Summary

- SoFi falls over 10% following the surprise early release of Q1'22 numbers.

- The fintech smashed Q1'22 targets and guided up for the year.

- The stock only trades at 2x '23 sales targets despite a path to 40% growth because the market latches onto small negatives.

A confluence of events has SoFi Technologies (NASDAQ:SOFI) plunging to new lows despite the company boosting 2022 financial targets on the early release of Q1'22 earnings. The fintech has faced a frustratingyear with the Biden admin. extending the federal student loan payment moratorium multiple times causing a disruption to their business. My investment thesis remains ultra-Bullish on the stock after dipping again despite forecasting a very strong year ahead.

Negative Headlines

The fintech is down to $5 following a wild morning where the stock traded down on weak results in the sector by Upstart Holdings (UPST) followed by an early earnings release. The combination of these events has market participants just dumping shares, especially seeing that Upstart fell 60%.

Also, the stock wasn't helped by the media latching onto mixed Q2'22 guidance despite strong Q1'22 numbers and guiding up for the full year. The company had just reduced 2022 guidance due to the extension of the student loan moratorium.

The updated guidance is as follows in comparison to consensus estimates:

- Q1'22A - $322M vs $284M consensus

- Q2'22E - $330-$340M vs $339M consensus

- 2022E - $1.505-$1.510B vs $1.47B consensus

The market is focused on the Q2'22 guidance for revenues of $335 million at the midpoint in comparison to estimates at $339 million, but SoFi has a history of blowing away estimates, including the massive $38 million beat in the last quarter. The fintech still appears on track to hit the Q4'22 revenue target of $442 million, which amounts to 58% growth.

Remember, SoFi had to cut 2022 revenue estimates by $100 million due to the extension of the student loan moratorium until August 31, 2022. The company decided to just strip out the student loan numbers from estimates for the whole year due to the Biden Administration constantly discussing loan forgiveness as a goal.

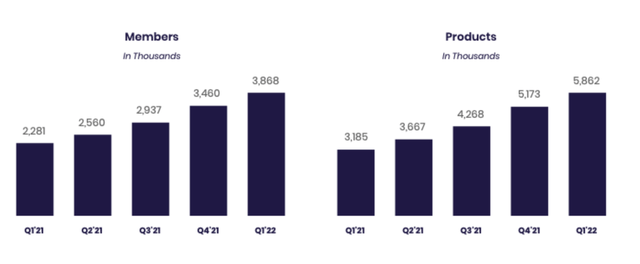

SoFi continues to add new Members and sign those Members up for additional financial Products. The strong shift away from Lending Products has the fintech able to survive a market where the original student loan customers aren't regularly in the market now. The company averages signing up customers to 1.5 new Products.

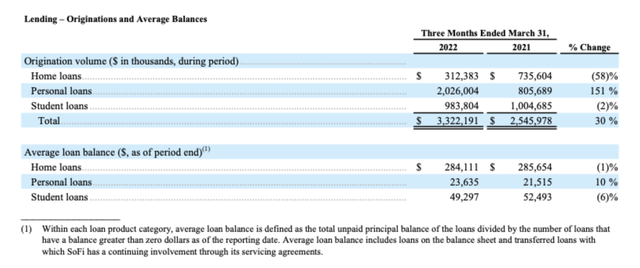

Maybe even more important, SoFi is no longer reliant on student loans to drive the crucial Lending Products category. The company has completely shifted into offering a Personal Loans product with average loan balances around 50% of student loans. This category has seen loan originations explode to top $2 billion in Q1'22. Even with Home Loans and Student Loans down YoY, total loan volumes were up 30% YoY.

The market is naturally worried about the impact of a recession and rate hikes, but SoFi only lends to borrowers with strong credit and incomes. The company remains primed to grow the business with the constant expansion of a suite of financial products and the flexibility to shift to new areas of lending opportunities.

Panic Low Opportunity

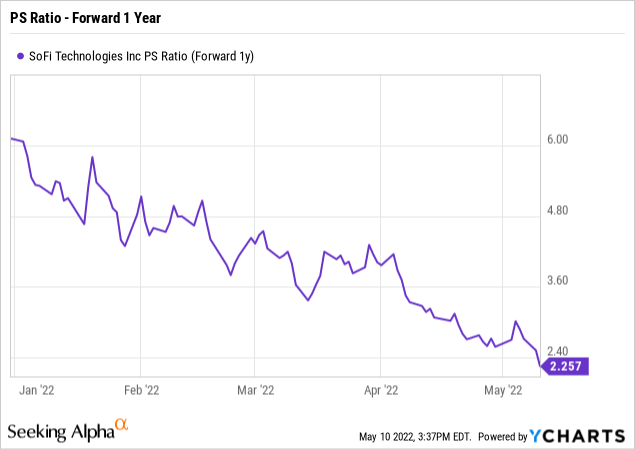

SoFi has fallen by 50% since the end of March and the business remains in strong shape. The market continues to extrapolate on a confluence of events to generate a negative outcome while the fintech is still poised for exceptional growth this year.

The stock has seen the market cap dip to only $4.3 billion here. SoFi will end the year generating revenue at a $1.8 billion annual clip. The company doesn't yet generate the profits the market likes so much in this inflationary environment with adjusted EBITDA forecasted at only $105 million this year, but this is where retail investors have the opportunity of strong long-term returns.

After this panic period ends, the market will return to finding a fintech with growth in excess of 40% appealing at only 2x 2023 revenue targets. All of the stock weakness this year is due to multiple contraction, not a change in the long-term prospects of SoFi.

The best part about buying SoFi now is that the student loan business is more of a bonus. The company doesn't need to refinance student loans in order to grow at an exceptional clip going forward.

Takeaway

The key investor takeaway is that SoFi released strong results for Q1'22. The market wants to panic on guidance that hikes 2022 numbers providing a great opportunity for retail investors. The stock could still fall lower in this wildly negative market, but SoFi is exceptionally cheap here.