Summary

- The market has punished growth stocks very hard, but it often pays to go against the herd at such times.

- Focusing on profitability and valuation is more important in such an environment, but you should do that properly for growth stocks.

- CrowdStrike has a FCF margin of 27% and continues to grow fast. While its valuation looks expensive, looking forward, it's not outrageous.

- Datadog has a FCF margin of 34% and is similar to CrowdStrike. It can definitely grow into its valuation fast.

- Maybe somewhat more surprising to some readers, Roku has a FCF margin of 15%, even with the supply-chain issues. It's the CTV leader in the US, Canada, Mexico and Latam and is already cheap now.

Introduction

When the markets turn, you often see a lot of investors following the herd but it often pays to do exactly the opposite, although that may feel very uncomfortable over the short term. There is a lot of negativity out there, about themarkets in general and the economy.

Many already are fully convinced that we are heading for a recession. While this is possible, up to now, there are no signs yet. The Fed's Beige Book last week showed that 8 of the 12 Districts expect slowing growth in the future but at the moment, but just 3 thought there would be a recession coming. But all 12 still see growth right now. If a recession is not coming, we will see a great upswing in stock prices. But even if there will be a recession, a lot of that has already priced in. If it's a severe recession, there could of course be more downside, that's for sure, but that's also why I always scale in slowly over time, over years.

Because the markets (and interest rates) have changed, I think it's important to emphasize profitability more now. But, of course, we still look at the future and that's why you may be surprised that I still pick some "expensive" stocks. You'll see my reasoning, though.

CrowdStrike (CRWD) is a cybersecurity company that works through a cloud platform. Its competitive advantage is that it has a lightweight agent that makes sure your computer (or any other endpoint) doesn't slow down and you don't even have to reboot for installation or updates. It expands its Falcon platform very fast with new products and as a result, its dollar-based net retention rate is very high at more than 120% in every quarter since its IPO.

There is sometimes confusion between dollar-based net retention and dollar-based net expansion, therefore a fast explanation. You take your full set of customers at the end of Q1 2021 and you see what they spend. Let's say $100M to make it easy. With a dollar-based net retention rate, DBNRR, you measure how much the same customers spend right now, including customers that went away or went belly-up.

For a DBNRR of 120%, your customers have to spend 20% more than they did last year, even if you include the ones that are not customers anymore. For dollar-based netexpansionrate, you only count the dollar amount of those who staid as customers. Net expansion rates make sense for companies where there are a lot of temporary customers, like political campaigners using Twilio (TWLO), for example. With net expansion numbers, you can have 120% and still see negative revenue growth and that's why DBNRR numbers are much clearer and it's so impressive that CrowdStrike has been seeing such high numbers.

The stock had held up pretty well even during this growth crash, as it's a fantastic company. But right now, it's down 42% from its highs, after being down more than 50% a few weeks ago.

Could the stock drop more? Of course, that's always possible. It still trades at a forward PS ratio (price to sales) of 15. In this environment, that is a premium. But unlike a lot of other companies, it's highly profitable. It had a Free Cash Flow of $604.3M in the trailing twelve months.

With a current market cap of almost $40B, that means that CrowdStrike still trades at a price to free cash flow level of about 65 times. Not cheap, of course, but you have to look at the company's growth profile here.

What I mean is that CrowdStrike had a free-cash-flow margin of 37% over the trailing twelve months. So I think the company can generate stable FCF of around 35% to 40%.

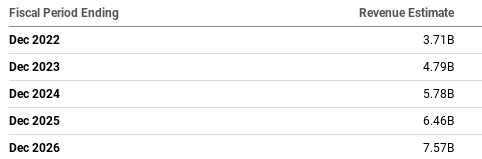

Looking at the earnings estimates for the next five years, you see that CrowdStrike is estimated to have $6.65B of revenue in 2026 (reporting in January 2027).

If you want to put that in perspective, PepsiCo (PEP), a stable stalwart, had $6.3B of FCF on total revenue of $79.5B last year. That's an FCF margin of 8%. It trades at an estimated 2026 FCF multiple of around 30 times, much higher than CrowdStrike.

Which stock is expensive for long-term investors, then? Pepsi is just a random example that I took and I have nothing against the company. There are also dividends and buybacks involved, but I think that this shows you the context that what can look expensive by one metric (PS ratio) doesn't necessarily mean it is expensive for long-term investors.

