Covered call ETFs haven't been able to avoid all of the losses in stocks this year, but they've done a much better job at offering a degree of downside protection. Through July 27th, the S&P 500 has fallen 15% year-to-date, but several covered call ETFs, including the ones I'll discuss below, have limited losses to the 7-10% range. Considering the risk/return profile of these funds, this is actually a little better than many might expect. Depending on the strategy, these funds offer varying degrees of downside protection and upside capture, but topping the broader market by 4-7% in many cases is a solid year in an adverse environment.

Bonds are looking a little better in being able to provide at least reasonable yields, but the duration risk has made them unpalatable. Covered calls have been a much preferred yield strategy for the 1st half of 2022, but the 2nd half may look a lot different. Investors are starting to pivot away from the Fed narrative and have begun paying more attention to a recession. That'll probably be bullish for bonds and bearish for stocks until the point where the Fed stops raising rates and turns dovish.

Covered calls can be a great way to maximize yield when conditions aren't exactly favoring more share price gains. Those high yields, of course, come with a tradeoff. Investors who write calls capture the income from options premiums, but end up giving up a lot of capital growth upside (the shares get called away as they're appreciating). If you're expecting a sideways or even modestly declining market, covered call strategies can be a way of outperforming on a total return basis or just earning a potentially double digit yield.

The ETF industry offers more than a dozen different funds using covered call strategies, including the Global X Dow 30 Covered Call ETF (DJIA), which was just launched earlier this year. Global X is by far the biggest issuer of these products, but several fund companies have jumped in to offer some relatively unique strategies that could prove to be beneficial to investors throughout the remainder of 2022.

Here are 7 high-yielding covered call ETFs to consider in 2022.

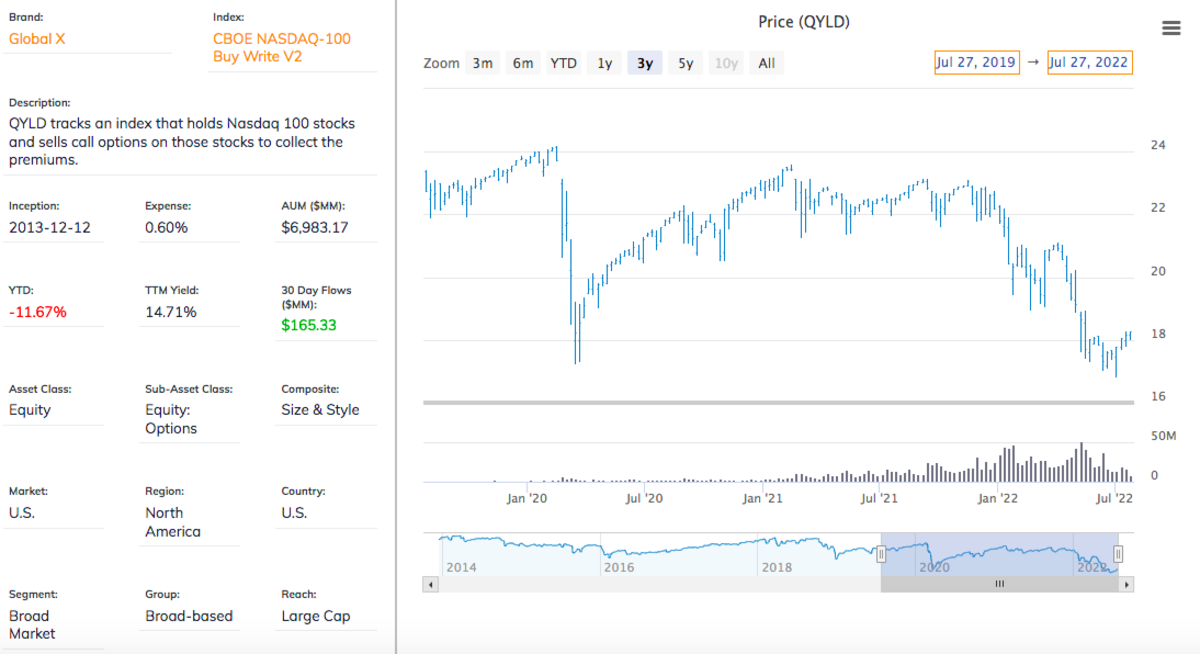

Global X Nasdaq 100 Covered Call ETF

QYLD is easily the largest covered call ETF out there, which shouldn't be surprising given that it uses the Nasdaq 100 as its core index. The fund's strategy is very straightforward - it buys all individual index components in the same weighting to effectively mimic the Nasdaq 100 and then writes a series of at-the-money calls on 100% of the portfolio's assets in order to maximize income.

