Summary

- Amazon is one of the companies whose growth has not yet reached its limit and not even entered the plateau phase.

- In terms of comparative valuation, AMZN is undervalued against the market.

- DCF-based Amazon stock price target suggests 30% upside potential. But I think this is not even a basic scenario, but a pessimistic scenario.

I present my comprehensive Amazon (AMZN) analysis in light of the results of the last quarter.

#1 Price vs. Growth

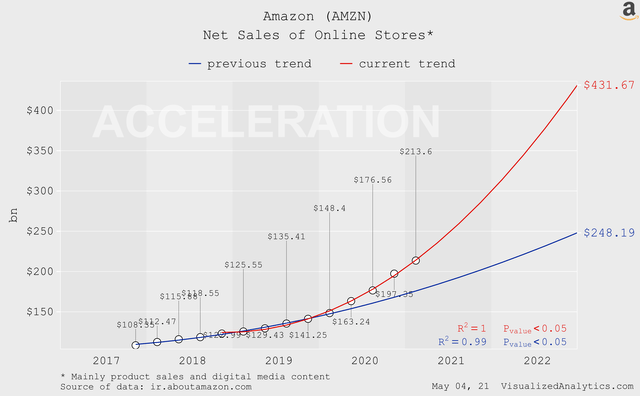

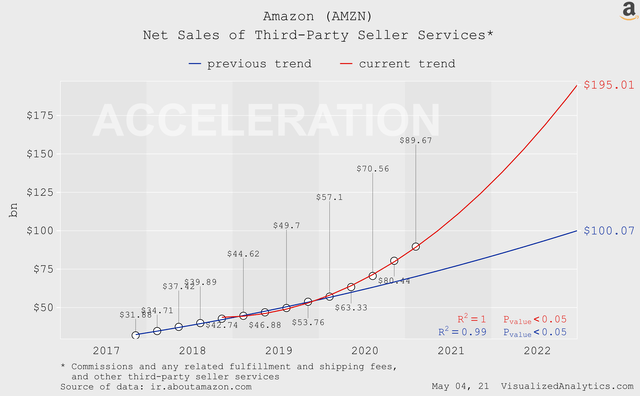

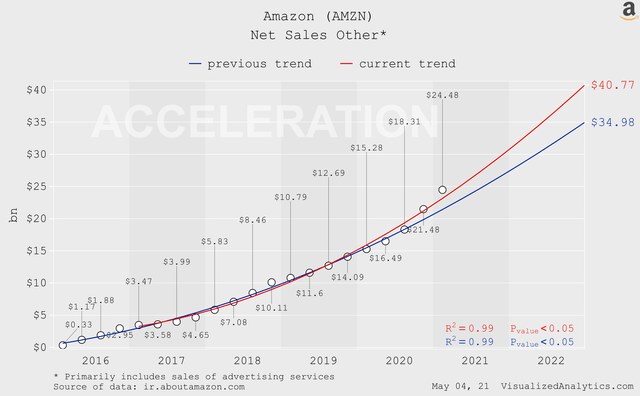

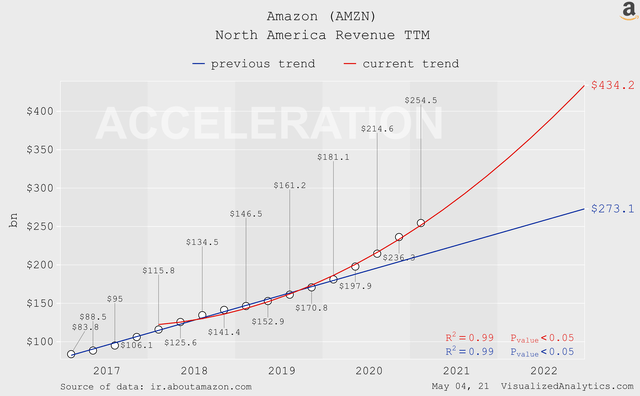

First of all, let's assess whether we can statistically state that Amazon's growth has accelerated or slowed down in the last quarter. To do this, let's compare the revenue growth trends of the key segments of the company with and without the results of the last four quarters.

