Summary

- Beyond Meat has lost nearly 50% of its value relative to all-time highs, spurred on by a variety of problems.

- The company's growth rates have declined materially, while it also reported surprising market share losses.

- The company's gross margin also continues to be in focus as it falls nearly ten points below historical levels.

- Beyond Meat is also still minting losses, and analysts don't expect the company to be profitable until 2023.

The recent market correction has put a damper on sentiment for many growth stocks that were very popular amid the pandemic, and Beyond Meat (BYND) is no exception. The plant-based meats producer, widely considered the best-known brand in meat substitutes, survived throughout the pandemic by capitalizing on its sales to fast-food outlets which remained open, plus by leaning in on soaring grocery sales.

But now in the post-pandemic era, the story is starting to weaken substantially. Driven both by souring fundamental performance plus the fact that Beyond Meat remains an incredibly expensive stock, shares of Beyond Meat have been in a sharp downtrend since the start of the year and have lost about 50% from all-time highs.

The question for investors here: is it time to buy the dip in Beyond Meat, or does the correction have further to go?In my view, Beyond Meat is still a watch-and-wait stock: there are far more bearish drivers for this company that don't warrant getting in at the current price.

There are a number of things "wrong" with Beyond Meat right now. Here's a rundown of the things that are most top-of-mind for investors:

- Sharp growth deceleration, and the fact that Beyond Meat's guidance for Q3 came in substantially below consensus expectations (for which the company blamed rising COVID-19 cases).

- Evidence of market share loss has investors worried about brand momentum.

- Persistently low gross margins and still-heavy profitability holes leave this company's scalability in question.

In spite of what many investors consider to be glaring flaws, Beyond Meat still trades at a premium valuation - even after its recent heavy declines. At current share prices near $115, Beyond Meat has a market cap of $7.24 billion. After netting off the $1.01 billion of cash and $1.13 billion of debt on its most recent balance sheet, Beyond Meat has an enterprise value of $7.36 billion.

For FY22 (next fiscal year), meanwhile, Wall Street analysts are expecting Beyond Meat to generate $832.7 million in revenue, representing 52% y/y growth (after the deceleration in the current quarter, we'll see if this target proves too aggressive). Even against what I consider to be a fairly optimistic number, Beyond Meat trades at 8.8x EV/FY22 revenue- which is rich for a company that only shoulders a low ~30% gross margin profile.

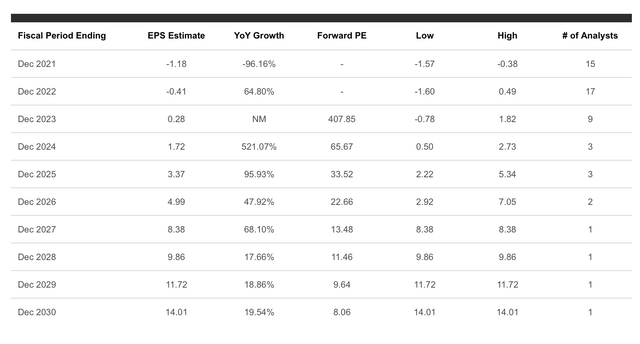

Note as well that Wall Street isn't expecting Beyond Meat to turn a positive profit (from a pro forma EPS standpoint) until FY23. And in order for Beyond Meat's P/E ratio to start looking "reasonable", we need to look out as far as FY26 - when consensus is calling for $4.99 in pro forma EPS (indicating that Beyond Meat's $115 share price right now trades at a 23x P/E versus FY26 profits).

Figure 1. Beyond Meat earnings estimates

There's still a lot of air in this balloon, in my view, that warrants continued downside. Steer clear and let Beyond Meat's downside action continue to consolidate.

Q2 recap: one bad-news quarter after another

Recall that Beyond Meat got pummeled in Q1 for printing low growth and for commencing a new trend of declining gross margins. That story only got worse in Q2. Even though Beyond Meat's revenue growth optically rebounded, part of that was due to easier comps versus the immediate onset of the pandemic last year, while the rest of the story continued to throw off giant red flags.

