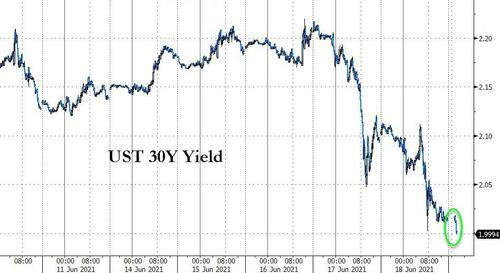

30Y Treasury Yield Tumbles Below 2.00%, Japanese Stocks Plunge

zerohedge2021-06-21

Short-dated Treasury yields are extending their rise from Friday's bloodbath as the collapse of the long-end of the term structure accelerates in early Asia trading.

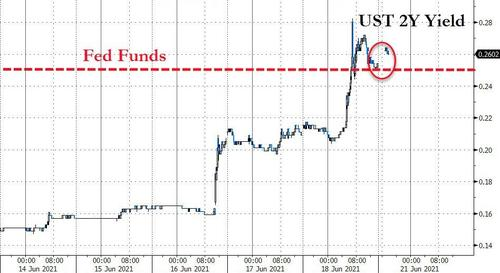

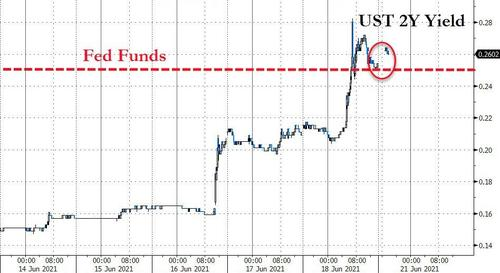

2Y is back above the Fed Funds rate...

Source: Bloomberg

Source: Bloomberg

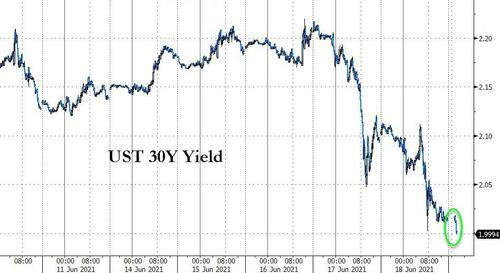

and 30Y yields are back below 2.00%...

... for the first time since March...

Source: Bloomberg

Source: Bloomberg

10Y yields are at their lowest since early March...

Source: Bloomberg

Source: Bloomberg

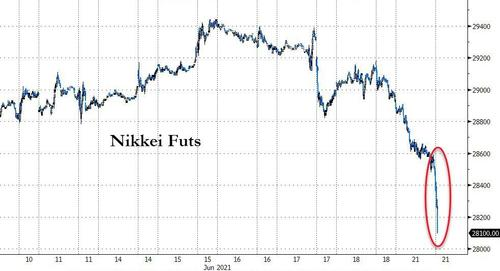

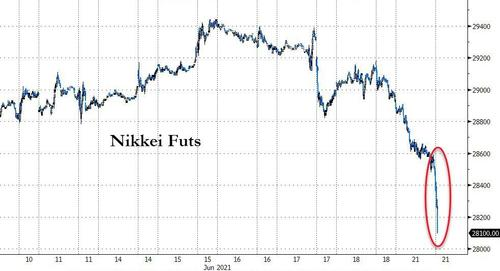

And Japanese equity markets are none too happy with Powell's policy error malarkey...

Source: Bloomberg

Source: Bloomberg

AsLance Roberts noted earlier,there have been ZERO times in history when the Fed started a rate hiking campaign that did not lead to a negative outcome.We suggest this time won’t be any different.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.