The dynamics of the 'Online Stores' segment showed a qualitative breakthrough. Without taking into account the last four quarters, a near-linear trend was observed here. Now, it has become exponential:

Source: VisualizedAnalytics.com

The 'Third-Party Seller Services' segment - the exponential growth continues:

Source: VisualizedAnalytics.com

The 'Subscription Services' (Amazon Prime) segment - here the acceleration remains, and the result of the last quarter was better than the trend:

Source: VisualizedAnalytics.com

The 'Other' (advertising services) segment has also showed a significant acceleration:

Source: VisualizedAnalytics.com

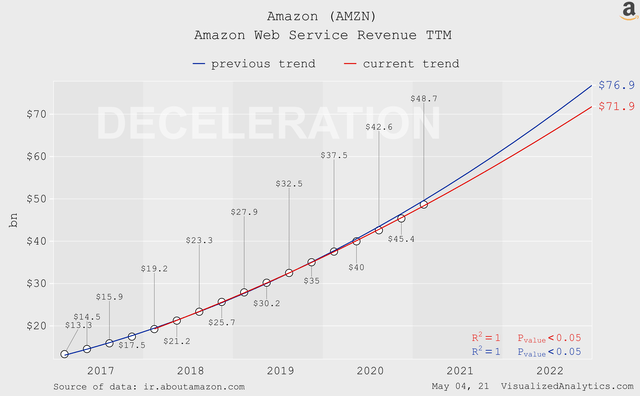

The growth trend of 'Amazon Web Services' has slowed down, but judging by the results of the last quarter, there is a gradual return to the previous trend:

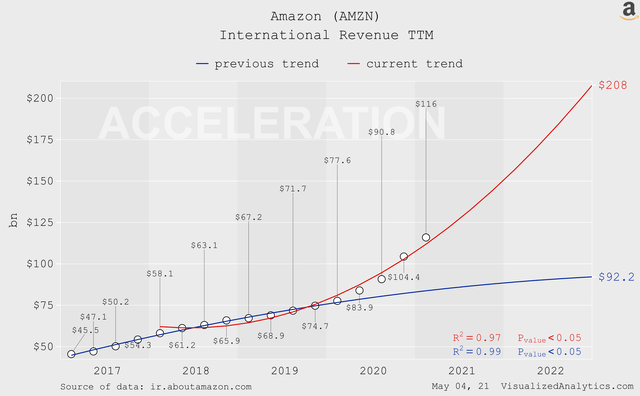

Geographically, Amazon's revenue was also significantly better than the trend:

So, statistically, not subjectively, we should recognize the acceleration of the company's growthin all key segments. In my opinion, this is exactly what is expected from Amazon.

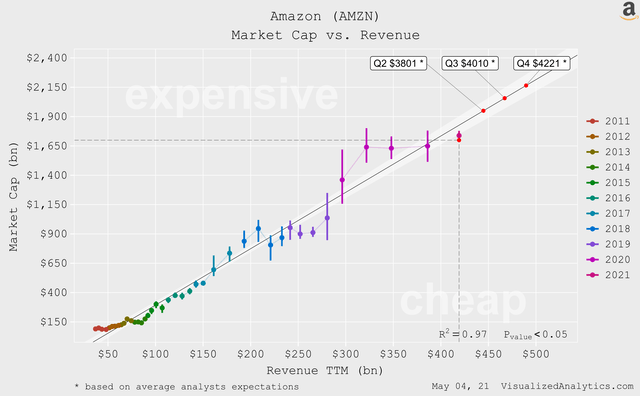

Further. Over the last 10 years, Amazon's capitalization has been in a qualitative linear relationship with its revenue:

Source: VisualizedAnalytics.com

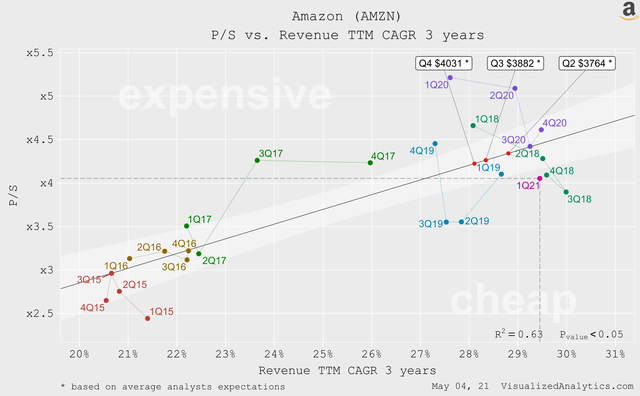

There is also a certain influence of the company's revenue growth rate on its multiples:

