Summary

- Institutional investors collectively bought about 11.7% of the company's total share count in the last 13F cycle.

- Palantir's growth momentum can accelerate in the coming quarters thanks to its rapid customer additions.

- Readers and investors may want to remain long on the name.

Investing forums are lately rife with debates around Palantir's (PLTR) growth prospects. While some believe its lofty stock-based compensation expenses make it a poor investment, others feel its rapid revenue growth makes it a once in a lifetime opportunity. Amidst this tug of war between the bulls and the bears, institutional investors have quietly picked sides already. Latest data reveals that this class of investors once again actively bought shares of the data analytics company in the latest 13F filing cycle. Let's take a closer look at their trading activity and try to understand why they're so bullish on Palantir.

The Active Buying

I'd like to start by saying that institutional investors don't have a crystal bowl and they don't always get it right. However, this class of sophisticated investors does have access to certain resources - such as access to company management, supply chain connections, analysts to conduct scuttlebutt research - that give them an edge over retail investors. These institutions are mandated by the SEC to disclose their trades in 13F filings. So, following their trading activity can sometimes provide us with leading insights about where a company and its shares might head next.

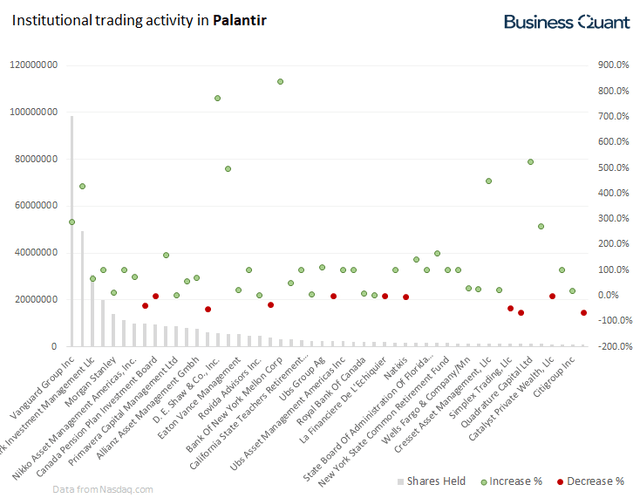

As far as Palantir is concerned, the Nasdaq site states that institutional investors collectively bought roughly around 217 million of its shares, on a net basis, in the last 13F filing cycle. The company has around 1.86 billion shares outstanding which means that these investors collectively bought a gigantic 11.7% chunk of Palantir's entire share total in the last cycle alone.

It's also worth noting that the buying activity wasn't concentrated across just a few institutions. In fact, the number of institutions that increased their holdings in Palantir outnumbered those that reduced their positions in the name by a factor of 2.4. This goes to indicate that a broad swath of institutions has grown extremely bullish on Palantir. For the record, the latest 13F filing cycle spanned from April through June, and the data was released this week.

Next, I wanted to check if Palantir's largest institutional investors traded any differently. After all, if its largest investors were selling, while other institutions were buying, then that discrepancy would require a further examination in itself. So, I compiled the trading activity of Palantir's 50 largest institutional investors that filed their 13F documents between April and June. The results were rather interesting.

As it turns out, only 11 of the 50 institutional investors reduced positions in Palantir while the remaining 39 either maintained or increased their exposure to the company. Some firms had initiated new positions while others increased their holdings by several thousand percent. In order to maintain the scalability and readability of the chart, I marked these entries as 100% on the chart above.

But having said that, the results confirm that the recent buying into Palantir wasn't limited to a substratum of its institutional investors, but was instead widespread across institutions of varying sizes. We're now presented with the next question - why are institutional investors so bullish on Palantir in the first place?

Bullish for Good Reason

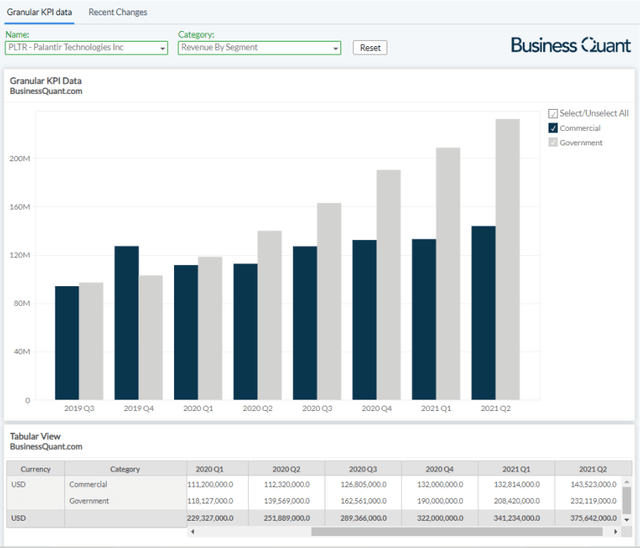

For starters, Palantir has lately been growing its revenues across both its reporting segments. Its government and commercial revenues, for instance, have increased by 66% and 27.3%, respectively, over the last one year alone. These elevated growth rates across both its segments highlight excellent execution on the management's part, and I believe it's a commendable feat. There's no telling as to when the company's growth momentum will slow down, at least not for the time being, which makes it a good growth stock.