Here's the upside. QYLD currently yields roughly 12%, making it one of the highest yielding ETF choices out there. It also pays dividends on a monthly basis, making it incredibly convenient for investors looking to live off of their portfolio income.

Here's the downside. Because options are written over 100% of the portfolio, you're essentially giving up a lot of the capital growth upside. That's easy to see looking at the chart above where the share price peaked around the $23-24 level before drifting down to the high teens.

Global X has a unique twist to its covered call ETFs though. It caps distributions at 1% monthly for its full covered call ETF suite (i.e. not the covered call & growth funds). Thus, the 12% yield "cap". In cases where the income earned exceeds the 1% cap, it goes back into the fund's net asset base and gets reflected in a higher share price. In essence, QYLD can offer high income AND share price growth under the right circumstances even though it uses a 100% overlay.

That's happened in 2022 where options premiums have gone way up as volatility increases. In recent months, QYLD (along with XYLD and RYLD) have more than doubled the yield cap. That's helped support the share price, although it hasn't translated into gains.

If you're a believer that the Nasdaq 100 is moving sideways or even slightly down over the next 12 months, QYLD could be a nice option for investors.

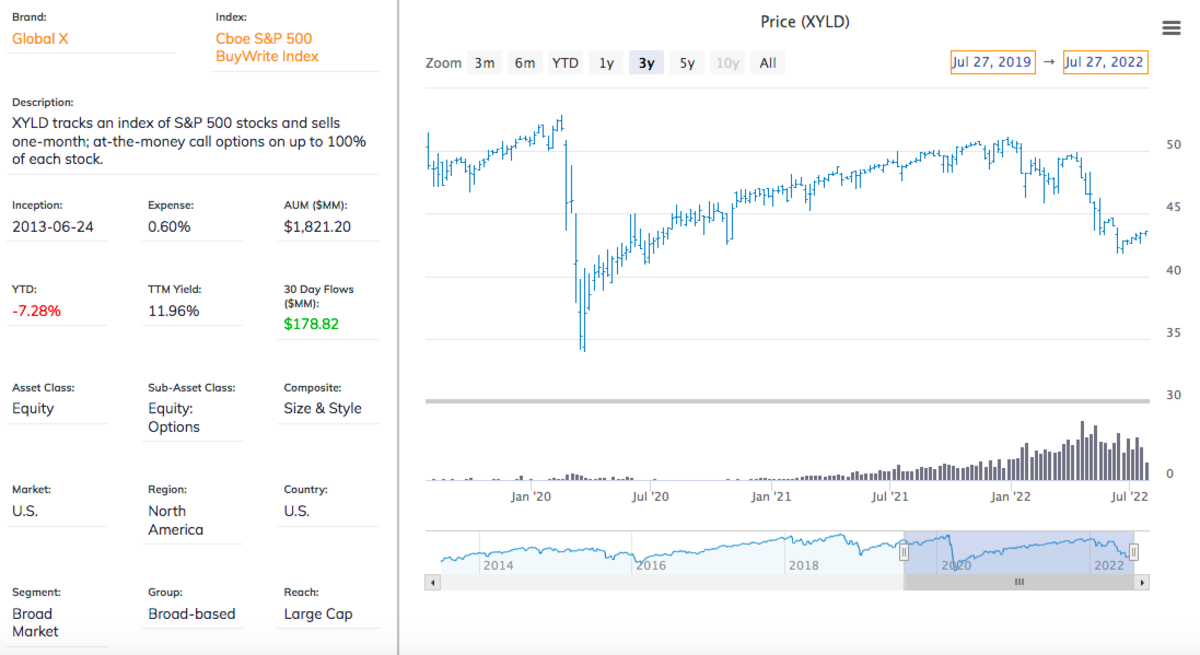

Global X S&P 500 Covered Call ETF

XYLD is effectively the same as QYLD, except it uses the S&P 500 as its core index instead of the S&P 500. It also yields approximately 12%. The S&P 500 is generally considered less volatile than the Nasdaq 100, but above average market volatility has made the fund more than able to hit the 12% yield mark.