Source: VisualizedAnalytics.com

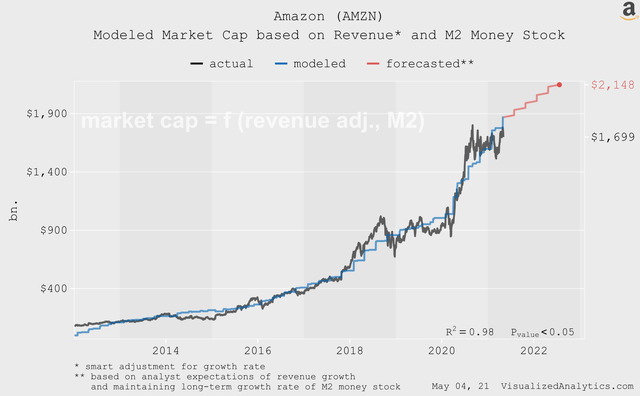

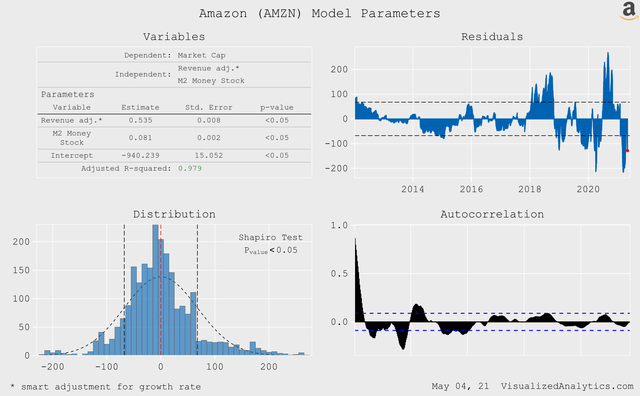

Based on these two relationships and taking into account the influence of the growth of theM2 money stockin the US, it is possible to build another model that allows us to determine the balanced level of the company's capitalization. In addition, this model allows to model the growth of the company's capitalization based on the current expectations of analysts regarding the company's revenue growth in the next four quarters. Here is this model:

Source: VisualizedAnalytics.com

As you can see, firstly, this model indicates that the company's current price is alreadybelow the balanced level. And secondly, it assumes a25% growthin capitalization in the next four quarters.

#2 Comparative Valuation

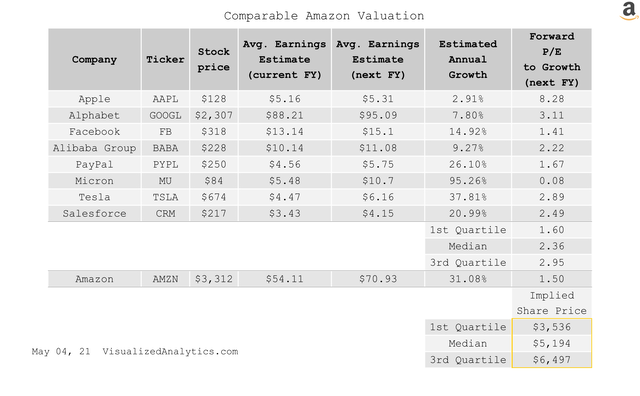

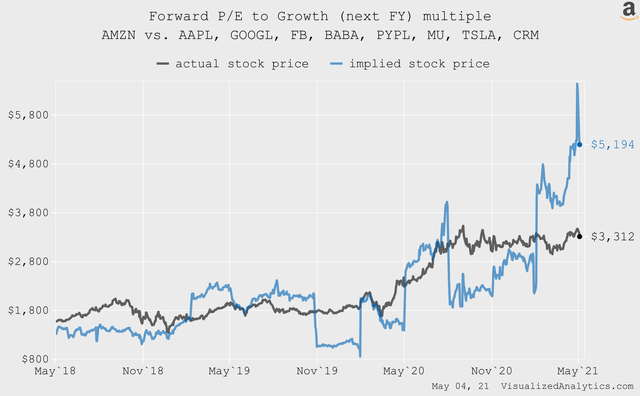

In the previous block, I modeled Amazon's balanced price based on revenue. What is remarkable is that if we apply the same approach to the comparative valuation of the company using multiples, we will fail. At least I have not been able to find a single revenue-based multiple that would make it possible to successfully compare Amazon to other companies. But the forward P/E (next FY) multiple adjusted by the expected EPS annual growth rate made it possible to find a suitable model:

As you can see, judging by this multiple, Amazon is significantly undervalued.

