Summary

- Nvidia is poised to post impressive revenue growth and gross margins next month as GeForce RTX GPU sales likely boomed.

- Nvidia’s gross margins (non-GAAP) may grow to 70% by next year due to strong gaming revenue momentum.

- Nvidia’s commentary on China’s cryptocurrency crackdown and how it affects CMP sales will allow for a better modeling of revenues going forward.

- Split or no split, Nvidia has 28% upside.

- I lay out my post-split plan to buy Nvidia at certain key levels.

Nvidia (NVDA) executed a 4:1 stock split last week Tuesday. While stock splits don’t change a firm’s valuation, Nvidia may initiate a new upleg as earnings next month are likely going to be impressive. My stock price target for Nvidia, adjusted for the stock split, is $250. Nvidia also faces a couple of tests and you should watch out for these key levels before buying.

Nvidia’s stock split

Nvidia’s 4:1 stock split has made the stock look cheaper but the fundamentals or the valuation of the firm have not changed. If you bought 100 shares of Nvidia at $800 pre-split, you now own 400 shares with a cost base of $200… the total value of an investment position is unaffected by Nvidia’s stock split, in both cases it is $80,000.

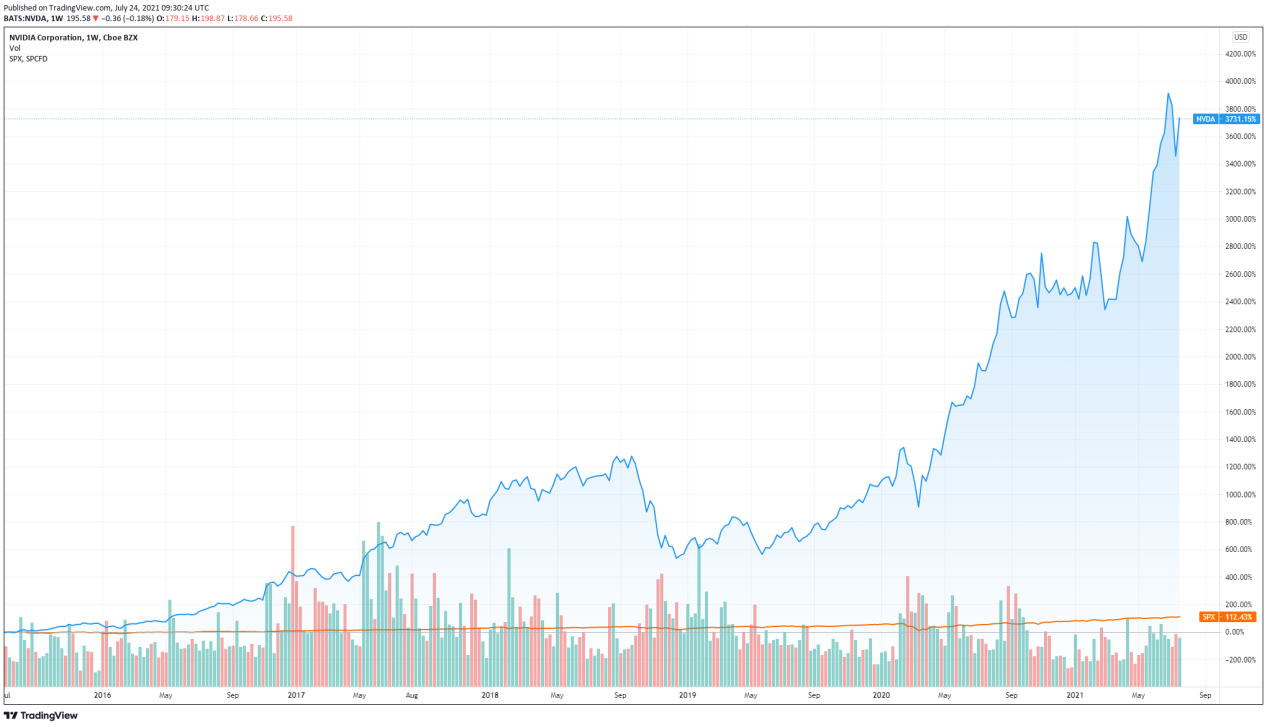

