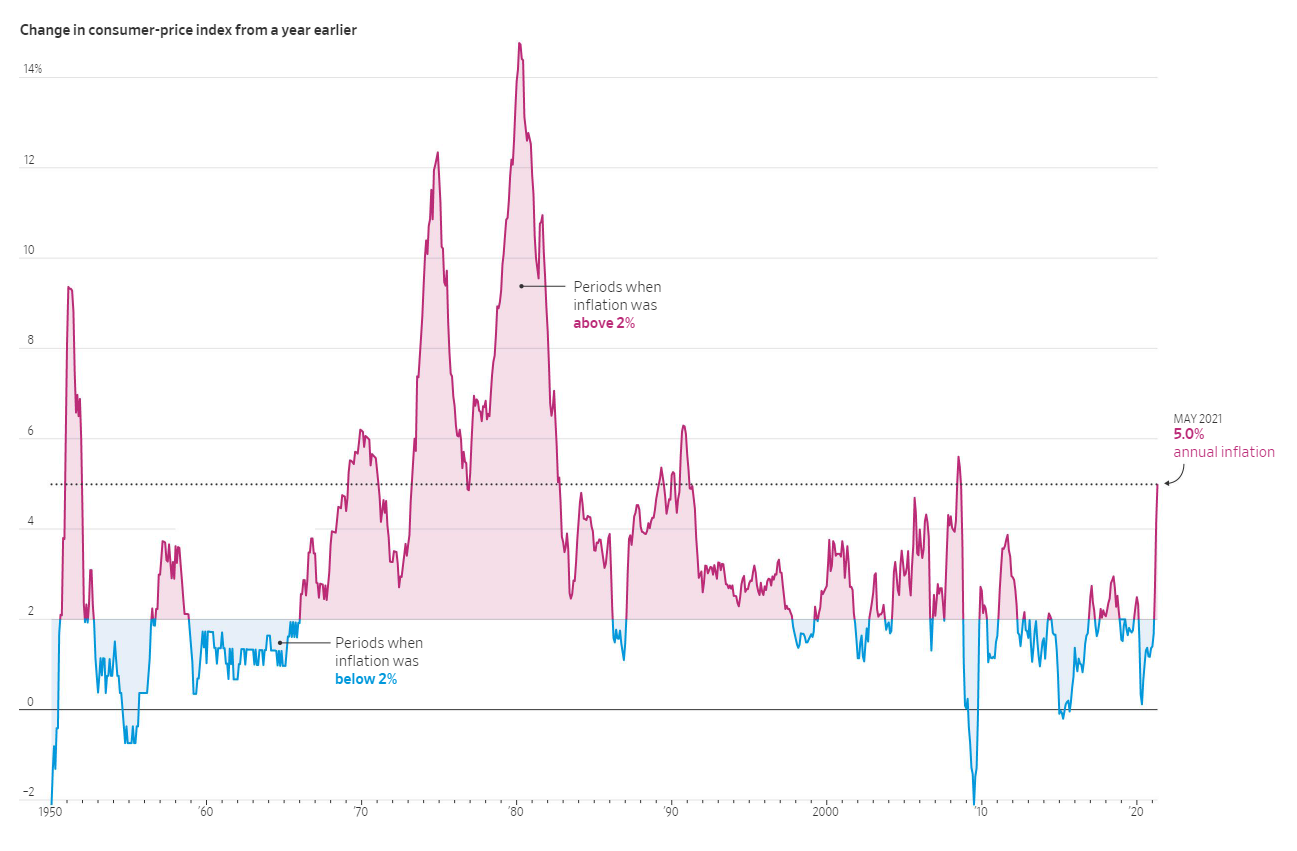

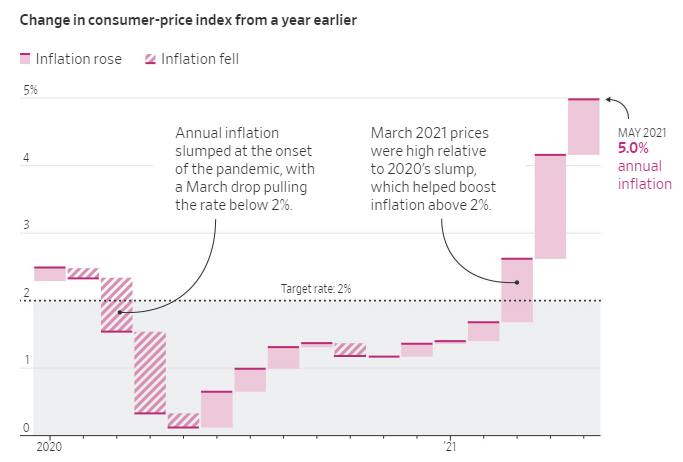

Annual inflation hit a 13-year high in May, but annualized price growth from 2019 was more modest.

As consumers deal with starkly higher prices than a year ago, the Federal Reserve has maintained its stance that high inflation, the increase in the price consumers pay for goods and services, isn’t expected to last very long.

The Fed tweaked its outlook and now expects toraise interest rates by late 2023—sooner than previously anticipated—noting progress in economic activity and employment.

And while inflation’s 13-year high, as measured by the annual change in the consumer-price index from a year earlier, has caused concern, the central bank restated its belief that the rise in prices is “largely reflecting transitory factors.”

The Fed cuts its benchmark interest rate in economic downturns to lower borrowing costs and boost activity. When the economy is thriving, prices rise and the Fed tends to raise rates to keep inflation from climbing too far above its 2% target. Its preferred gauge, the personal-consumption expenditures price index, typically tracks just belowthe consumer-price index.

