The product named Grace uses technology licensed from SoftBank Group-owned Arm

Graphics-chip giant Nvidia Corp. is increasing the competitive pressure on Intel Corp.with plans to start selling central-processing units to serve the booming data-center market.

Nvidia said Monday its first processor for data centers would operate 10 times faster than existing chips. Dubbed Grace, after the famed computer scientist Grace Hopper, the chip is based on technology developed by Arm Ltd., a U.K. chip designer that Nvidia is in the process of buying for around $40 billion.

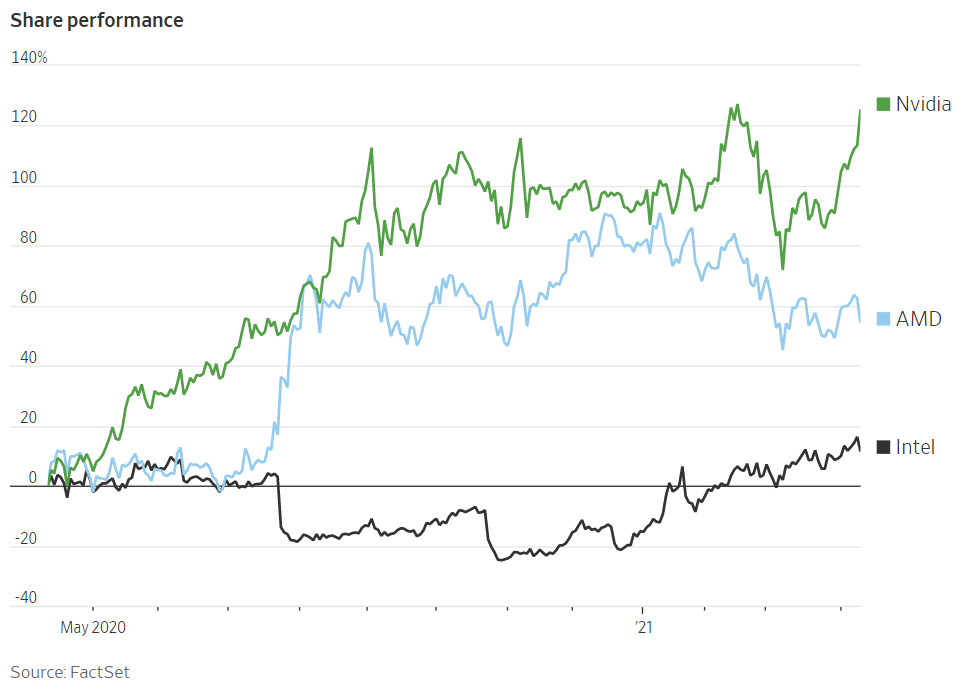

The new chip puts Santa Clara, Calif.-based Nvidia, known for its speedy processors that power videogaming hardware, squarely in competition with Intel, which dominates the global market in supplying chips to data centers, according to Mercury Research. Advanced Micro Devices Inc. is a distant second in chips for data centers.