Companies execute stock splits to make their shares look more affordable and increase liquidity in the market. Nvidia, post-split, has the same market value as before, $485B, only the number of shares outstanding has increased by the factor of four. While there is no evidence that stock splits produce higher returns post-split, the fact that the stock, at least on paper, looks more affordable could lead to increased buying of Nvidia. My stock price target before the split was $1,000 (Nvidia: A $1,000 Stock Price Is Not As Crazy As It Sounds), which calculates to an adjusted stock price target of $250 post-split (28% upside).

What's in store for Nvidia next month?

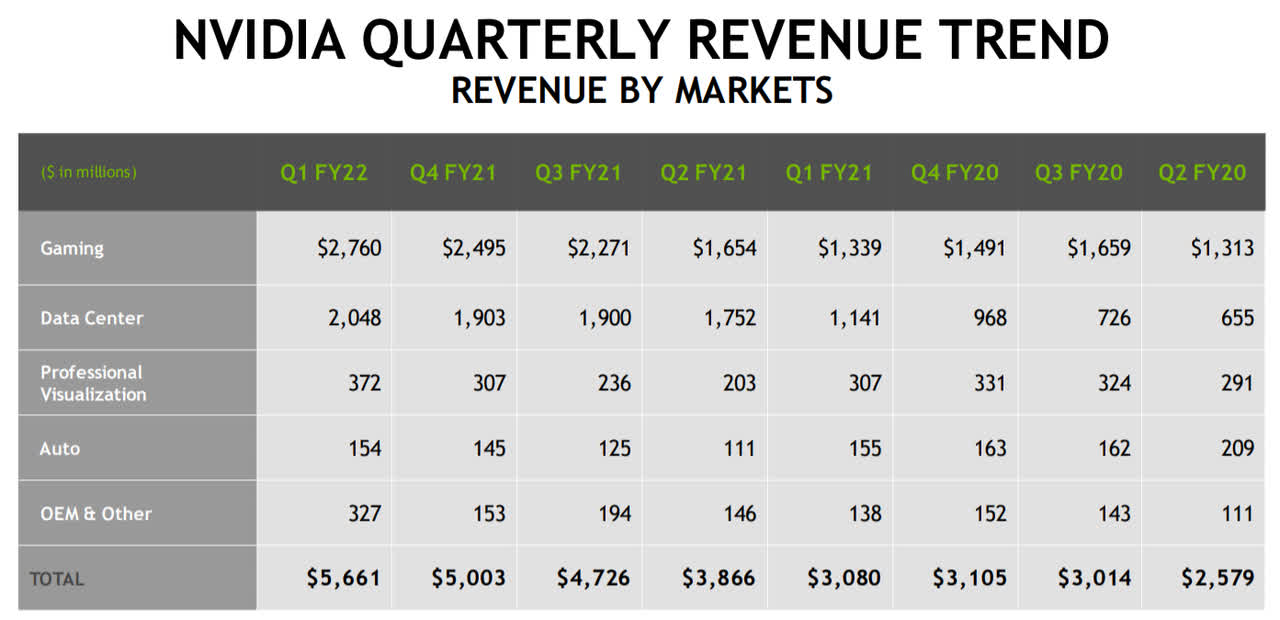

Nvidia is set to open its books for the second quarter on August 18, 2021 and the semiconductor firm is likely going to report impressive revenue growth for Q2’22. Nvidia's total Q1'22 revenues got an 84% bump year-over-year and increased at a 13%-rate Q/Q. Nvidia’s gaming revenues increased at an average annual rate of 22% since FY 2017 while its data center revenues soared 86% annually over the same time period, predominantly because of Nvidia’s Mellanox acquisition in 2020 which considerably expanded Nvidia’s presence in the high performance and data center computing markets.

