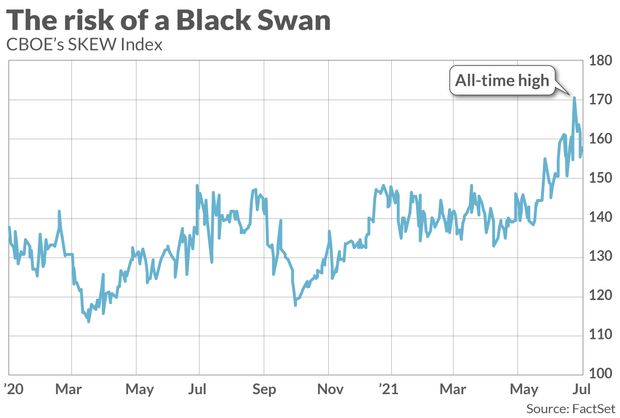

In late June the CBOE’s SKEW Index — a.k.a the “black swan” index — hit an all-time high. That reading was more than 40% higher than its average since 1990, which is how far back data extend. In fact, the June reading was 20% higher even than the highest the SKEW reached during the U.S. stock market’s February-March 2020 waterfall decline.

This new high certainly seems scary. Yet I’m not convinced that the SKEW’s high recent readings mean that more traders than usual are betting on a sharp decline for the the U.S. stock market, including the Dow Jones Industrial Average,the S&P 500 Index and the Nasdaq Composite.

In fact, it’s possible that the higher SKEW index reading means just the opposite.

To illustrate, imagine there are two groups of investors: permabears, who more or less permanently think that stock prices are about to fall, and the mainstream consensus, which is bullish. In this hypothetical case, the SKEW Index in effect would measure the distance between these two groups’ forecasts.

Notice, therefore, that there is more than one way for the SKEW Index to rise. One way, which is what most assume is the case when the index rises, would be for the permabears to become even more bearish. But the SKEW Index would also increase if the permabears didn’t alter their bearishness and the mainstream consensus became more bullish.

There is some evidence suggesting that this latter possibility is happening now. Consider the Crash Confidence Index, aperiodic survey introduced in 1989 by Yale University finance professor Robert Shiller. The latest results indicate no notable increase in the percentage of U.S. investors who believe the stock market is about to crash.

Other evidence pointing in the same direction is the increasing bullishness among short-term stock market timers. For example, timers my firm monitors who focus on the Nasdaq in particular are, on average, more bullish now than on 94% of all trading days since 2000. (That’s according to my firm’s Hulbert Nasdaq Newsletter Stock Sentiment Index, or HNNSI.)

It’s also worth noting that there is more than one way for the SKEW Index to fall. Assuming the permabears don’t change their forecasts, the SKEW will fall if the mainstream consensus becomes more bearish. That’s because the distance between the two groups’ forecasts — what the SKEW measures — will narrow.

So instead of a falling SKEW suggesting less concern about a market decline, it might instead be signaling an increased concern.

All we know for sure from the SKEW’s recent all-time high, in other words, is that disagreement among investors is particularly wide right now. Though we don’t know for sure, my hunch is that this extreme disagreement traces to the already-bullish mainstream consensus becoming even more bullish. Contrarians should take note.