XYLD has been a little unusual in that it did an effective job of being able to capture share price gains in addition to the high yield. It couldn't hold that trend in 2022, but most ETFs, even covered call ones, had trouble generating much above average performance. XYLD could be preferable to QYLD if you want a little less tech exposure in your portfolio.

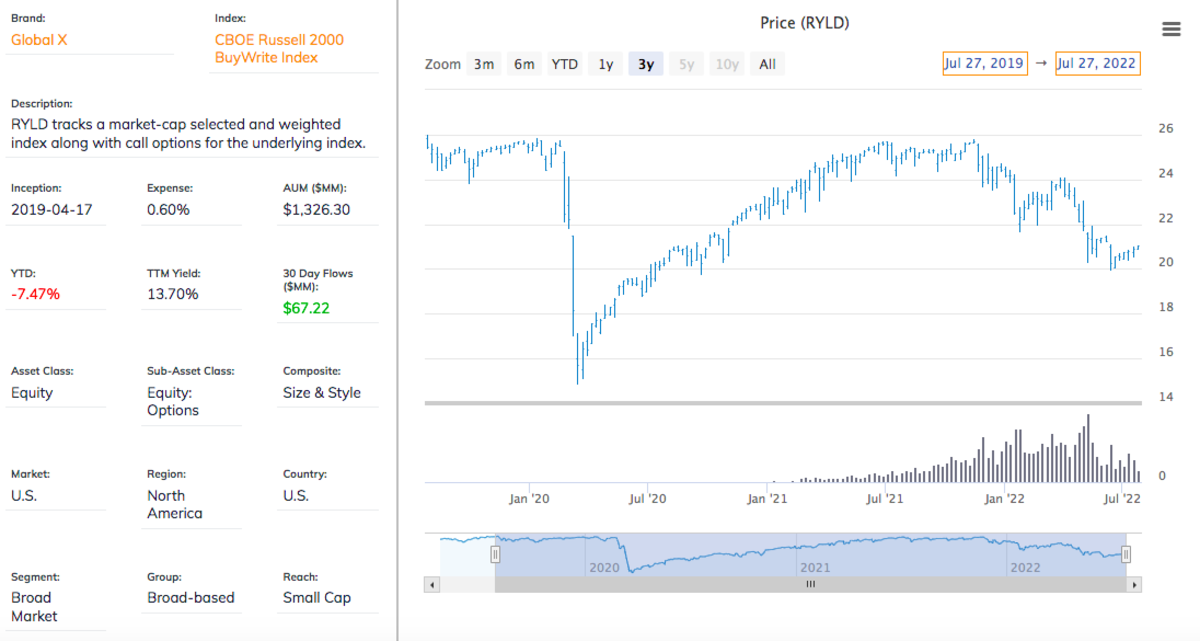

Global X Russell 2000 Covered Call ETF

Let's round this out with Global X's covered call ETF using small-caps instead of large-caps. RYLD is the only ETF out there writing call options over a small-cap portfolio, so it's a bit of a unicorn. Its 12% yield is in line with QYLD and XYLD for the reasons mentioned already - higher risk levels tend to come with higher income premiums.

As we've already seen over the past month or two, that risk can be a problem. Small-caps have been declining and RYLD has declined with it. The yield is certainly attractive, but these covered call ETFs can experience share price declines along with their indexes under the wrong conditions. Look no further than Q1 2020 and Q1 2022 to see what can potentially happen.