Nvidia gets the bulk of its revenues from gaming and data centers. Gaming center revenues increased 11% Q/Q to $2.76B in Q1’22 and revenues will likely have grown at a similar rate in Q2’22 due to strength in the gaming market and accelerating customer uptake of the GeForce RTX 30 Series GPU. The RTX 30 Series has been industry-defining by making "ray tracing" the new standard for game developers. Ray tracing is a graphics rendering method that allows for the realistic modeling of light effects in computer games. Strong sales in GeForce RTX 30 Series GPU sales could result in a 10-12% Q/Q revenue bump for Q2'22.

Data centers, which generate the second biggest pile of revenues for Nvidia, saw growth slowing down in Q1'22 and I am looking forward to hearing an update from Nvidia's management about the prospects for the data center business for the rest of the year. I expect Nvidia to report mid-single-digit revenue growth in data centers for Q2'22 and, hopefully, an update about the Arm acquisition.

What will be interesting to see in next month’s earnings report is how the Chinese cryptocurrency crackdown is impacting Nvidia’s cryptocurrency mining processor/CMP business for the rest of the year, which Nvidia is building from scratch. Soaring cryptocurrency prices in the first quarter have led to a surge in demand for CMPs, a business that is set to contribute up to $1.5B in revenues in FY 2022 (my current estimates are for ‘low-case’ CMP revenues of $1.0B and ‘high-case’ revenues of $1.5B). CMP revenues are included in Nvidia’s “OEM & Other” revenues and based on firm guidance are projected to be $400M in Q2’22.

Revenues unrelated to gaming and data centers for Q2’22 - Professional Visualization, Auto, and OEM/Other - are likely going to exceed $1.0B and could reach up to $1.2B depending on how strong demand for CMPs was in Q2’22. Since reduced mining difficulty as a result of falling cryptocurrency prices has made mining more profitable, Nvidia should head into the second half of the year with some CMP revenue tailwinds providing support.

