Amazon stock does not currently offer investors dividend payments, but could it? The Amazon Maven discusses the possibilities and the challenges.

In the value-to-growth spectrum, Amazon stock can be safely categorized as the latter. The company has been growing revenues at a robust annual pace of 25% over the past decade, and shares trade at a rich 60 times current-year earnings.

It is unusual for growth stocks to pay a dividend, since much of the cash produced is reinvested in the business. But could the cloud and e-commerce giant begin to distribute dividends to its shareholders in the foreseeable future, possibly unlocking value as the stock becomes more appealing for dividend investors?

Cash is not a problem

On its path to world domination, Amazon has been performing superbly in the past several years. The company’s financial results improved even further during the pandemic year, as secular trends in online retail and cloud adoption accelerated.

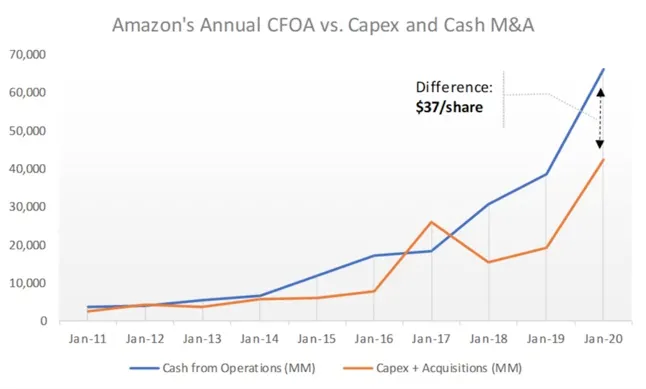

The chart below shows how Amazon’s cash from operations spiked from less than $4 billion in 2011 to $17 billion five years later and a whopping $66 billion in 2020. The 33% annualized growth rate has been even higher than the pace of revenue increase, as the business gains scale and margins expand.

However, Amazon’s cash appetite has also grown alongside cash flow generated. The most important source of cash consumption has been capex – capital investments in things like distribution facilities and data centers. The orange line above represents capex plus cash M&A activity, which has been historically modest, but that has increased fast since the 2017 acquisition of Whole Foods.

The graph above makes it clear that Amazon has not had a cash problem. At the same time, it suggests that the company’s lavish cash inflow has been finding good use within Amazon itself.

Dividend is unlikely for now

One could reasonably argue that, despite the reinvestments in the business, Amazon would still be able to distribute some of its cash to shareholders in the form of dividends (the company barely buys back any of its shares currently).

The gap between cash from operations and capex plus M&A in 2020 amounted to $37 per share, the equivalent of over 1% of Amazon stock’s value – think of it as a “potential dividend yield” of 1% or more. Even if the company were not able to sustain such dividend through operations only, which it likely could, Amazon would still have access to cheap debt financing to cover any potential shortfalls.

Yet, I find it unlikely that Amazon will consider paying a dividend soon, even after next month’s CEO transition. Growth opportunities in e-commerce, cloud and tech products and services still seem plentiful, and the Seattle-based company is more likely to remain true to its growth DNA for now.