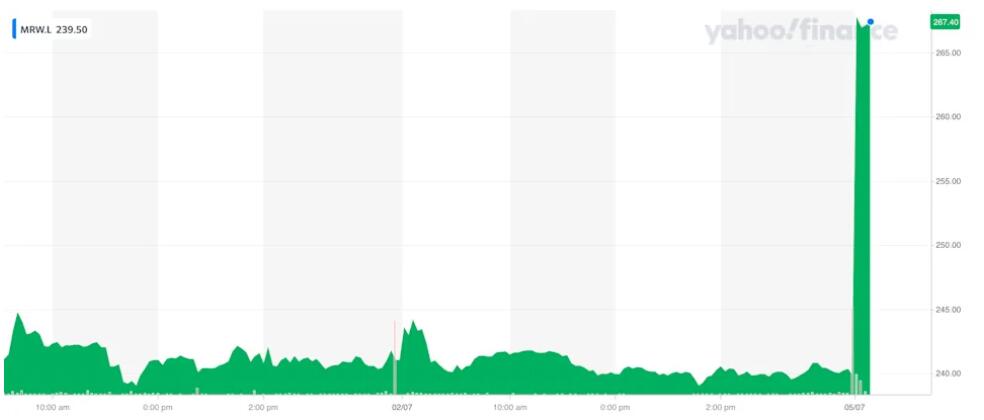

A takeover battle for Morrisons (MRW.L) sent the UK supermarket group's stock price soaring on Monday after two new bidders entered the fray.

Morrisons' stock climbed over 11% at the open in London as investors digested news of an agreed offer from Fortress Investment Group and a possible bid from Apollo Global Management.

Morrisons announced on Saturday it hadagreed a £6.3bn ($8.7bn) takeover by a consortium led by SoftBank-backed Fortress Investment Group. The agreement follows an earlierrebuffed offer from rival private equity house Clayton, Dubilier & Rice.

On Monday, Apollo Global Management (APO) — a third private equity group — said it was considering bidding for Morrisons. In a brief statement, the group said it was "in the preliminary stages of evaluating a possible offer".

Shares in Morrisons shot higher to reach 267p on Monday morning — well above the 254p-a-share bid announced by Fortress on Saturday. The premium suggests traders believe a bidding war could yet force the takeover price higher.

"Just because Morrison directors have irrevocably committed to vote in favour of the proposal, this doesnotcommit other shareholders to doing the same – so this agreed offer is not necessarily the end of the saga," Barclays analyst James Anstead wrote in a note on Monday. "There is nothing stopping other potential bidders from getting involved."

Morrisons is the UK's fourth largest supermarket and works as a supplier for Amazon's (AMZN) Prime and Fresh offerings in the UK. Morrisons is seen as an attractive acquisition target because it owns a large amount of property in the UK.

"Morrisons the most likely candidate of an acquisition given they own more than 80% of their stores which Fortress can borrow against," said Ross Hindle, an analyst at Third Bridge. "Fortress has said they do not anticipate any material sale and lease back of stores but we will have to wait and see on this."

Morrisons first attracted takeover interest last month when private equity group CD&R made a £5.5bn bid for the business. The supermarket's board rejected the offer, arguing it undervalued the business.

"Initial bidders Clayton, Dubilier & Rice may still come back to the tills to make a better offer," said Susannah Streeter, a senior investment and market analyst at Hargreaves Lansdown.

CD&R and any other rival bidders have until 17 July to table any counter offers.

The flurry of interest in Morrisons is part of a surge of private equity dealmaking in the UK. A combination of Brexit and the pandemic has left the share prices of many businesses depressed, making many ripe for a takeover. Earlier this year Morrisons rival Asda wassold to a private equity-backed group for £6.8bn.

"A deal was always going to come, even after the failed bid by CDR," said Hindle. "Morrison shares have been trading flat for the past three years and there has been no real sign of substantial or step-change growth coming."

Disclosure: Apollo Global Management has agreed a deal to buy Yahoo Finance UK as part of a broader transaction with current owners Verizon. The deal has yet to close.