#3 Discounted Cash Flow Model

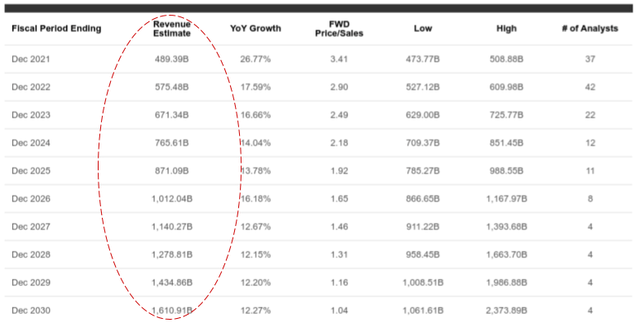

When predicting Amazon's revenue for the next decade, I proceeded from the average expectations ofanalysts:

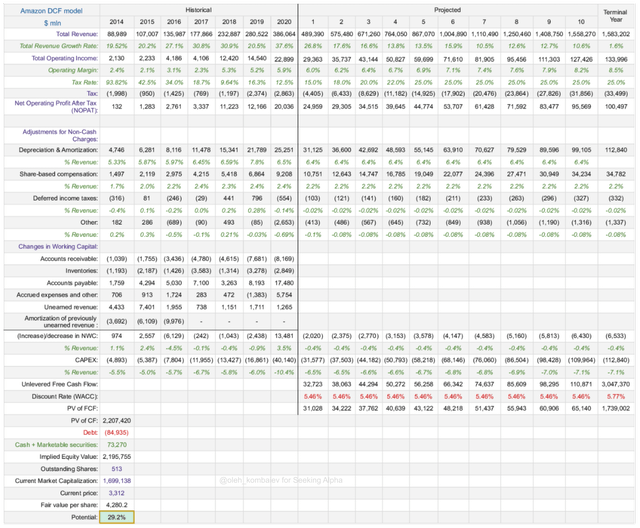

When predicting the dynamics of Amazon's operating margin, I also proceeded from analysts'expectationsregarding the growth of the company's EPS, and taking into account the gradual increase in the tax rate to 25%. In my opinion, a gradual increase in the operating margin to 8% in the terminal year is a very realistic scenario.

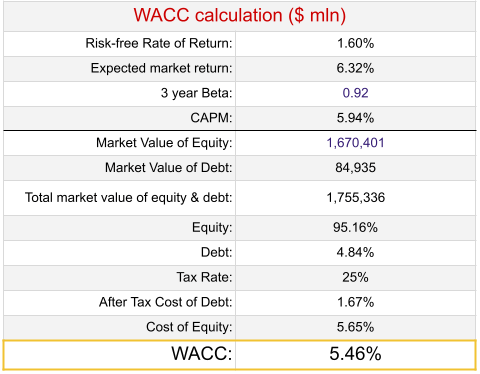

Here is the calculation of the Weighted Average Cost of Capital:

Some explanations:

- In order to calculate the market rate of return, I used values of equityriskpremium (4.72%) and the current yield of UST10 as a risk-free rate (1.6%).

- I used the currentvalueof the three-year beta coefficient (0.92). For the terminal year, I used Beta equal to 1.

- To calculate the Cost of Debt, I used the interest expense for 2019 and 2020 divided by the debt value for the same years.

Here is the model itself:

Source: Author

The DCF-based target price of Amazon's shares is $4,280, offering 29% upside.

Final thoughts

- Amazon is one of the companies whose growth has not yet reached its limit and not even entered the plateau phase. In a sense, this is a startup with $73 billion cash.

- The fact that Amazon remains in the acceleration phase does not mean that its capitalization is constantly undervalued. But in this case, based on the patterns between the company's capitalization and the parameters of its revenue, we can conclude that the company isundervalued.

- Comparing Amazon to other companies through the prism of expected EPS growth, it must be admitted that the company ismuch cheaperthan the market.

- DCF model based on average expectations analysts indicate a 30% undervaluation. At the start of the year, a similarmodelindicated a 20% undervaluation.

- When you look at Amazon's revenue forecast for the next decade, you realize that the company will face growth problems. But in my opinion,it is better to invest in a company facing growth problems than aging problems.