Summary

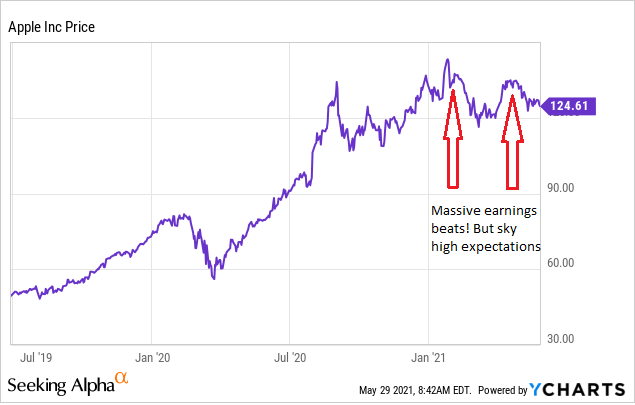

- Despite crushing Q2 earnings estimates, Apple shares have gone in reverse and are underperforming the broader market.

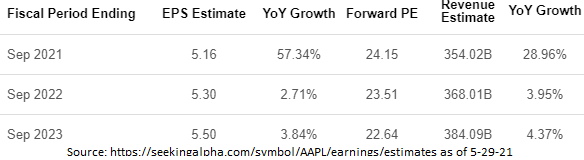

- I believe Wall Street expectations for Apple's FY2022 are unreasonably high and likely contributing to the recent weakness.

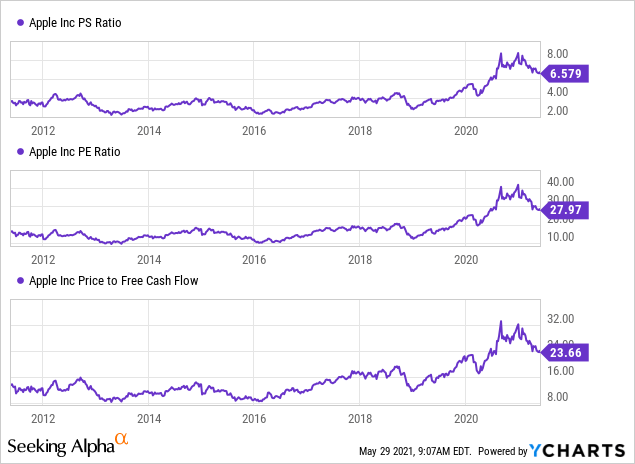

- Apple's Price/Earnings, Price/Sales, and Price/Free Cash flow still remain significantly elevated to historical levels.

- I have serious doubt that iPhone, iPad, and Mac sales can continue the current hot sales pace over the next year.

Apple (AAPL) bulls have to be frustrated. Despite massive earnings beats in both its Q1 holiday quarter and Q2 January-March quarter, the shares have gone no where. The thesis from my last article on Apple, that COVID-19 lockdowns, government handouts, and the launch of 5G all culminated to pull demand into Apple's FY21 year,gained a supporter from analysts at New Street, who are now predicting the same.

New Street isn't predicting that the sky is falling, and neither am I. They are just modelingiPhone shipments in the 180M-200M range versus the 234M consensus.Does this sound like an extreme view? I don't think it is, especially since SA Contributor Paulo Santos has been tracking iPhone sales in China and has seen a significant slowdown from the white-hot start to the beginning of this year. I think similar slowdowns for iPad and Mac are a few quarters away.

What is AAPL's current valuation? Does it make sense?

From the comments I've received on my last two articles, bulls must think I hate Apple and have an axe to grind. This could not be further from the truth. I've owned Apple outright many times in the past, and still own a significant stake in it through my Berkshire Hathaway (BRK.B) holdings. So I'm not rooting against it by any stretch, I'm just calling it like I see it - and I see the valuation as very stretched.

Apple's Price/Earnings, Price/Sales, and Price/Free Cash flow still remain significantly elevated- 50% or more - from their historic norms.

This is a key issue because the forward revenue growth and earnings estimates for Apple are already low and predict minimal growth. At these rates, nearly all of the earnings growth would come from the share repurchases.

