Summary: SoFi Technologies will release its second quarter earnings report before the US stock market opens on July 29. Today, SoFi Technologies has become one of the most dynamic companies in the digital finance sector with its competitive platform. As of July 22, its year-to-date increase exceeded 36%.

First quarter review

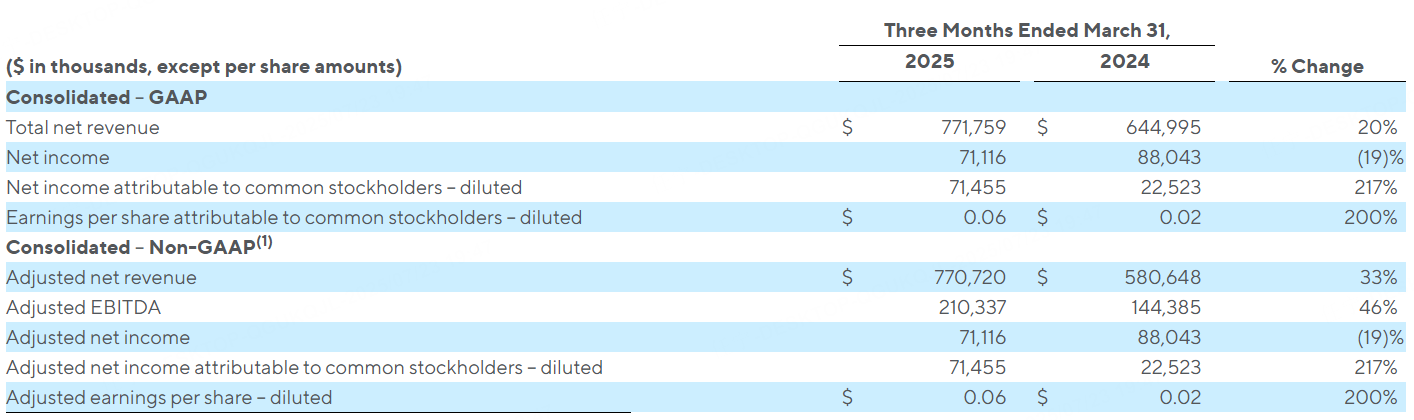

In the first quarter of 2025, SoFi's net income calculated in accordance with US Generally Accepted Accounting Principles (GAAP) was US$771.8 million, a year-on-year increase of 20%. Adjusted net income reached US$770.7 million, a year-on-year increase of 33%, a record high.

In the first quarter, GAAP net profit reached US$71.1 million, and diluted earnings per share reached US$0.06.

According to Bloomberg data, analysts generally expect SoFi's second quarter revenue to be $804 million, adjusted net profit to be $67.35 million, and adjusted earnings per share to be $0.059.

Key points

Growth prospects support value

SoFi is above the market average in almost all traditional valuation indicators and should be given a corresponding premium. After SoFi obtained a banking license, its non-loan financial services business grew rapidly, which led to a significant improvement in the company's performance. Compared with large banks and emerging digital banks, SoFi's growth advantage is more significant.

The company's CEO has repeatedly stated that he hopes SoFi will become a top 10 financial services company. If SoFi can maintain this growth momentum, this goal may become a reality.

Re-bet on cryptocurrencies

SoFi had previously exited the field, but is now turning 180 degrees and re-betting on cryptocurrencies. First, SoFi cannot miss this historic opportunity; second, other digital banks such as Chime are also providing basic financial services, and SoFi needs to differentiate itself by providing cryptocurrency products; in addition, as a bank, SoFi can use its own advantages to deepen its presence in the cryptocurrency field, such as exploring stablecoins and digital asset loans.

The Fed may cut interest rates in the future, which is good for SoFi's loan business

Although the interest rate cut will compress the interest rate spread and profitability, SoFi's business structure is more diversified and does not rely entirely on a single loan product. On the contrary, lower interest rates may promote increased consumption and lending activities, which will bring new growth momentum to SoFi's student loan, corporate loan and mortgage business. At the same time, SoFi can also bring users of the loan business into its financial ecosystem to create more business opportunities.