One can't say that Goldman's clients have too much faith in Goldman's trade recos.

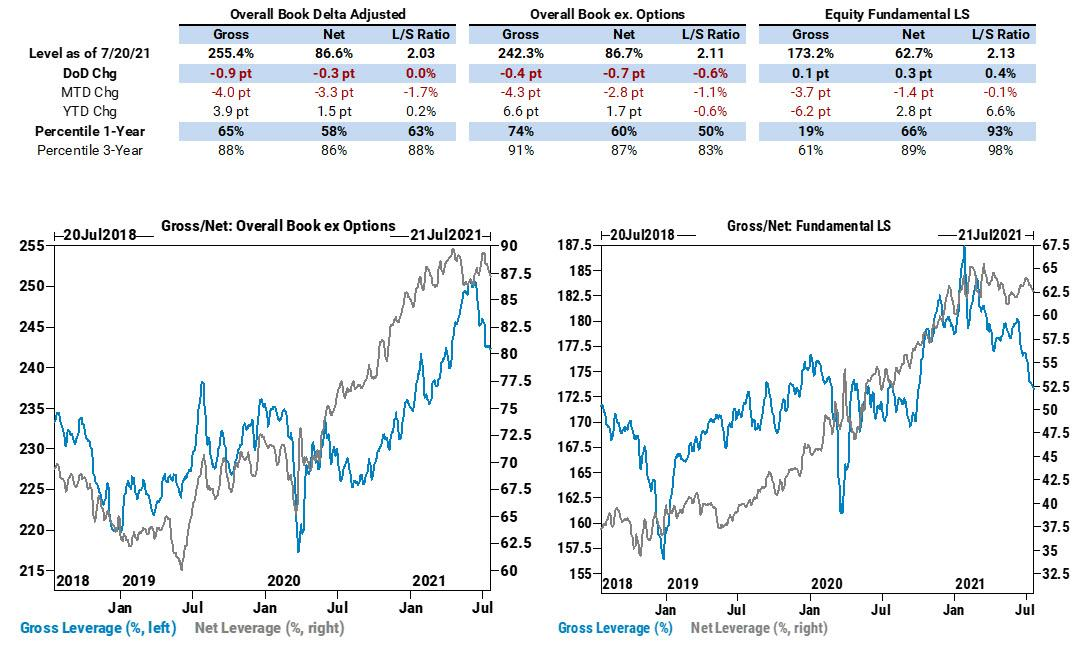

As Goldman's flow trader John Flood was urging clients on Monday "not to buy this dip", they did just that and on Monday Goldman's Prime Brokerage service observed a surge in hedge fund dip buying as the S&P tumbled as low as 4,220. Those same hedge funds, however, clearly unsure what happens next, then proceeded to dump the rally andon Tuesday the GS Prime book saw the largest 1-day net selling since June 17(-2.2 SDs vs. the average daily net flow of the past year) and the biggest net selling in single names since Nov 2019, driven by long-and-short sales (1.6 to 1), as all regions were net sold led in $ terms by North America and DM Asia, and driven by long-and-short sales (2.5 to 1). This defensive positioning has continued through much of the post-Monday rally.

Some more observations from Goldman Prime on the post-bottom action:

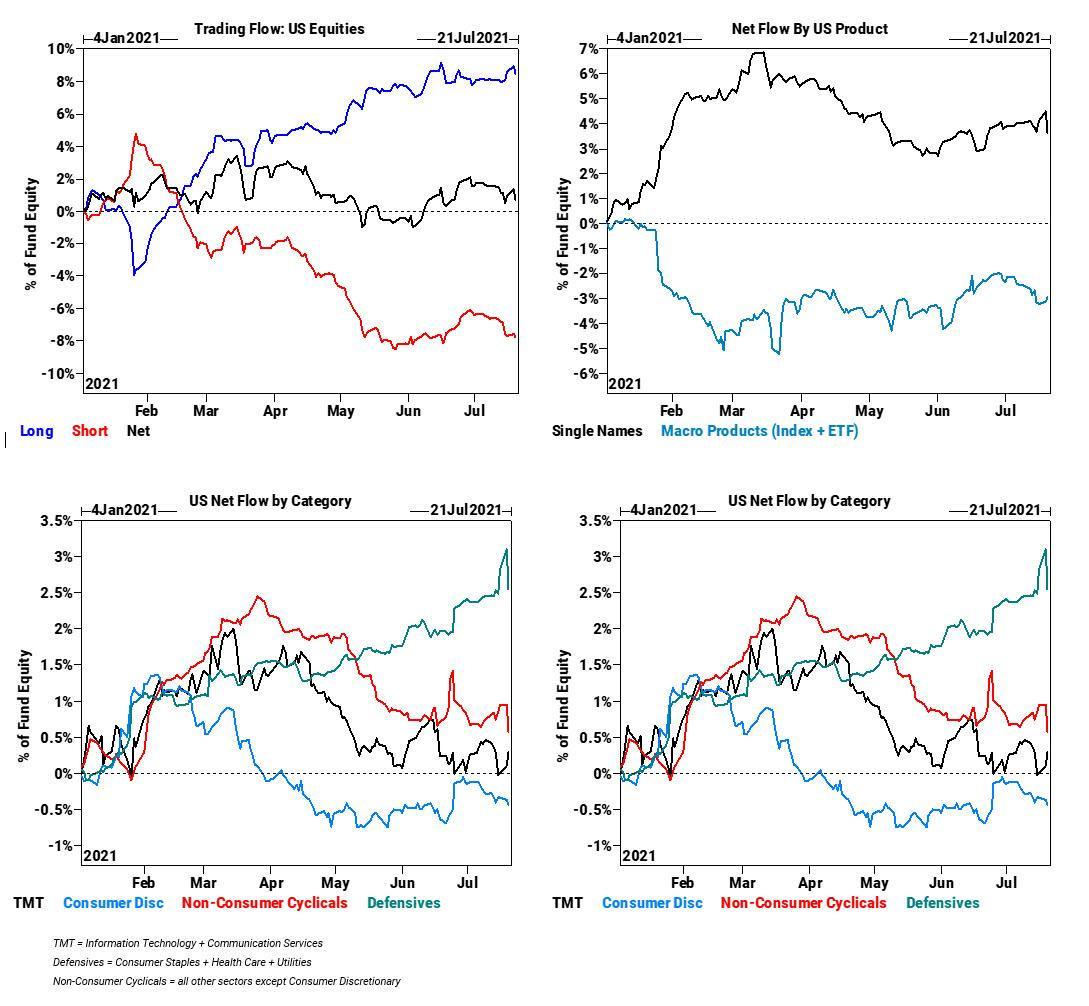

- Single names saw the largest 1-day $ net selling since Nov ’19 (-4.0 SDs), which far outweighed net buying in Macro Products (Index and ETF combined).

- 8 of 11 sectors were net sold led in $ terms by Health Care, Industrials, Consumer Disc, and Utilities, while Info Tech, Energy, and Financials were net bought.

- Despite the reversal in overall net trading activity, the underlying themes that stood out on Monday generally continued on Tuesday.

- Buying Stay at Home (GSXUSTAY) vs. Selling Go Outside (GSXUPAND) for a second straight day.

- Constituents of the GSXUSTAY collectively were net bought again and saw the largest 1-day $ net buying since 6/28, driven by long buys.

- Members of GSXUPAND collectively were net sold for a second straight day, amid risk-off flows with long buys outpacing short covers. That said, the pace of net selling in the group significantly moderated vs. what we saw on Monday.

Buying Expensive Software (GSCBSF8X) again– basket constituents collectively were net bought for a second straight day and saw the largest 1-day $ net buying YTD, driven entirely by long buys.

Risk-off in FAAMG (GSTMTMEG) – the TMT mega caps collectively were modestly net sold, driven entirely by long sales, though net flows diverged by individual names. The group collectively has been net sold in 9 of the past 10 sessions (except 7/19).

And visually:

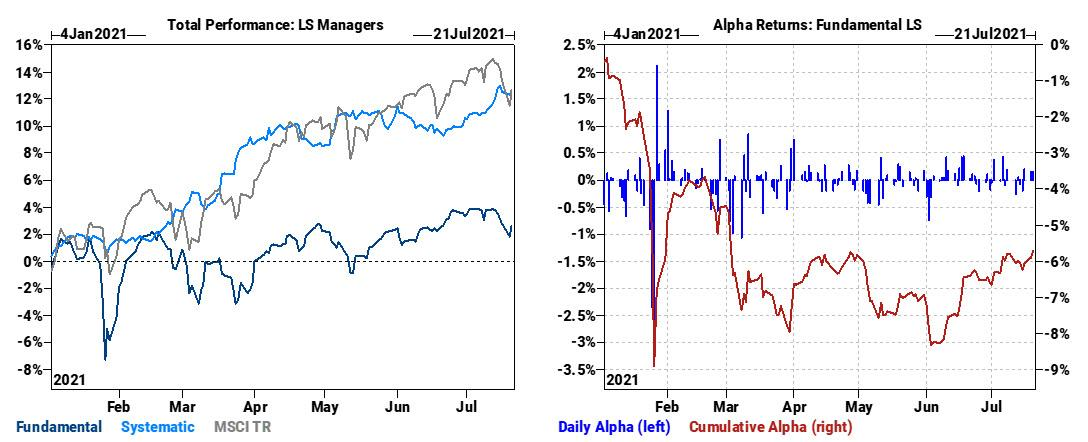

What does this mean for hedge fund performance? Despite the whipsaw, Goldman notes that fundamental LS managers experienced positive alpha for a third straight day and MTD

Yesterday (July 20th)

- Fundamental LS +0.8% (alpha +0.2%) vs MSCI TR +1.0%.

- Systematic LS -0.2%

July MTD

- Fundamental LS -0.7% (alpha +0.9%) vs MSCI TR -0.3%

- Systematic LS +1.5%

2021 YTD

- Fundamental LS +2.6% (alpha -5.7%) vs MSCI TR +12.7%

- Systematic LS +12.2%