Lightly staffed trading desks during the summer months could spur more volatility in the weeks ahead

U.S. stock futures swung in a choppy trading session, pointing to more volatility ahead for major indexes as June trading kicks off.

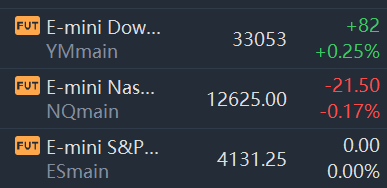

Futures for the S&P 500 on Wednesday wavered between small gains and losses. Contracts for the Dow Jones Industrial Average gained 0.3%, while those for the technology-focused Nasdaq-100 fell 0.2%, erasing gains from earlier in the day. On Tuesday, major U.S. indexes fell, leading the S&P 500 to end May roughly flat after a tumultuous month marked by major moves in both directions.

VIX rose 0.7% and VIXmain rose 0.2% separately.

Gold fell 0.8% to $1833.5.

Wednesday’s session ushers in a new trading month, but few investors expect a reprieve from the volatility that has dominated the markets this year. Many traders remain worried about the pace of the Federal Reserve’s interest-rate increases and whether they will plunge the U.S. economy into a recession. Eight of the last 11 extended Fed rate-rise cycles have eventually ended in recession, according to Deutsche Bank analysts.

Still, many traders say a recession isn’t guaranteed, and any significant economic slowdown could be many months away. That has led some investors to wade into the market and scoop up shares with beaten-down valuations, injecting more volatility into markets.

More lightly staffed trading desks during the summer months could spur more volatility in the weeks ahead. Summer trading tends to have lower trading volumes and less liquidity, leading to more dramatic moves in stocks. Many investors are also bracing for more volatility ahead in other asset classes, which have also notched dramatic swings this year.

In the bond market Wednesday, the yield on the 10-year U.S. Treasury note advanced to 2.869%, from 2.842% Tuesday, as investors dumped government bonds. Yields and bond prices move inversely. Yields on the benchmark note still remain well below this year’s closing high of 3.124%, but have advanced this week as traders have continued to reassess the path of interest rates.

Crude prices rose, as investors digested European Union leaders’ plan to impose an oil embargo on Russia and a ban on insuring ships that carry Russian oil. Brent crude, the international benchmark for oil prices, rose 1.5% to $117.37 a barrel. West Texas Intermediate, the U.S. marker, advanced 1.7% to $116.63.

In premarket trading in New York, Salesforce jumped 8.7% after reporting revenue that outpaced analyst expectations, easing concerns about demand for its business software. Shares of energy companies also climbed, tracing oil prices higher.Marathon Oil and Occidental Petroleum each advanced more than 1% ahead of the opening bell.

Fresh data on activity at U.S. factories are due later Wednesday, as are results from Hewlett Packard Enterprise and the meme stock GameStop.

Overseas, the pan-continental Stoxx Europe 600 fell 0.2%, erasing earlier gains. Shares of Dr. Martens jumped 27% after the shoemaker reported a significant rise in pretax profit for fiscal 2022 and indicated it was navigating the current inflationary environment with price increases.

In Germany, shares of DWS Group, Deutsche Bank’s asset-management arm, fell 6.7%. The Frankfurt offices of Deutsche Bank and DWS Group were raided by authorities Tuesday over allegations of greenwashing in its mutual funds. DWS on Wednesday said its chief executive was stepping down.

In Asia, trading was mixed. China’s Shanghai Composite lost 0.1%,as Covid-19 lockdowns eased in China’s financial capital. Hong Kong’s Hang Seng fell 0.6%. Japan’s Nikkei 225, in contrast, rose about 0.7%.