Investors got spooked by a potential boost to capital-gains rates for high-income taxpayers.

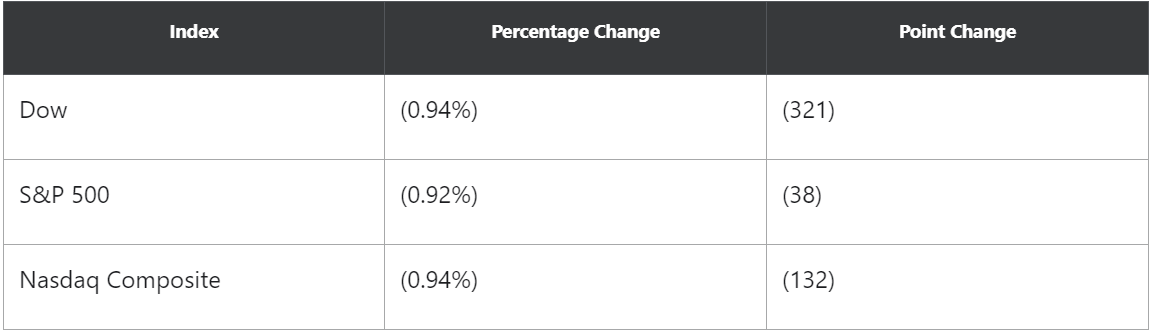

The stock market had a turbulent day on Thursday, with initial gains during the first half of the trading session giving way to sharper losses in the mid-afternoon. By the end of the day, the Dow Jones Industrial Average (DJINDICES:^DJI),S&P 500 (SNPINDEX:^GSPC), and Nasdaq Composite (NASDAQINDEX:^IXIC)were all down close to 1% on the day, reversing most of the positive momentum that Wall Street built up in the previous day's session on Wednesday.

The midday decline came amid reports that the Biden administration would propose tax increases on high-income taxpayers. The proposal targets a provision that long-term investors have taken advantage of for decades: the favorable tax rate on capital gains, the profits they realize when they sell stocks or other investments.

What taxes could go up, and on whom?

The proposal, as reported, would affect the way long-term capital gains get taxed for those with incomes above $1 million. Currently, investors pay the same tax rates on short-term capital gains on investments held for a year or less as they do on most other forms of income, such as wages and salaries or interest. However, if an investor holds onto an investment for longer than a year and then sells it, long-term capital-gains tax treatment applies.

Although the brackets aren't exactly aligned, in general, those who pay 10% or 12% in tax on ordinary income pay 0% on their long-term capital gains. Those paying 22% to 35% typically pay a 15% long-term capital-gains tax, while top-bracket taxpayers whose ordinary income tax rate is 37% have a 20% maximum rate on their investment gains for assets held long term.

Under the proposed new rules, favorable tax treatment for long-term capital gains would remain completely in place for everyone in the first two groups and even for many in the third group. However, for taxpayers with incomes above $1 million, the lower long-term capital-gains tax rates would go away and they'd instead have to pay ordinary income tax rates on those gains, as well.

Why investors shouldn't be surprised

The reported proposal isn't a new one. Biden discussed it during the 2020 presidential campaign as one of the aspects of his broader tax plan. It's likely that the final version of any actual bill introduced in Congress would also include an increase in the top tax bracket to 39.6%, which was the level in effect immediately before tax-reform efforts made major changes to tax laws for the 2018 tax year.

Moreover, the legislation is far from a done deal. Even with Democrats having control of both houses of Congress and the White House, the margins are razor-thin. Already, some Democratic lawmakers have balked at tax-policy proposals, and in the Senate, the loss of even a single vote would be sufficient to prevent a tax bill from becoming law.

Is a stock market crash imminent?

It's understandable that investors would worry that a capital-gains tax hike might cause the stock market to drop. If investors sell their stocks now to lock in current lower rates, it could create short-term selling pressure. In the long run, though, the fundamentals of underlying businesses should still control share-price movements.

Moreover, this wouldn't be the first time capital-gains taxes have risen. In 2012, maximum capital-gains rates rose from 15% to 20%. Yet that didn't stop U.S. stocks from continuing what would eventually become a decade-long bull market.

Tax-law changes require some planning, but investors shouldn't change their entire investing strategy because of taxes. Letting them define how you invest can be a huge mistake and distract you from the task of finding the best companies and owning their shares for the long haul.