AT&T has announced the giant merger of its WarnerMedia business with Discovery. The Apple Maven discusses the implications to the video streaming industry and how the deal could impact Apple.

Early on Monday, May 17, another mega deal was announced in the media space. AT&T’s (ticker $T) WarnerMedia, the parent company of HBO and Warner Bros. studio, will merge with Discovery (HGTV, Food Network, etc.). The deal has been priced at a whopping $43 billion.

A few years ago, this attention-grabbing merger would have meant little to Apple (ticker $AAPL). But in the age of online streaming and growth opportunities within Apple’s services segment, the deal can certainly have an impact on the Cupertino company.

Video is getting more competitive

The AT&T-Discovery deal is clearly targeted at improving the companies’ position in DTC (direct-to-consumer) distribution of a respectable portfolio of media assets. AT&T argues the case:

“The ‘pure play’ content company will own one of the deepest libraries in the world with nearly 200,000 hours of iconic programming and will bring together over 100 of the most cherished, popular and trusted brands in the world under one global portfolio, including HBO, Warner Bros., Discovery, DC Comics, CNN […] and many more.”

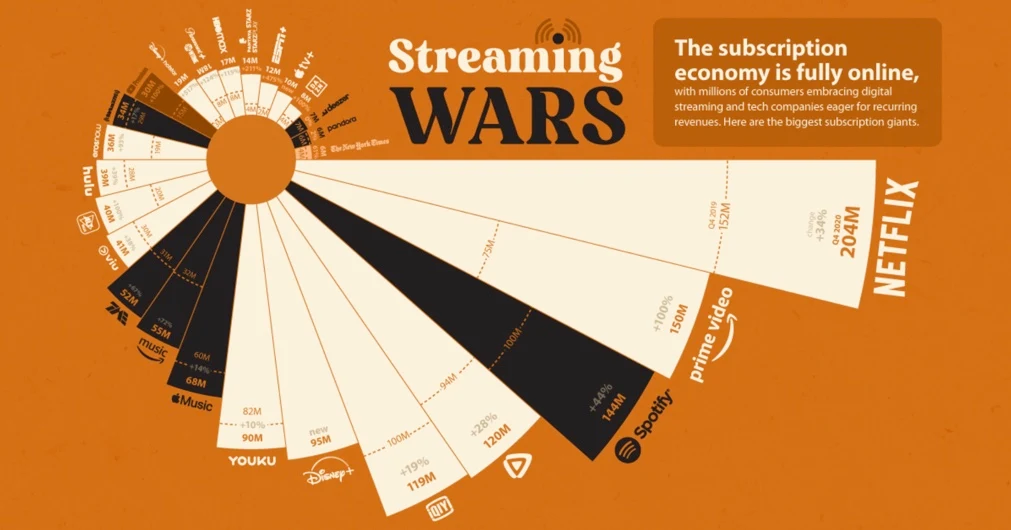

This is yet another step in the consolidation of the mega media players that makes the video streaming space even more competitive. The new WarnerMedia-Discovery conglomerate will probably be better positioned to fight the leaders in the industry for a larger chunk of market share (see chart below): Netflix (ticker $NFLX), Amazon’s (ticker $AMZN) Prime Video, Disney+ (ticker $DIS) and Hulu.

Caught in the middle of the war is Apple. The Cupertino company launched its Apple TV+ service in November 2019 as another piece of the service ecosystem puzzle. But Apple TV+ has yet to prove successful in the face of so much competition for streaming video,as I discussed about a year ago.

The AT&T-Discovery deal will likely put pressure on Apple toup the antein order to become more competitive in video streaming. Apple’s strategy could involve several initiatives, including:

- Strategic acquisition of media assets through the deployment of Apple’s large pile of cash (around $80 billion, net of debt);

- Partnerships with other content providers to increase Apple TV+’s appeal. For instance,Apple teamed up with ViacomCBS to offer a $15 bundle in August 2020;

- Promotional pricing, similar to (1) the free one-year offer to new Apple device owners or (2) the Apple One service bundle.

Quite a bit could be a stake for Apple in video streaming. I estimate that Apple TV+ accounts for a sub-10% chunk of the company’s services revenues. However, video streaming could be a source of material revenue and earnings growth, should the strategy be executed well.