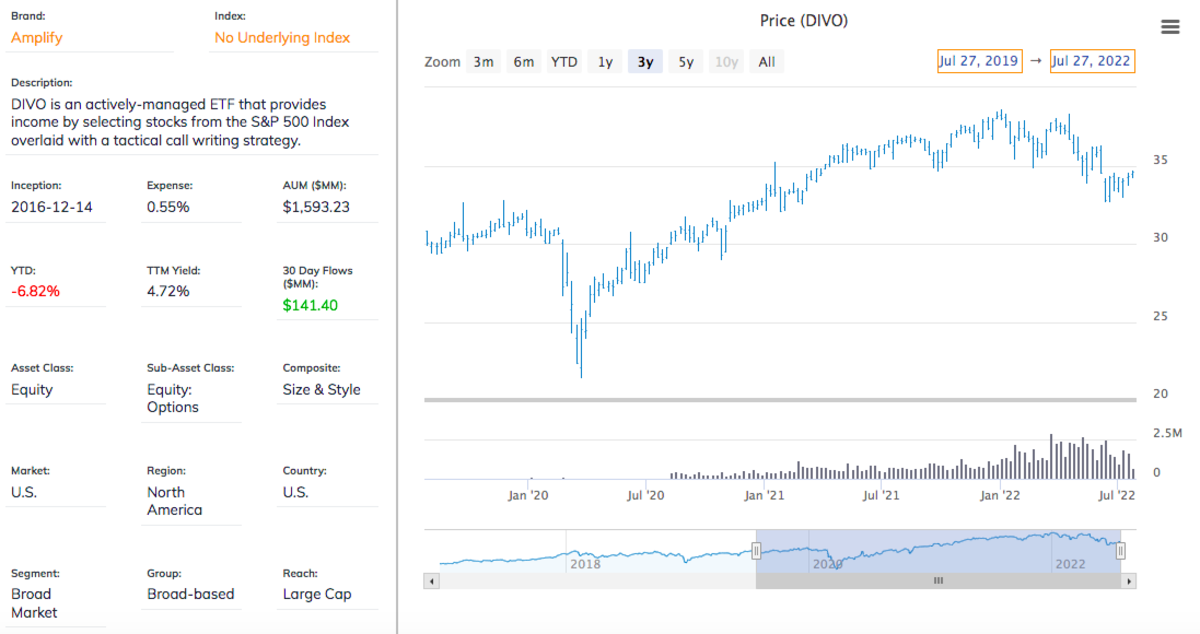

Amplify CWP Enhanced Dividend Income ETF

DIVO is unique in both how it takes a quality approach to portfolio construction and uses a tactical strategy to determine where and how to write call options on the portfolio. The fact that it's actively managed also provides an advantage in that it allows the management team to pivot quickly should conditions change.

DIVO's portfolio consists of roughly 20-25 stocks that have histories of both dividend and earnings growth and are adjusted according to market cap, management track record, earnings, cash flow and return on equity. On top of that portfolio, covered calls are written against individual stock positions on a tactical basis looking for the most attractive opportunities. DIVO aims to deliver a yield of between 4-7%, which is a combination of dividend income and options premiums. As of the latest semi-annual update, DIVO had options written against 6 stocks.