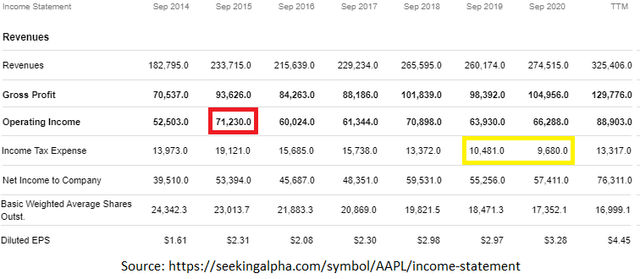

But these forward estimates assume Apple will repeat the record year they are having again in FY2022. I think the odds of that happening are slim. Instead, I expect a similar situation of what happened between FY2014-FY2016, where operating earnings increased significantly from FY2014 to FY2015, then declined moderately in FY2016.

Apple's FY21 could be peak sales and earnings for a long time

Since 2016, Apple has introduced a lot of successful new products: the Apple Watch, AirPods, and Apple TV, to go along with many new versions of Mac, iPhone, and iPad, along with impressive growth in Services.

Yet with all of that success, Apple's Operating Income peaked in 2015 until shattering the prior peak over the last 12 months. From 2015-2020, Apple was able to grow EPS roughly 7%, with significant help from share repurchases and the TCJA corporate income tax cut. (Without this tax cut, 2020 EPS would have been ~$2.88 rather than $3.28, implying an EPS growth rate of around 4.5%.)

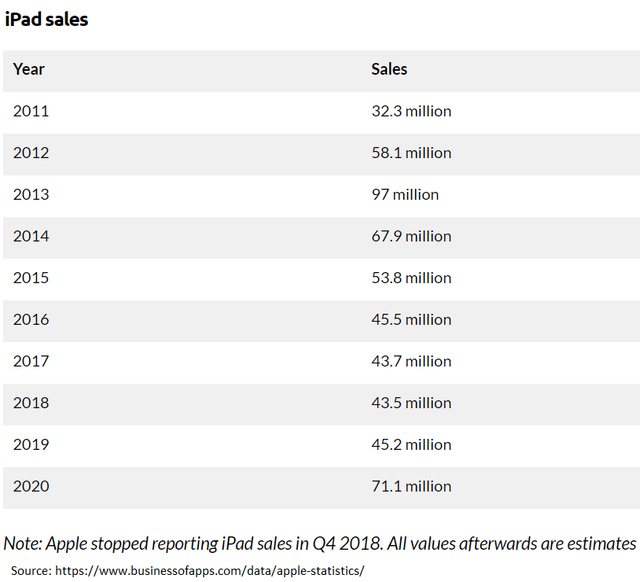

Ultimately, I believe Apple's recent torrid sales performance will not be repeated and should not be considered a new run rate like Wall Street analysts are modeling. I look at iPad sales as an illustration of this. For the last several years, volumes had been steady until exploding 57% last year and continuing the same strength early this year.

Did iPads suddenly become so much more popular? Or were there just a lot of parents working from home that wanted iPads for their kids? I'm going with the latter.

Conclusion - Apple is still a Sell

Wall St. analysts wasted no time increasing earnings expectations for next year based on what I believe is mostly an extrapolation of the current results.

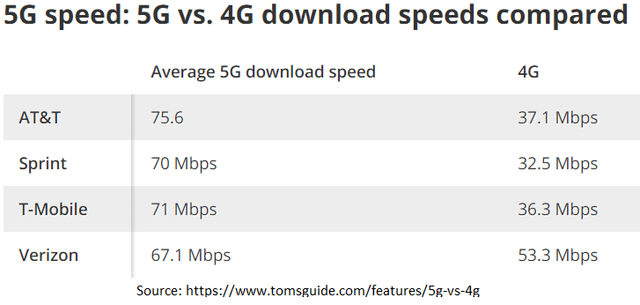

Admittedly, I'm less bullish on the 5G Supercycle than most. I believe that the innovators and early adopters will rush to upgrade, but most of the mass market will remain on the normal upgrade cadence, which continues to lengthen. I think the iPhone is a victim of its own success - that the recent iPhones are all so good, upgrading to newer phones is less compelling, and because 4G is "good enough" for most people.

Apple earned $2.97 in 2019. They've already earned $3.08 in the first two quarters of this year and current estimates are $5.16 for the full fiscal. Even with the growth in Services, I just do not see them repeating this performance next fiscal year, and expect earnings closer to the $4-4.50/share range, far short of the $5.30 that's currently expected. That would put Price/Earnings back above 30 with a negative growth rate. If this happens, shares could retest the $100 level.

Apple is still a sell here for me. It's a great company that's simply priced too richly. Valuation always matters.