Summary

- We present a detailed analysis of Tesla's growth prospects, revenue streams, and market share.

- TSLA has grown substantially over the past few years, but so has the entire auto industry. The automotive business may be at a cyclical peak.

- From these price levels, we believe TSLA will return just 3% per annum to long-term shareholders.

Investment Thesis

Tesla Inc (NASDAQ:TSLA) has perhaps been the most popular investment globally over the past five years. During that time, the stock has gained nearly 1000% in value and now trades at a PE of 100.

Tesla needs to deliver substantial growth in a competitive and cyclical industry to justify its current valuation. We take the view of the long-term shareholder and argue the risk still outweighs the reward.

A Cyclical Peak

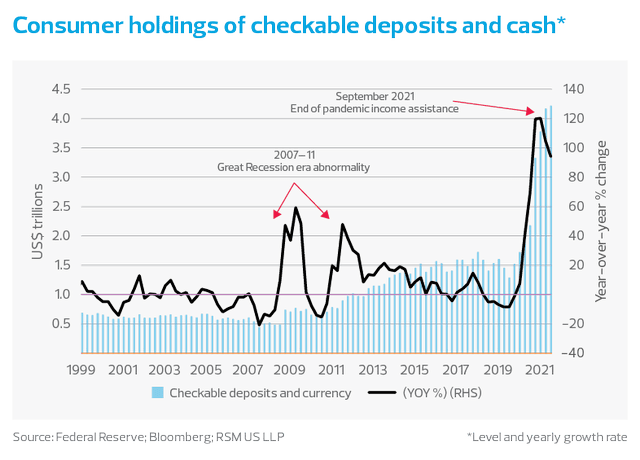

The COVID-19 recession was not a typical recession. Interest rates hit rock bottom, making a new vehicle purchase very affordable. Banks were willing to lend, and consumers had more cash around than ever before.

Cash Balances of U.S. Consumers (RSM)

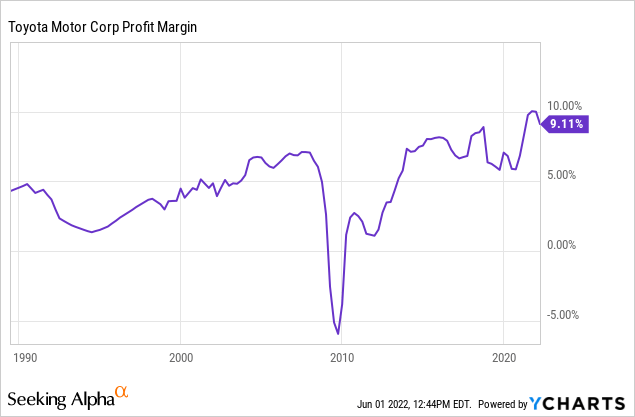

Tesla's margins have increased, but that is an industry-wide phenomena. Toyota Motor Corp. (TM) is the largest auto manufacturer in the world by revenue. The company has never seen profit margins as high as 2021.

While this is all great news, the auto industry is notoriously capital intensive and cyclical. Inflation increases the cost of manufacturing vehicles. As interest rates rise, Tesla may not be able to pass those costs on to consumers. Nearly every auto manufacturer experienced loses in the global financial crisis of 2009, and some even went bankrupt. Tesla is not immune to seeing its net income and margins decline if we see another substantial recession.

Tesla's Future Growth

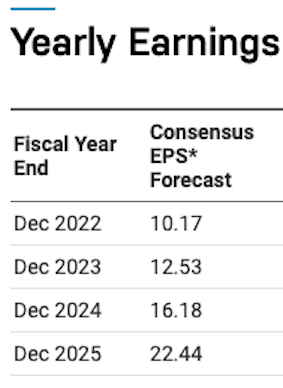

First, let's take a look at earnings estimates for TSLA:

Tesla EPS Forecast (NASDAQ)

From 2022 to 2025, TSLA's earnings per share are projected to grow at 30% per annum. Yes, the days of 50% per annum growth are in the rearview mirror for TSLA. But, 30% is nothing to complain about. The problem is, growth often continues to slow as a company matures.

