It’s a meme-stock world; we just live in it—and small-company fund managers are doing their best to ignore it.

It all started with GameStop (ticker: GME) in January;since then, retail traders on Reddit message boards have collaborated to push share prices higher for several small-company stocks. These companies—such as Express(EXPR),BlackBerry(BB),Bed Bath & Beyond(BBBY),and others—aren’t any more profitable or otherwise more attractive based on fundamentals. Investors left owning the stock after the initial promoters of the shares sell their stakes often end up with a losing investment.

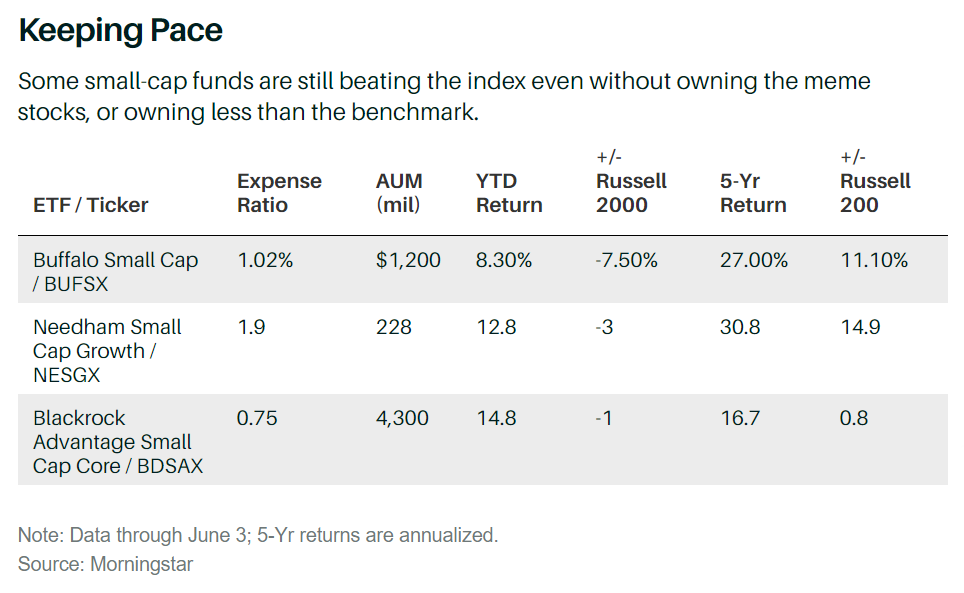

Small-cap fund managers, for the most part, have avoided these stocks. “Oftentimes, [meme stocks] do not meet our criteria,” says Jamie Cuellar, manager of the $1.2 billion Buffalo Small Capfund (BUFSX). “And we do not change our investment process if the market is rewarding meme stocks.” Chris Retzer, manager of the $228 million Needham Small Cap Growthfund (NESGX), says the same: “We would not chase those names based on our fundamental viewpoints.”

