Summary

- Oatly is a fast growing Swedish oat milk company.

- The company is riding the growing demand for alternative milk. This is being driven by environmental and health reasons.

- With its production capacity expected to increase fourfold, Oatly is set to maintain its high revenue growth.

- This is strongly priced into the current valuation of the company.

Oatly (OTLY) tastes great. This is a first-hand account of a lactose intolerant lover of breakfast cereal. Before Oatly was a revolving door of dairy alternatives that never truly hit the mark. So I buzzed with investor excitement when the company announced it was going public. This would quickly dampen when its eventual public valuation reached a high of $17 billion, more than 38x times trailing twelve months revenue as at its fiscal 2021 first quarter.

The bullish narrative for the Swedish oat milk company has been built on what is now undoubtedly a structural shift in consumer eating patterns to plant-based alternatives. The benefits are broadly altruistic and multifaceted ranging from animal welfare to health and the environment. This forms one leg of ESG based macrotrends along with green energy and the electrification of transportation that aims to limit anthropogenic climate change.

Can The Future Of Eating Drive Alpha?

Plant-based diets will play an increasingly dominant part of previously meat dominated diets. This great disruption has driven stocks like Beyond Meat (BYND) and Tattooed Ched (TTCF) to stratospheric highs as investors take stakes to gain exposure to what many have described as the future of food.

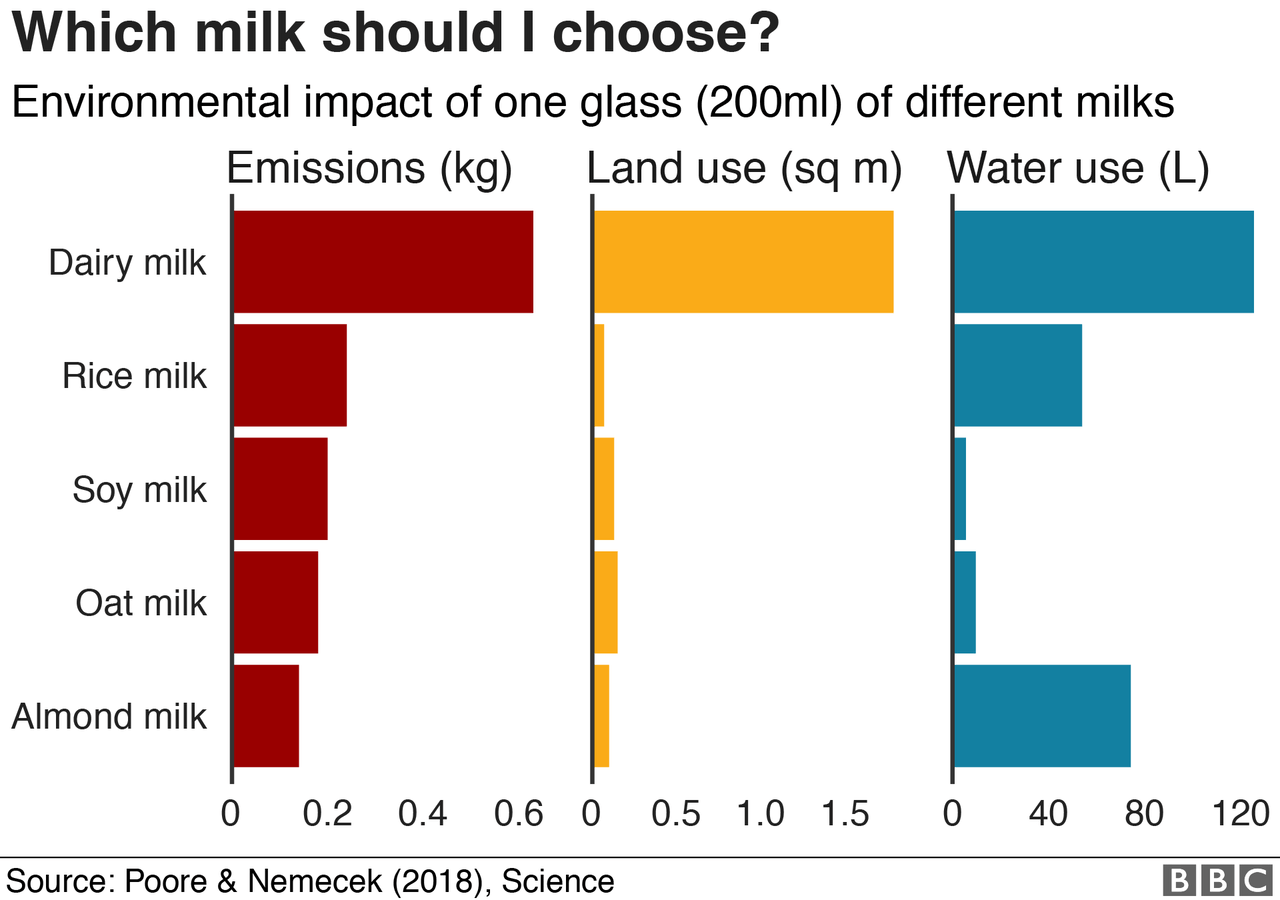

Even bears, skeptical on the short term valuation of such companies, have conceded to the inevitability of this. Dairy milk is the worst type of milk for the environment and for the world to actively limit global warming to “well below” 2C, there will need to be a radical shift to better alternatives.

