What assets are set to score a boost after the U.S. Senate passed a roughly $1 trillion infrastructure package with broad bipartisan support Tuesday, putting it on track to possibly be passed by the House and be signed into law by President Joe Biden?

Thebill reauthorizes spendingon existing federal public-works programs and pours a fresh $550 billion into water projects, the electrical grid and safety efforts. It includes $110 billion for roads, bridges and other projects, as well as $66 billion for rail, $65 billion for broadband internet and $55 billion for water systems.

Some analysts say that much of the bill’s positive impact on the economy have already been priced into financial markets but it is possible that a further fillip for stocks could be enjoyed, especially as worries linger about the potential for the delta variant of COVID-19 to stymie aspects of the economic recovery from the deadly pandemic.

“The passage of the infrastructure bill is a nice headline but unlikely to be a big market mover at this point,” wrote Brian Price, head of investment management at Commonwealth Financial Network in emailed remarks.

“I think a lot of the enthusiasm has been priced in over the past few weeks and investors are focused on other factors at this point,” he said, perhaps, referring to investors’ current fixation over the likelihood that the Federal Reserve will taper its monthly purchases of $120 billion in Treasurys and mortgage-backed securities, which had helped to stabilize the market during the height the pandemic back in March and April of 2020.

Still, the stock market was headed higher on Tuesday, with the Dow Jones Industrial AverageDJIA,+0.46%and S&P 500SPX,+0.10%at or near all-time closing highs, after the bill’s passage in the Upper chamber, with a 69-to-30 vote, with 19 Republicans also joining the Democratic yeas, The Wall Street Journal reported.

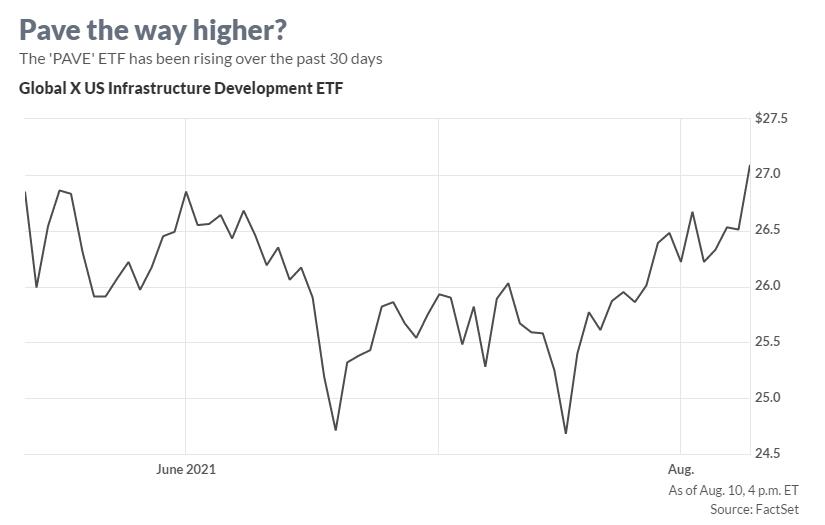

A popular exchange-traded fund that offers exposure to stocks that would benefit from an infrastructure bill, the Global X U.S. Infrastructure Development ETFPAVE,+2.19%,was up 2.2% on Tuesday and has climbed 4.7% within the past 30 days, FactSet data show.

PAVE, referring to the infrastructure ETFs ticker symbol is up 28% so far in 2021, compared with year-to-date gains of around 15% for the S&P 500 and the Dow.

PAVE holds 100 stocks, from small-cap to large-cap companies, that derive at least 50% of revenue from infrastructure construction, materials and equipment supply and related services in the U.S.

Similarly, the iShares U.S. Infrastructure ETFIFRA,+1.45%,another way to play infrastructure, rose 1.3% on Tuesday and is up nearly 22% in the first eight months of the year. The iShares ETF also includes 20 electric utilities and four water utilities, and for that reason isn’t always viewed as a pure-play infrastructure fund.

The Industrial Select Sector SPDR ETFXLI,+1.02%,which tracks the S&P 500’s industrial sector, was up 1% on Tuesday and has gained nearly 18% in the year so far.

Back in the spring MarketWatch’s Philip van Doorn wrote that there are about 20 companies that are included in PAVE that might have the most upsidepotential for investors. Those include Team Inc., which was up 4.4% on Tuesday but has declined 56% in the year to date and Primoris, which was up 2.9% on the day but down 3.6% so far this year.

| Company names | YTD % return |

| Team Inc.TISI,+4.37% | -56.83 |

| Primoris Services Corp.PRIM,+2.90% | -3.6% |

| Columbus McKinnon Corp.CMCO,+2.03% | 17.6% |

| Builders FirstSource Inc.BLDR,+2.72% | 19.6% |

| Advanced Drainage Systems Inc.WMS,+1.89% | 40% |

| Altra Industrial Motion Corp.AIMC,+3.15% | 10.5% |

| Dycom IndustriesDY,-0.96% | -5.7% |

| Cleveland-Cliffs Inc.CLF,+5.05% | 78.7% |

| Rexnord Corp.RXN,+1.91% | 51% |

| Herc Holdings Inc.HRI,+2.28% | 90% |

Overall, the investment in infrastructure is the biggest investment in roads, bridges and tunnels and other areas of America’s inner workings in a generation.

Edward Moya, analyst at Oanda, said that the infrastructure package, should it get quickly passed by the House, is very constructive in “driving the cyclical trade,” particularly as there have been concerns about the delta variant of COVID.

“Spending will take a few years to ramp up and will in any case be spread over the rest of the decade,” said Michael Pearce, senior U.S. economist at Capital Economics, in a recent note.