Last Friday, Powell's unexpectedly dovish Jackson Hole speech sparked another melt-up in risk assets.

Ahead of the latest rally, Wall Street's most bearish strategists such as Citigroup's top strategist Tobias Levkovich, had issued multiple dire warnings about a euphoria on Wall Street and how markets resemble 1999. His year-end equity call for the S&P 500 is 4,000 but has been forced to acknowledge in a note to clients he's made "significant" mistakes in his prediction.

Levkovich is still holding to his guns and predicting the benchmark will end this year at 4,000 before reaching 4,350 by June 2022.

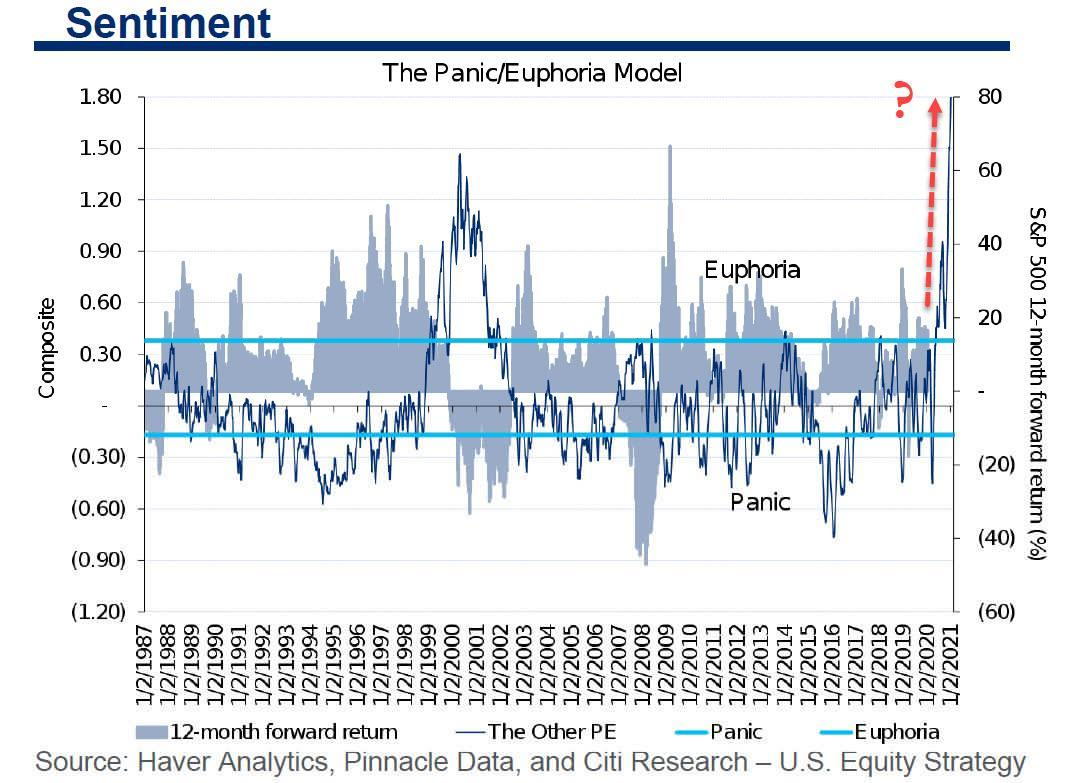

As shown in Panic/Euphoria Model - which considers factors including the number of investor positions anticipating a fall in stocks, levels have exceeded the Dot Com period.

"Caution that proves to be wrong can cost one a career,"Levkovich told clients in a note last week, quoted by Bloomberg."Nevertheless, we feel compelled to stand by our analytical process."

In term's of valuations, Levkovich is right - equities are way overvalued compared to historical norms.

"We suspect that these items may not be drivers going forward and other factors including euphoric sentiment and stretched valuation become more impactful, offset to some degree by reinvigorated share repurchase programs," he said. "The stock market needs to consolidate the past 18 months' worth of gains and portfolio managers require more visibility into 2022 profits."

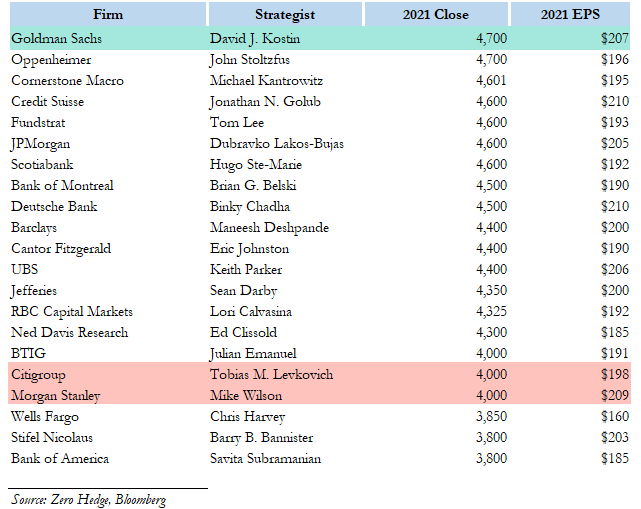

Mike Wilson, the chief U.S. equity strategist at Morgan Stanley, is in the same camp as Levkovich, who expects a 10%+ S&P 500 correction. Two weeks ago, Wilsonreluctantly raised his S&P price targetto 4,000 from 3,900. Meanwhile, Goldman's David Kostin is on the opposite side of the bet, last month hiking his year-end S&P price target from 4300 to 4,700, up about 7% from here, justifying his optimism byunexpectedly low bond yields which traditionallyrepresent a slowing economy.In other words, stocks will rise because the economy will slow from here. Just brilliant.

Here's where the equity strategist stand with their S&P 500 year-end targets.

joke"mystery" to all: as Steve Chiavarone, a portfolio manager and head of multi-asset solutions at Federated Hermes,told Bloomberglast week, “If someone would have told me in March of last year, when Covid was first rearing its ugly head, that 18 months later we would have case counts that are as high—if not higher—than they were on that day, but that the market would have doubled over that 18-month period, I would have laughed at them.”