Oat milk has low emissions at 0.18kg CO2e per glass. And while its land use is slightly higher than soy or almond milk with 0.16 sq m of land needed to end up with one glass of oat milk, it doesn't require as much water for growth. This at 9.6l required per 200ml glass is lower than milk and most other alternatives bar soy milk.

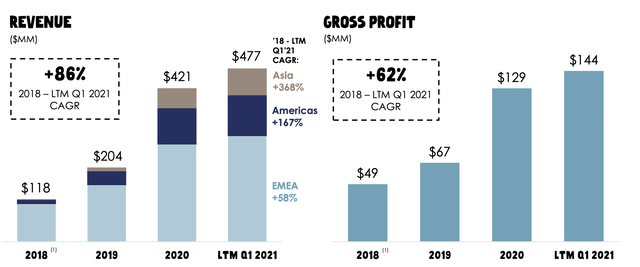

These factors have led to rapid revenue growth for Oatly which saw sales of its oat milk products reach $140 million during its fiscal 2021 first quarter. This year-over-year growth of 66% came on the back of what Oatly's management has described as a $600 billion total addressable global market for dairy. Gross profit margins of 30% during the quarter meant gross profits came in at $42 million. This was down from margins of 32.4% in the comparable YoY quarter. The company is not profitable and lost $29.2 million in operational cash flow during this quarter.

Oatly is set to announce its Q2 2021 results soon. This is expected to be strong with its products now available in at least 32,200 coffee shops and at least 60,000 outlets across Europe, America, and Asia. The company plans to dramatically expand its production capacity from 300 million litres at the end of 2020 to 1.4 billion litres at the end of 2023. This will be through 9 production facilities, up from its current 3.

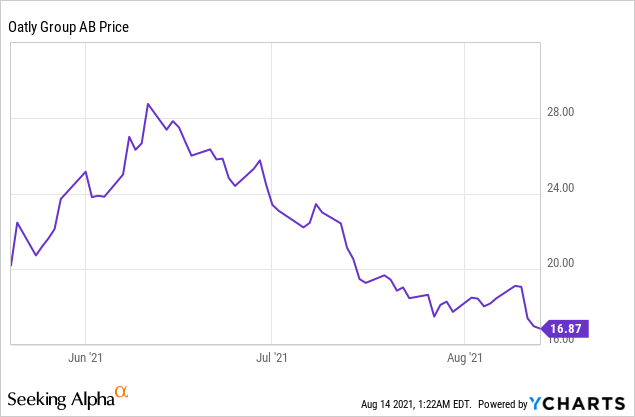

For bears, the sticking point for Oatly being uninvestable continues to be its valuation. While its stock price has fallen 42% from its highs to $16.87 as of writing this article, this is still 22x trailing twelve months revenue of $447 million. However, this drops to 16x price to sales when revenue of $615 million expected for its 2021 fiscal year is used. Whether its gross margins can be maintained as competition in the sector heats up is also yet to be seen. We are perhaps seeing early signs of frustration with the company pursuing a failed lawsuit against a small British oat milk company. The defence and expansion of its current gross margins will be a Sisphesian undertaking and Oatly's brand will be instrumental in building out its moat so its hyper revenue growth eventually translates into strong profits and cash generation for its shareholders.

The Oat Milk Pioneer Takes On The Public Market

Oatly's oat milk is better than its competitors. This is directly reflected by its hyper revenue growth and its social media following. This will continue to grow as the company executes on its expansion plans which will see production capacity more than quadruple over the next 3 years. Hence, as oat milk looks set to win the battle between alternative milk, Oatly likely faces a favourable future. It will continue to take market share from traditional dairy in developed markets across the world. This will be driven not just by those who are intolerant to milk but by a mainstream environmental aware audience who are driven by a need to play their part in mitigating their ecological footprint.

However, Oatly current valuation leaves very little room for failure. The company trades on a rich multiple which current longs would have to wait some years for the company to grow into if revenue growth moderates. I've added the company to my watch list and will continue to review it as a potential investment in the months ahead.