserve will not take rescue actions in the short term.

However, JPMorgan Chase expects that although U.S. soft data will be under pressure, hard data will remain resilient, which may set a cushion for the U.S. economic downturn. The report also mentioned that if the White House can reach a trade agreement or framework (such as the US-UK agreement) with a certain G7 country before the tariff statement is released, it may break the current bearish pattern and enable the market to downplay the impact of tariffs imposed on the EU/Japan and other regions. (Author's note: From Trump's weekend statement, this possibility is limited)

Morgan Stanley introduced some current consensus in the market before April 2:

For example, most investors probably agree that a "Trump put" exists, so they believe the tariffs are temporary. The "Trump put option" is widely believed to be in the 5000-5300 point area. Some also believe that after the current significant correction in TMT sector valuations, the U.S. market will outperform in all scenarios; The Fed will activate the "Fed put option" at its June meeting at the latest.

But Tyler does not fully agree with the above market consensus.

Tyler said,Trump intends to quickly reconstruct the global manufacturing structure, and his policy vision is longer-term, and his tolerance for the correction of US stocks may far exceed expectations.Therefore, the "Trump put option" does not exist yet, and even if it does, the strike price of the S&P 500 may be lower than 5,000.

In addition, the Fed's policy shift will also observe the relationship between unemployment rate and inflation. With the current combination of low unemployment rate of 4.2% and sticky inflation of 2.8%, unless the unemployment rate rises to 5% and the CPI maintains the status quo, it will be difficult for the Fed to take accommodative action.

JPMorgan believes that some areas of the "Big Seven" in the US stock market can play a defensive role, but the uncertainty of chips means that Nvidia may not be able to rebound, thereby weakening the defensive capabilities of the Big Seven.

In view of the current market environment with high volatility, if investors want to hedge risks, they can use the following strategies.

At this moment, what investors need most is appropriate hedging and short-selling methods. There are six commonly used hedging methods in option strategies for investors' reference.

1. Buy put options

Buying put options has two functions, generally for shorting, and the other is for risk management strategies. Investors use it to guard against losses in holding stocks or assets. This form is usually called protective put options(Protective Put).

Simply buying a put option is itself a bearish strategy, where traders believe that the asset's price will fall in the future. Protective put strategies are combined with stocks already held and are used when investors are still bullish on a stock but want to hedge against potential losses and uncertainties.

Put options can be used for shorting, and protective puts can be used for stocks, currencies, commodities, and indexes, providing downside protection when the price of an asset falls.

2. Selling call option strategy (Covered Call)

In addition to buying put options, investors can also sell call options to hedge against market crashes. When investors hold corresponding stocks, this strategy is called the Covered Call strategy. The specific method is to short sell the corresponding call option while holding underlying shares.

The Covered Call strategy is usually suitable for investors who think that they are "optimistic about the stocks they hold for a long time, do not want to sell the stocks in their hands, and expect that the stock price will not skyrocket or plummet recently". If the market "falls slightly", this strategy can also play a good hedging effect. In addition, if an investor chooses to sell a call option that is not in the money, the hedging effect will be similar to that of buying a put option.

3. Bear market spread strategy

A bear spread strategy is an option strategy in which an option trader expects the price of the underlying asset to fall in the coming period, the trader wants to short the underlying, and wants to limit the trade to a certain risk range. Both call options and put options can be used to build a bear market spread. If you use a call option, it is generally called a bear market call spread. If you use a put option, it is generally called a bear market put spread. (Bear Put Spread).

Specifically, the bear market call spread is achieved by buying a call option at a specific strike price while selling the same number of call options with the same expiration date at a lower strike price.

A bear put spread is achieved by buying a put option at a specific strike price while selling the same number of puts with the same expiration date at a lower strike price.

The main advantage of a bear spread is that it reduces the risk of short trading (buying a call at a higher strike price helps offset the risk of selling a call at a lower strike price). Because if the stock moves higher, there is theoretically unlimited risk in shorting the stock, and the risk of shorting using a bear call spread is much lower than shorting the stock directly. On this basis, options with different expiration dates can also be combined to turn the strategy into a calendar spread, etc.

4. Reverse ratio spread

The disadvantage of the traditional spread method is that when going long or short, although the risk is limited, the upward and downward profits are also limited. Using the ratio reverse spread can solve this problem, achieving unlimited profits and limited risks.

In the ratio spread strategy, a trader buys a call or put option on an at-the-money ATM or an out-of-the-money OTM, and then sells at least two or more identical OTM options. If a trader is bearish, they will use a put ratio spread.

The bearish reverse ratio spread is also called the defensive bear market spread strategy. In a combination with a ratio of 2: 1, investors will sell one put option with a higher strike price and buy two put options with the same expiration date at the same time. If the stock price falls sharply, this strategy can accelerate investors' profits, and if the stock price rises rapidly, it can also bring certain profits. Therefore, this strategy is suitable for investors who have pessimistic expectations for market trends.

5. Collar strategy (Collar)

To protect the downside risk of stocks, there is a strategy of buying put options (Protective Put), and to reduce the cost of holding stocks, you can sell Covered Call options (Covered Call). In order to take care of both, Collar options-this new strategy was born.

The operation method of collar option is to buy an out-of-the-money put option as insurance on the premise of holding stocks, and at the same time sell an out-of-the-money call option to pay the cost of insurance. This is equivalent to putting a Collar on the stock, and the income of the stock is locked in it, hence the name of the Collar option. The collar option is in fact a combination of Protective Put and Covered Call, which limits the risk of downside at the expense of removing some of the possibility of upside profit.

Collar options are available when traders have a bullish position in the underlying market and want to protect the position from market downside. When the full cost of a put option is covered by selling a call option, it is called a zero-cost collar strategy.

6. Volatility VIX and leveraged ETFs

Investors often get the latest readings from the volatility index VIX in volatile markets to feel the market sentiment. The VIX is also often referred to as the "panic index" because it usually rises sharply when the broader market falls sharply. Investors can also trade futures and options on the VIX to hedge.

If investors think that the market will fall further sharply next, they can hedge by buying VIX call options. On the contrary, if investors think that the market will stabilize and rebound in the future, investors can also make profits by shorting VIX with options.

Investors can also use the related options of leveraged ETFs to enhance their hedging effect.

7. Summary

Finally, to make a summary, if investors think that the market will continue to plummet, it is suitable to use four strategies: buying put options, reverse ratio spreads, bear market spreads, and buying VIX call options for hedging. Among them, the reverse ratio spreads have limited risks and profits. Unlimited, the cost of bear market spreads is lower, and buying VIX call options has the best hedging effect under specific circumstances.

If investors believe that the market will stabilize or fall slightly, investors can use the sell call strategy, the collar strategy, etc. In comparison, selling call options has more room when the stock goes up, and the collar strategy locks up the downward space while retaining the upward space.

Comments