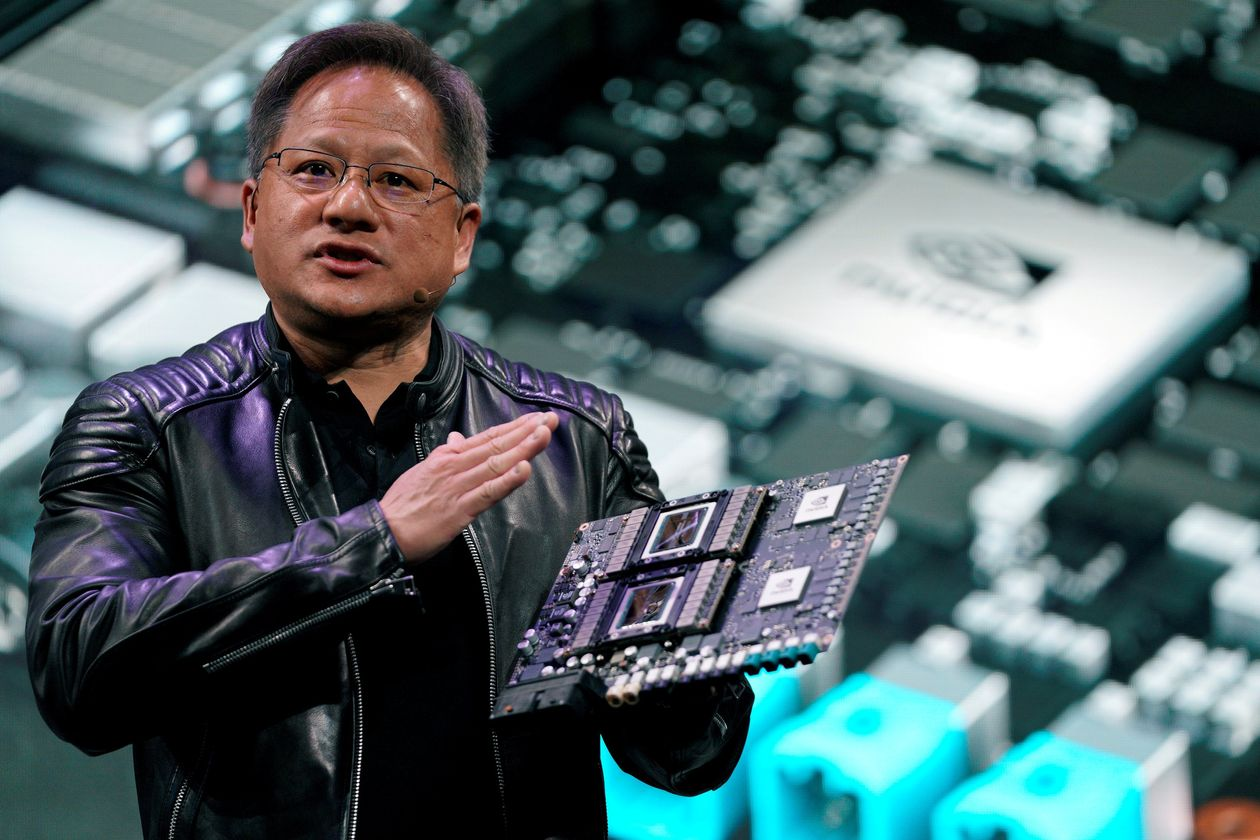

Nvidia last year overtook Intel as the largest chip maker by market value. Its stock has soared in part because of Chief Executive Jensen Huang’s bet on some of the hottest fields in tech, videogaming and artificial intelligence.

The company said that the Grace chip aims to be able to handle a targeted segment of computing where processors need to analyze vast sets of data quickly, a process that requires fast computing performance and massive memory. It can be used for such tasks as language processing and artificial intelligence.

Intel last week launched its latest generation data-center chip that the company said provides faster processing and provides improved features for AI calculations.

“Leading-edge AI and data science are pushing today’s computer architecture beyond its limits—processing unthinkable amounts of data,” Mr. Huang said in a statement.

Nvidia and AMD in recent years have been chipping awayat Intel’s dominance and building up through major acquisitions, which can help with rising development costs and desires by customers for a more diverse set of chips. Intel’s new CEO Pat Gelsinger last month unveiled a far-reaching plan to revive the company’s fortunes, including $20 billion in chip-plant investments and a move into becoming a bigger contract chip maker serving others.

AMD is in the process of buying San Diego, Calif.-based chip makerXilinxInc.for $35 billion.

Meanwhile, Nvidia is working to get regulators to sign off on the deal reached to acquire Arm from SoftBank Group Corp.The company has said it has engaged regulators in the U.S., U.K. European Union and China among other jurisdictions, and that it expects the deal to close in the first quarter of 2022.

Mr. Huang said Monday that Nvidia was also looking to bring Arm-based products into new markets such as cloud-computing and autonomous systems. Grace, which Nvidia said would be available in early 2023, was among a series of announcements made as part of a company event.

It also said that Grace would power supercomputers that the Swiss National Supercomputing Centre and U.S. Department of Energy’s Los Alamos National Laboratory have committed to build.

Nvidia stock rose $32.36, or 5.6% to $608.36 in Monday trading, as the company also said that first-quarter revenue was tracking above its prior guidance of $5.3 billion. Meanwhile Intel shares fell $2.86, or 4.2% to $65.41 and AMD retreated $4,18, or 5.1%, to $78.58.