A sudden burst in consumer demand from the economy reopening and an imbalance in supply disruptions are among the main factors driving up prices compared with the same period last year.

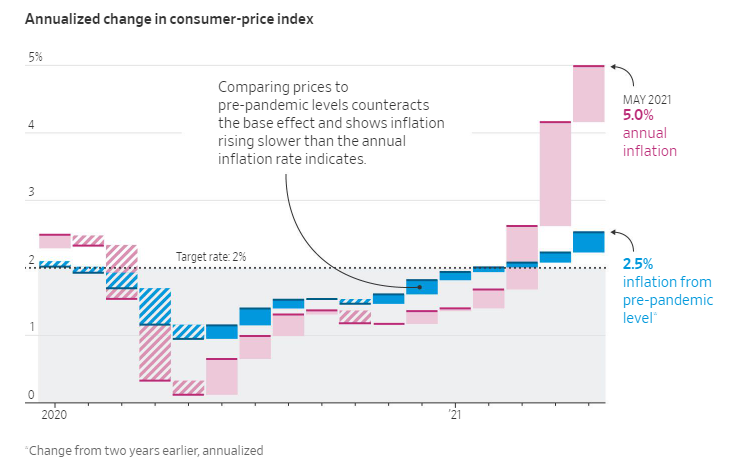

Adjusting for the base effect

Another much-discussed consideration is the importance ofthe so-called base effect, which is the outsize impact when comparing change from one year that was unusual to the next. This can be caused by an economic anomaly—like last year’s pandemic lockdown, when prices dropped.

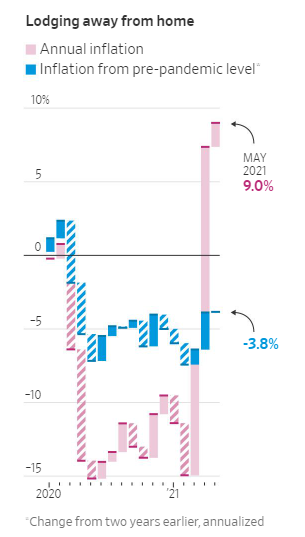

Recovery lag

Some sectors that illustrated the base effect had high annual inflation in May but prices were actually below their pre-pandemic levels.

For example, lodging away from home, which includes hotel and motel prices, plummeted in early 2020 when travel restrictions were put in place. As restrictions eased this year, prices shot up. They were 9% higher in May compared with a year earlier during the beginning of the pandemic. Those prices, however, are still below pre-pandemic levels.

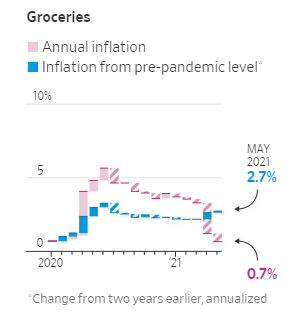

Reverse base effect

The base effect impacted inflation for groceries in the other direction. As people shifted toward eating at home early in the pandemic, prices rose. Annual inflation peaked at 5.6% in June 2020 and fell to 0.7% in May from a year earlier—when prices were relatively high. Compared with pre-pandemic levels, though, prices never rose more than 3.3% and were up 2.7% in May.

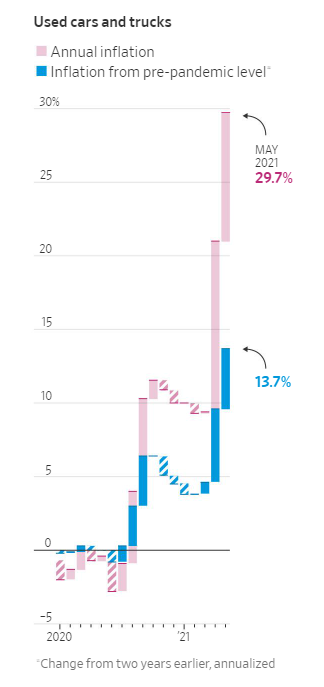

Tight supply

Prices for some goods and servicse have risen by both measures of inflation in recent months. In some industries, supply-chain issues abound as demand heats up and companies struggle to keep pace.

The recentglobal chip shortagehas had a ripple effect throughout industries and in particular has strained new-car inventories, causing buyers to instead shop the used car and truck market. The demand and thin supply have helped push preowned-vehicle prices up 29.7% from a year earlier. The rise from pre-pandemic levels was high at 13.7%, but less stark than the one year-earlier comparison.

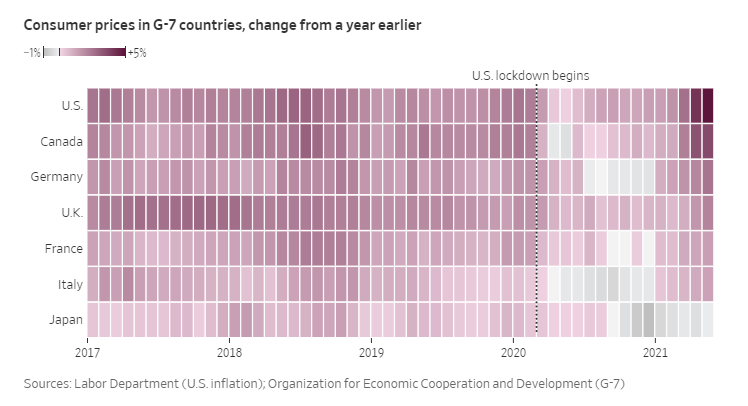

How the U.S. stacks up

As more people return to work and the economy fully reopens, the Fed will continue to monitor consumer prices. Inflation in the U.S. has been higher than in other Group of Seven countries—the world’s largest advanced economies—a reflection in part of the impact of strong fiscal stimulus on the U.S. economy.