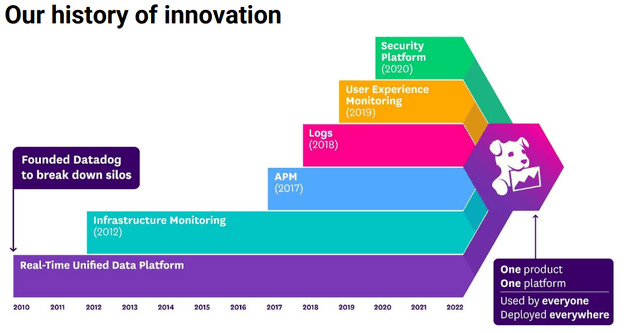

Datadog (DDOG) is an observability platform. The software and hardware systems of companies become much more complex and you have to know exactly where something goes wrong or it's not 100% efficient. You could call what Datadog does Monitoring-as-a-Service. The company has innovated fast over the years. It started with infrastructure and the company added APM (app performance management) and logs, making it the first fully-functioning platform to unite these. It kept expanding its offerings with User Experience Monitoring and Security.

And the numbers are growing fast. These are the four last quarters:

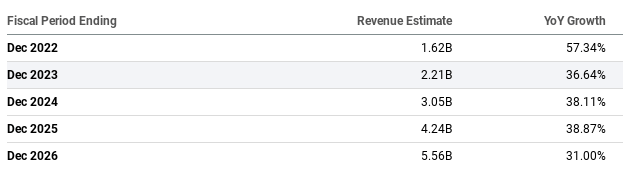

The consensus estimate for 2026 revenue is $5.56B.

I'm sure several readers will be surprised to see Roku (ROKU) here. Many have already given up on Roku, and I have heard so much negativity, including that it's a 'money-losing' company. Google (GOOGL) (GOOG) would crush Roku! Well, it didn't. Google and Roku made a deal about both YouTube TV and YouTube in Q4 2021. Amazon (AMZN) would crush it! Well, it didn't. Amazon and Roku made a new deal about Amazon Prime and IMDb TV a few weeks ago.

Roku is much more powerful than most investors realize. You can't just ignore such a huge part of the American households. But in the meantime, the stock is down more than 80%, as if it's a failing company.

On top of that, Roku is now the #1 streaming platform in Canada andin Mexicoand it hasovertakenSamsung as the #1 in Latin America.

Amazon's Fire has a market share of 45% and Apple TV (AAPL) 13%. Yes, that's above 100% because quite a lot of people own several devices. When you look at streaming hours, Roku has 42% of the American market, while the number 2, Amazon Fire, only has 18%, so that's a big difference there.

I think a lot of people misjudge Roku, especially with how Netflix (NFLX) is struggling. But for Roku, it doesn't matter which content provider wins. Even more, now that Netflix considers having an ad-supported option, Roku could benefit from its former mother company. On top of that, Roku makes its own content or buys it for The Roku Channel, which it can monetize. Roku has shown that it can do this on the cheap. It acquired the bankrupt Quibi for what was rumored to be less than $100M. If that is true, they have probably made that money back very fast and then some.

In the trailing twelve months, Roku had an FCF of $403.2M.

With a current market cap of $12B, Roku trades at only 29.5 times its TTM FCF. With total sales of $2.9B in the same period, Roku has FCF margins of around 14%. These are the revenue estimates for the next few years:

Let's be conservative and take $7.6B indeed, because Roku suffers from supply chain issues that probably won't be solved soon. Let's take a conservative 15% FCF margin for 2026 on that revenue. That's conservative because Roku gets 14% now under these very challenging circumstances. That means $1.15B in FCF for 2026 or just 10 times its current market cap.

Yes, there are supply chain issues right now for Roku, but there's also still a lot of potential for further growth..

Conclusion

Again, I want to stress that I'm not a market timer and I scale in very slowly. Yes, these stocks can always drop more, no matter how much they have fallen already. I invest money every two weeks and I have ramped up that biweekly contribution recently. This environment is precisely when dollar-cost averaging can be at its most powerful!

Of course, there have been a lot of bad companies that have been subsidized by easy money and now, when the tide goes out, we can see who was swimming naked, to paraphrase Warren Buffett. But companies that dominate their growing industries and are free-cash-flow positive while they also keep growing their revenue at a fast rate are of high quality.

In the meantime, keep growing!