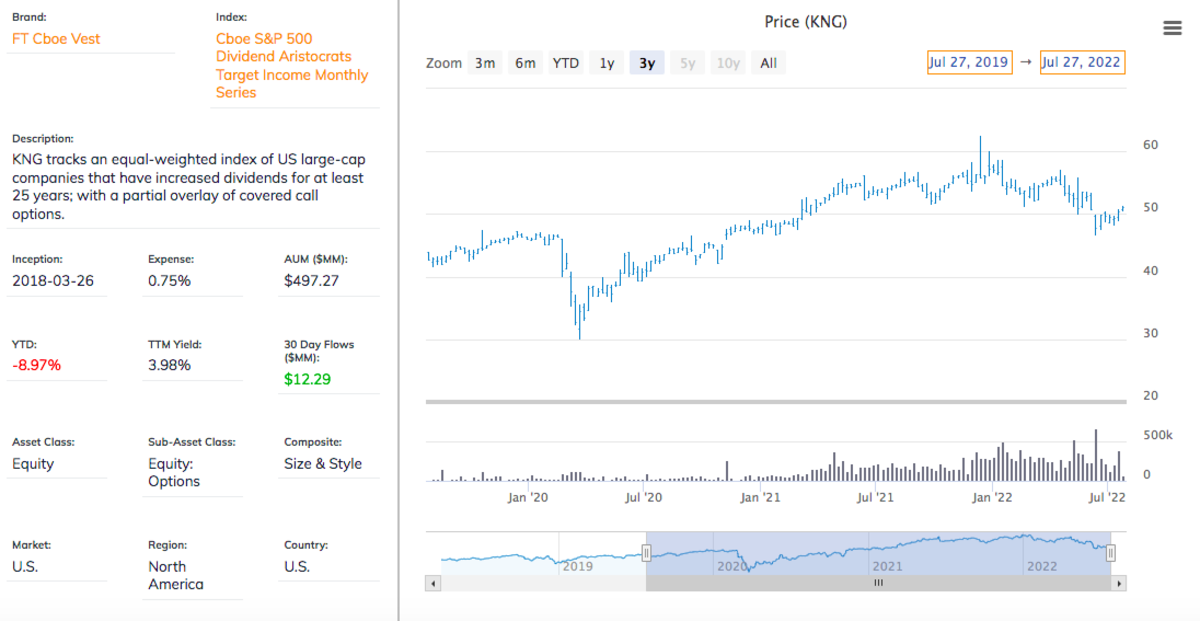

FT CBOE Vest S&P 500 Dividend Aristocrats Target Income ETF

KNG is an interesting option if you're interested in using dividend growth stocks as a key part of your income strategy. This fund starts with an equal-weighted portfolio of the stocks contained in the S&P 500 Dividend Aristocrats Index and then issues a rolling series of written call options on each of the aristocrat stocks. Its primary objective is generating an annualized income from stock dividends and option premiums that is approximately 3% over the annual dividend yield of the S&P 500. As of right now, it's coming a little short of that goal, offering a distribution yield of around 4.1% compared to the 1.5% yield of the S&P 500. This is a nice option for capturing a much higher yield from a very popular investment strategy.