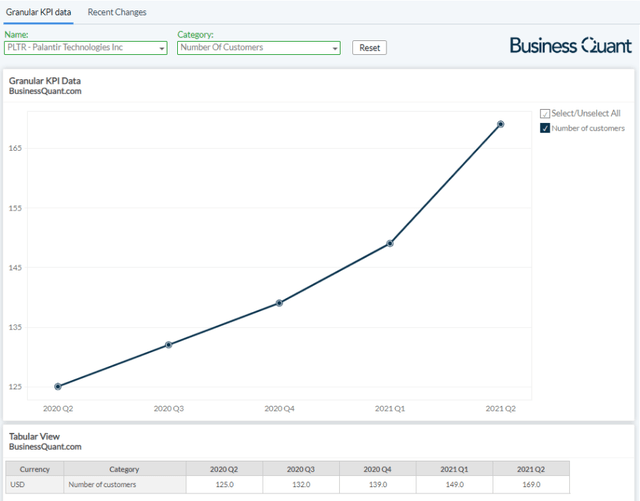

Secondly, I've explained this in my prior articles at length, that Palantir is undertaking a slew of measures - such as increasing its sales force, rolling out free versions of their platform for major enterprises, switching to a customer-friendly payment model - to expand its customer base. All these efforts seem to be finally bearing fruit. Palantir reported in its latest 10-Q filing that its customer count has risen to 169, up from 125 in Q2 last year.

This is important because as these new customers get familiarized with Palantir's platforms and integrate its offerings into their workflows, they're likely to ramp up their spending over the subsequent quarters. Enterprises usually follow a wait-and-watch approach to see if a particular thing is working out for their personnel before going full throttle on their spending. So, in essence, these new customer additions are likely to drive Palantir's revenue growth in the next several quarters. I believe this is another good reason why growth-seeking investors should consider Palantir.

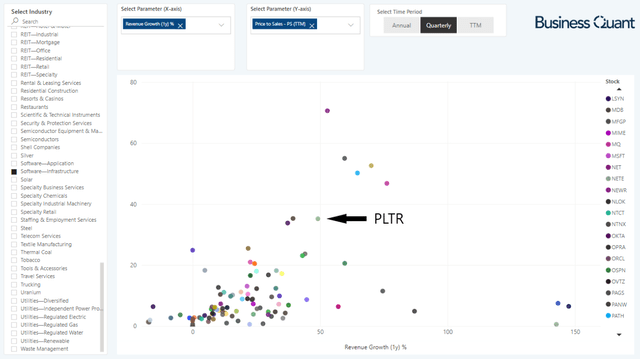

Lastly, Palantir may seem overvalued when just looking at its valuation multiples on a standalone basis, but that doesn't necessarily make it a bad investment. To put things in perspective, let's look at the scatter chart below. I plotted the price-to-sales (or PS) multiples on the Y-axis and the revenue growth rates on the X-axis. Next, I selected the software infrastructure industry to plot 105 of the constituting US stocks.

Surely, per the Y-axis, Palantir is trading at a higher PS multiple compared to its peers. However, it's also evident from the X-axis that Palantir is growing faster than most of the other stocks in its peer group. There are a few companies that are growing faster than Palantir, but they're trading at even higher multiples. So, in essence, investors are paying a premium to own the rapidly-growing quality stock, that is Palantir.

Final Thoughts

I'd like to add a caveat here. The 13F filings data is based on trades that have already taken place in the past and may not reoccur. So, readers and investors should, at best, use this data to test if their trade direction and investment thesis conform with the trading activity of Palantir's institutional investors.

Having said that, if these firms felt that the bearish narratives surrounding Palantir had any merit, they wouldn't have been so active with the buy orders and they might have trimmed their positions. But that did not happen.

Instead, a broad swath of institutional investors accumulated the data analytics firm's shares in large quantities. This suggests that these investors are forecasting a significant upside in Palantir's shares and are discounting the bearish narratives floating around in investing forums. This should come across as an encouraging sign for the company's long-side shareholders.

As far as I'm concerned, I believe Palantir is modestly valued given its elevated growth rates and also feel that its continued customer base expansion will drive its financial growth going forward. So, overall, I'm bullish on the company and believe that its shares will rise further in the coming weeks and months. Good Luck!