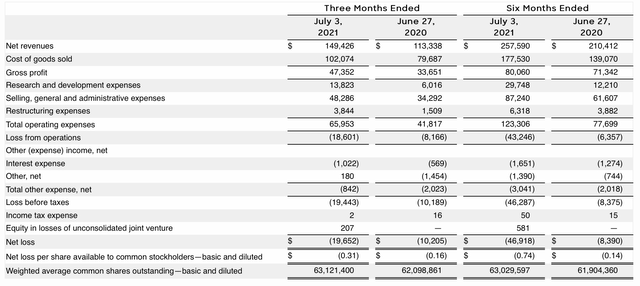

Take a look at the Q2 earnings summary below:

Figure 2. Beyond Meat Q2 results

Beyond Meat's revenue in Q2 grew 32% y/y to $149.4 million, which to its credit did beat Wall Street's expectations of $141.0 million (+24% y/y) by an eight-point margin. Revenue growth also accelerated relative to just 11% y/y growth in Q1.

However, it's not a purely good-news story. We should look to typical Q1-Q2 seasonality to judge how this performance played out, because last year's comps were shaky due to the pandemic. In FY19, Beyond Meat saw 67% sequential revenue growth between Q1 to Q2, versus just 38% sequential growth this quarter. Of course, Beyond Meat is now at a much larger base that makes ~70% sequential growth rates near-impossible, but we do have to note that the company is behind typical Q1-Q2 seasonality based on its own history.

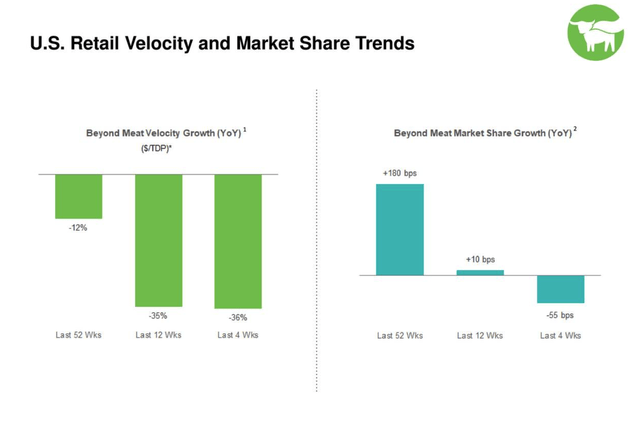

Furthermore, Beyond Meat has for quite some time seen its retail velocity drop. That trend continued (see left side of chart below) over the past quarter. Even worse - Beyond Meat is now starting to indicate thatover the past four weeks (as of early August, when the company reported earnings), it actually lost market share versus other plant-based meat companies.

Figure 3. Beyond Meat retail velocity / market share

Suddenly with this news, Beyond Meat is no longer looking like a hot consumer brand with plenty of greenfield market opportunity to chase. Also an eyesore for investors: Beyond Meat guided to a fairly wide Q3 revenue range of just $120-$140 million, representing 27-48% y/y growth, though Wall Street had hoped for much healthier $153 million (+63% y/y growth). In explaining the downside guidance, CFO Phil Hardin noted as follows on the Q2 earnings call:

Embedded in this guidance are a number of factors that are affecting our typical seasonality between our second and third quarters. These include first an anticipated sequential moderation of foodservice shipments following some pipeline restocking activity, particularly in June, second relative to a year-ago, we had five fewer shipping days in Q3 ahead of the July 4 holiday, which is obviously one of our key promotional periods during summer growing season.

Third, we've had some loss of distribution in our foodservice channels in both our U.S. and international businesses and some foodservice venues are finding it difficult to operate at full capacity, also due to near-term labor challenges. And lastly fourth, we believe some added caution is warranted given the recent uptick in COVID-19 infection rates due to the Delta variant and increased uncertainty associated with that, although not yet at a level that is causing major concern, we have seen a few early signs of customers reinstituting more restrictive measures and signaling a more cautionary disposition."

Lastly, we have to point out that adjusted gross margins continue to sour. In Q2, Beyond Meat's 31.7% adjusted gross margin fell 320bps y/y:

Figure 4. Beyond Meat gross margins

This continues to raise the question of whether Beyond Meat will ever truly scale, especially as the company has burned through -$13.1 million in adjusted EBITDA year to date (versus a $25.6 million profit last year, despite the pandemic).

Key takeaways

Disappointing growth, market share losses, and decaying gross margins - all of this sets a very pessimistic backdrop against a stock that is still trading at premium valuations, despite its recent correction. In my view, there's still plenty of downside left to go in this name. Steer clear here.