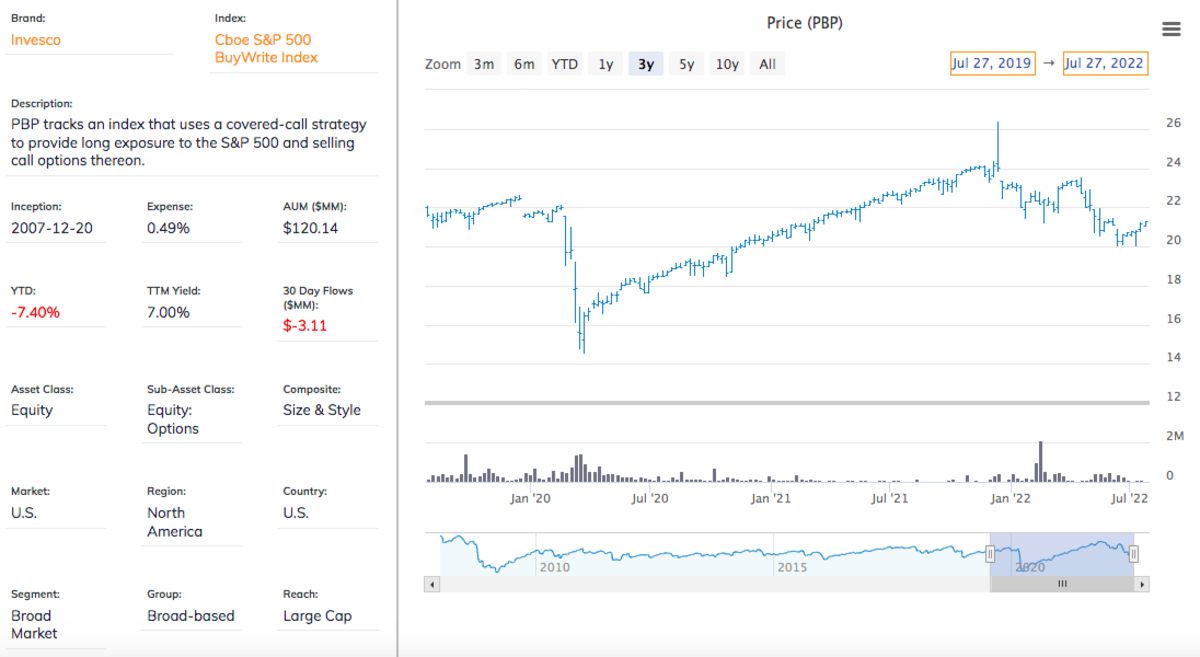

PBP is essentially Invesco's version of XYLD. It also lays a covered call writing strategy over the entire portfolio. The only major difference I see is that PBP will write options with strikes prices "at or above" the prevailing S&P 500 prices, where XYLD targets at-the-money options contracts specifically. The difference, though, has allowed PBP to capture somewhat higher share price returns over the past couple of years as well.

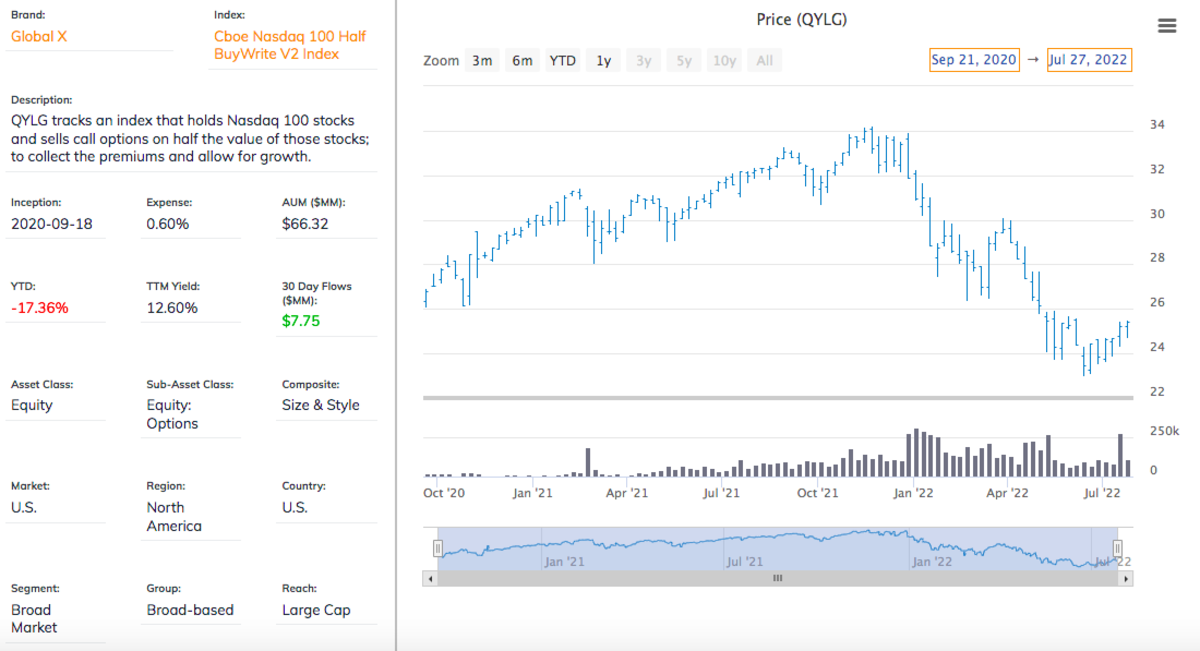

Global X Nasdaq 100 Covered Call & Growth ETF

QYLG is interesting in that allows for more share price growth potential in exchange for a lower yield. Whereas QYLD writes options over 100% of the portfolio, QYLG writes them over just 50%. Its current forward-looking distribution rate is around 6%, roughly half that of QYLD. QYLG as well as the Global X S&P 500 Covered Call & Growth ETF (XYLG) offer nice middle grounds between the underlying index outright and investing in a full-out covered call strategy, although downside potential is greater in a bear market.