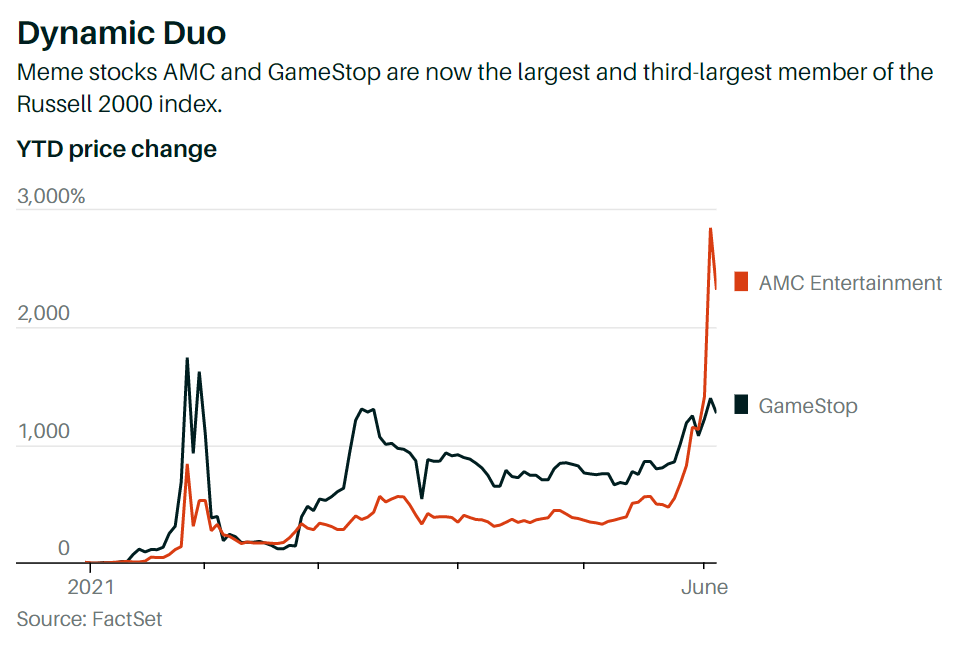

That’s good news for investors, though a challenging stance for fund managers. Shares of AMC Entertainment Holdings (AMC)—the latest leader of meme stocks—surged 418% from May 21 to this past Wednesday, before falling 23% as of Friday’s close. At its peak, the stock became the largest member of the Russell 2000 index—the benchmark against which many small-cap funds are measured—with a market value of $28 billion.GameStop was the third largest member. While each stock makes up less than 1% of the index, their wild surge means that they’ve contributed the most to the small-cap benchmark’s recent gains.

“I can imagine there are many small-cap active managers right now very frustrated by what they’re seeing,” says Ben Johnson, director of global ETF research for Morningstar. In the first five months of 2021, he says, not owning GameStop, or owning less than the benchmark, has been the biggest performance detractor for small-cap value funds. (Because meme stocks are generally of battered companies, they are usually found in the value index.)

Fund investors, however, should be wary of attributing too much over- or underperformance to whether or not a fund owns meme stocks. Sure, it can be marginally more difficult to beat the benchmark when meme stocks are on a tear. But they don’t have as much influence as many investors think: The Russell 2000 has gained 16% so far this year; AMC and GameStop combined contributed just 1.3 percentage points to that rise. That’s still a high hurdle for active managers to beat. Similarly, when meme stocks drop, it can make benchmark-beating gains look more impressive. Ultimately, the bigger issue is not the performance of meme stocks; it’s that their volatility makes evaluating the performance of funds difficult.

What’s more, the Russell 2000 will make its annual reconstitution at the end of June. If AMC and GameStop remain at their current levels, they’ll likely move from the small-cap index into the large-cap Russell 1000. That means if, or when, they tumble again, the drawdown will affect the large-cap index, not the small-cap benchmark.

“Small-cap managers who are underweight these names are forced into a difficult near-term choice,” wrote Wells Fargo analyst Chris Harvey in a Friday note. “Either add these names before the rebalance to limit relative-performance risk, or cross fingers and hope their prices fall before they are graduated out, i.e., before the underperformance is locked in.”

Some active funds, including the $4.3 billion BlackRock Advantage Small Cap Corefund (BDSAX), have added AMC and GameStop shares this year. The fund, however, has more than 800 holdings, and those two make up less than 0.3% of its portfolio.

Many active managers say they’re not too concerned about lagging behind the benchmark due to a lack of meme stocks. For starters, while these small stocks are making big moves and getting a lot of media attention, those moves ultimately have little real effect on the broad universe of small companies. “Meme stocks have minimal impact on long-term small-cap investors who focus on fundamental results,” says Needham’s Retzer. Are his clients concerned? “It’s not even a topic,” he says.

“People hire discretionary managers to use their discretion,” says Morningstar’s Johnson. “I would think they’d want the managers to stick to their guns and keep their cool through the environments we’re living through now.”

Fund investors should evaluate funds’ performance relative to other, similar funds, rather than their performance relative to the Russell 2000 benchmark. It’s also important to take a look at funds’ risk-adjusted returns—even if a fund does well owning meme stocks, those returns come with more inherent risk, and it’s important to know that a manager is willing to make momentum bets. If you’re an investor focused on owning good companies that do well because their businesses are growing, it might be OK to underperform the benchmark while the meme market rules.

This is not to say that active managers should always avoid meme stocks. While meme stocks’ rise is mostly driven by social-media hype rather than genuine fundamental improvements, the rally itself has led to changes that might help these struggling firms turn around. AMC, for one, has been raising money by selling new shares, which could be used to repay debt, acquire rivals, or invest in new growth opportunities.

The long-term implication of these moves has yet to be determined, says Retzer, but it’s certainly worth monitoring. “What they do with that cash will determine whether these valuation can be supported,” he says. “But under current fundamental analysis, it would be a struggle to view these stocks as value investments right now.”