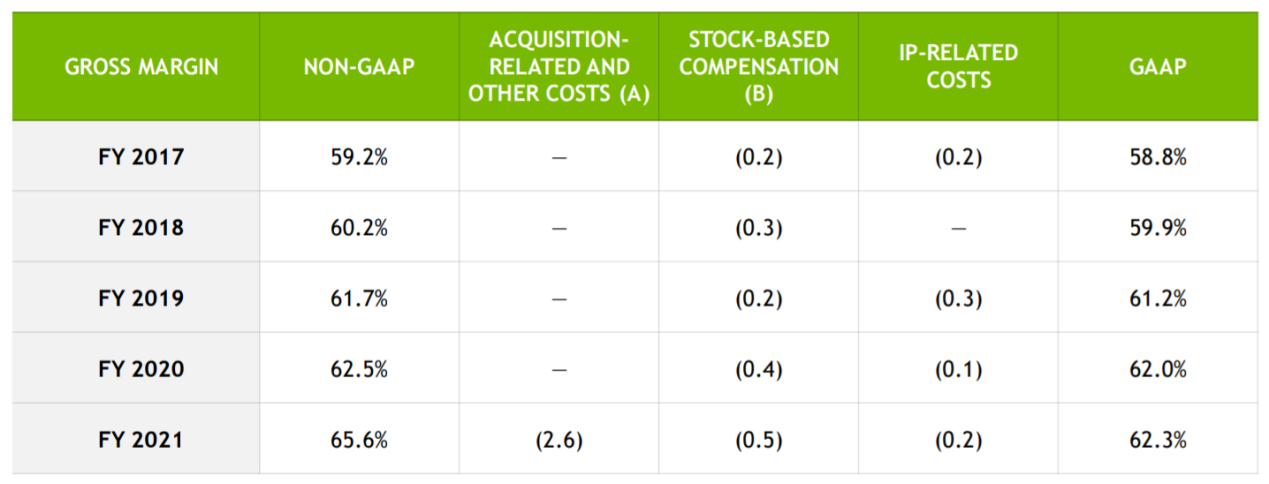

What I am really looking forward to in Nvidia’s Q2 report are Nvidia’s margins. Gross margins - a key figure for semiconductor firms - have trended up strongly, in part because of Nvidia’s Mellanox acquisition which has made a positive contribution to segment performance. I believe Nvidia can grow its gross margins (non-GAAP) to 70% by the start of next year, largely because of continued momentum in the gaming business which gives Nvidia significant pricing power. Nvidia’s guidance for Q2’22 non-GAAP margins was 66.5 percent, plus or minus 50 basis points and actual margins will likely come in at the top of guidance.

How I am playing Nvidia post-split

First of all, I am buying the post-split dips (if there are any!). The price of a stock may run-up before a stock split and drop afterwards as traders take profits. This may or may not be the case here. Nvidia’s closing market price on Friday was $195, equivalent to a $780 pre-split price, and the pre-split high of $835 (equivalent to a post-split price of $209) is in striking distance... it only takes a 7% increase in Nvidia's price from here to make new highs.

Second, I am taking a close look at Nvidia’s 50-day and 200-day moving averages to determine critical support levels. I am ready to buy every dip below a key support level as Nvidia’s upcoming earnings report could be enough of a catalyst to push Nvidia to new highs. The first support level is just below $179 (50-day moving average) which is also where the stock bottomed before the last reversal. If Nvidia's stock dips below $180 before earnings, I am ready to buy just at this level. If the 50-day moving average breaks, the next key support level is $147 (200-day moving average), a level I don't believe Nvidia's stock will fall down to. But if that's the case, then Nvidia would be considered a 'Strong Buy' just below $147.

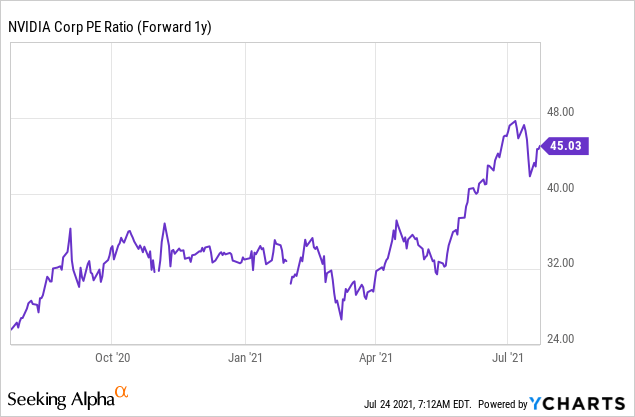

Nvidia is not cheap... and that’s for a reason. Estimates call for 50% Y/Y revenues growth this year and Nvidia might even see an acceleration in its top line growth next year. Nvidia trades at a P-E ratio of 45 which may be considered low given the revenue growth Nvidia offers...

Other considerations/risks

The market tends to reward good performance and because of a 5-year stretch of impressive business results, Nvidia trades at a high earnings multiplier factor. Nvidia’s outperformance relative to the S&P 500 can continue under the condition that revenue growth doesn’t slow.

High valuations for growth stocks are normal, but they also come with some risks. If Nvidia’s revenue growth slows and gross margins flatten out or decline, Nvidia may be ripe for a revaluation in which case the risk profile skews to the downside. Declining gross margins, next to a slowdown in revenue growth, are the two biggest risks for Nvidia's stock. A rejection of Nvidia's Arm acquisition and an outright ban of cryptocurrencies are other risks to watch out for. Given the rising rate of institutional adoption outside China, the risk of a crypto ban is quite low.

Final thoughts

Nvidia experiences broad-based strength in its businesses and should see moderate to strong revenue growth in each segment for Q2'22, led by gaming and GeForce RTX GPU sales. Gross margins are going to see a Q/Q improve based on gaming market strength and guidance for Q3’22 could put Nvidia’s non-GAAP gross margin very close to 70%. Key support levels to watch out for and buy the dip are $179 and $147.