Competition & Market Share

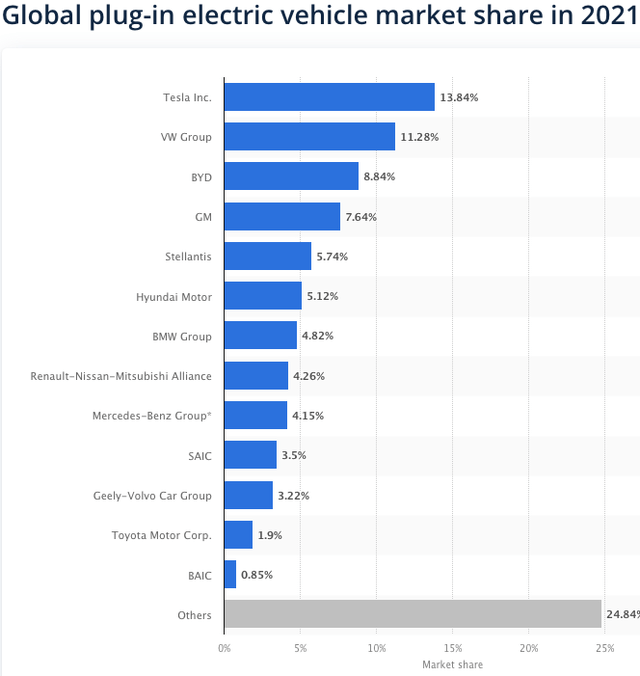

Tesla is going global and getting closer to its customer base, with new factories in Shanghai, China, as well as Berlin, Germany. You would think that this move should expand Tesla's share of global EV sales. But from 2020 to 2021, Tesla's global market share actually shrank from 17% to just under14%.

Despite this recent performance, we are estimating that Tesla maintains its current market share. TSLA's global expansion should eventually help in this regard. The company can also sell more entry-level EV's to maintain its share.

Competition is stronger for EV manufacturers now than it was three years ago. Every automaker globally knows the world is transitioning to electric vehicles. In China, BYD Co Ltd (OTCPK:BYDDF) presents a challenge for TSLA. Globally, Tesla is also up against many strong and entrenched brands such as Mercedes-Benz (OTCPK:DDAIF), Ford (F), and Toyota. Yes, they may not have the technology to match Tesla yet, but we cannot know for sure what the future holds.

Global EV Market Share (Statista)

Follow The Money

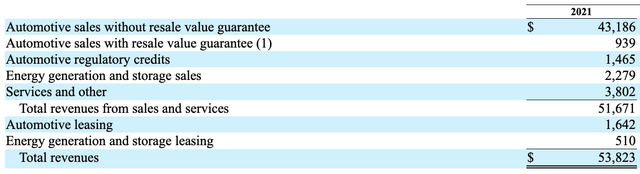

Tesla is still a car company first. To simplify, Tesla's revenue comes from two sources, automotive (EVs) and energy generation and storage (Energy). The energy part of the business represents only 5% of the revenue. Despite what people say, 95% of the TSLA's revenue still comes from automotive sales and related products.

Below is a breakdown of Tesla's Revenue for 2021:

Tesla Revenue Breakdown (2021 TSLA Annual Report)

From 2018 to 2021, Tesla's sales and leasing revenue from the energy business grew 21% per year from$1.56 billion to $2.79 billion. The remaining revenue from automotive and related products grew 37% per year. The energy business is near profitability, but still making losses. The cost of its revenue sits at$2.92 billion.

The Future Of EV

EV sales globally should grow around 20% per annum over the next decade.

- The number of electric vehicles sold globally is projected to grow at 17.5% per annum. We are projecting the per unit price of an EV to grow at just 2% per annum as competition improves, interest rates normalize, and used EV's come online.

The Tesla Story

The future of Tesla is very up in the air. Elon Musk has all sorts of stories for investors revolving around autonomous drive, robotics, ride sharing, and artificial intelligence. However, we do not yet have substantial revenues from Musk's many grand ideas. When those revenues do materialize, the businesses are likely to be loss making, much like TSLA's energy business has been thus far. Competition will be strong in these fields. There are many innovative entrepreneurs, especially in China and the U.S.

Margins

When it comes to Tesla's margins, there is just as much uncertainty. Margins for the auto business may have peaked as the industry seems to be at a cyclical high. Competition will only get stronger. Keep in mind that the auto industry is capital intensive and cyclical, with many producers reporting negative net margins in times of recession. On the other hand, the energy business should be profitable in the future. And, it is likely that Tesla develops another prominent business that is also profitable in 10 years' time.

- We are assuming these factors cancel each other out, resulting in a continuation of TSLA'scurrent net margin of 13.5%.

Our Estimate

Combining our projections for Tesla's market share, margins, EV sales, and energy business, we estimate Tesla will grow net income at 20% per year. The probability of underperformance in automotive and the probability of profitable developments in a new business appear equally weighted.

The Valuation

We are projecting TSLA to make $52 billion in 2032. This is a result of growing the company's net income($8.4 billion) at 20% per annum. We are also projecting shares outstanding to remain unchanged at 1.036 billion. This results in 2032earnings per share of $50.20.

Our base case scenario is a multiple of 20on TSLA's 2032 earnings. This gives us a 2032 price target of $1004 per share, implying a return of just 3% per annum.

Risks To The Thesis

There is risk on the upside and downside of this estimation. Tesla is a constantly evolving business, operating in a difficult industry. The company can change materially in 10 years' time. On the upside, a 2032 price of $1500/share is reasonable if there are positive developments in A.I. and renewables. On the downside, a 2032 price of $500/share is possible if Tesla fails to innovate or loses market share. Remember, mature auto manufacturers tend to have a PE of just 10.