Methodical investing over a multi-decade period trumps obsession over timing a trade right. This has certainly been the case of Amazon stock.

Amazon is one of the most cited cases of overwhelming success in Corporate America in the past couple of decades. While few could have foreseen the story unfold early enough to invest in Amazon stock at or near the IPO (i.e. perfect timing), methodically investing in AMZN shares over time would have actually been the ultimate “grand master” strategy.

Today, the Amazon Maven asks a question and analyzes the results: how would an investor have fared since 1997, not if he or she had bought AMZN once at the IPO price, but if he or she had added $100 to the Amazon stock position each month?

Amazon stock: building wealth slowly

There is nothing overly exciting about a methodical investment strategy whose goal is to grow capital slowly over a long period. Much of the fun chatter among investors tends to revolve around well-timed entries and exits. But in my opinion, the former is what is most important in successful investing.

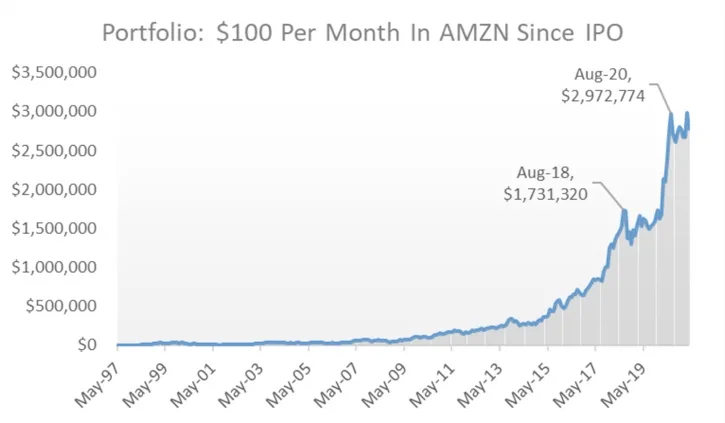

The chart below shows the value of a simple portfolio invested 100% in Amazon stock since the 1997 IPO. This hypothetical portfolio would have been “fed” $100 worth of AMZN each month and left untouched until today.

A couple of things stand out to me, maybe to the reader as well:

- A monthly investment of $100 per month (call it “a cup of coffee per day”) over nearly 25 years seems small to generate substantial wealth that would have been worth a whopping $2.78 million now.

- The portfolio would have been noticeably large only after several years of the strategy being in place, due to the power of compounded gains over time. It seems that patience is a virtue that pays off not in months, but in many years or even decades.

- Through recessions and bubble bursts, the portfolio’s value would have climbed relentlessly, with only a few bumps along the way. At play here is the fact that, through periodic investments, an investor can take advantage of Amazon stock price dips by buying cheaper.

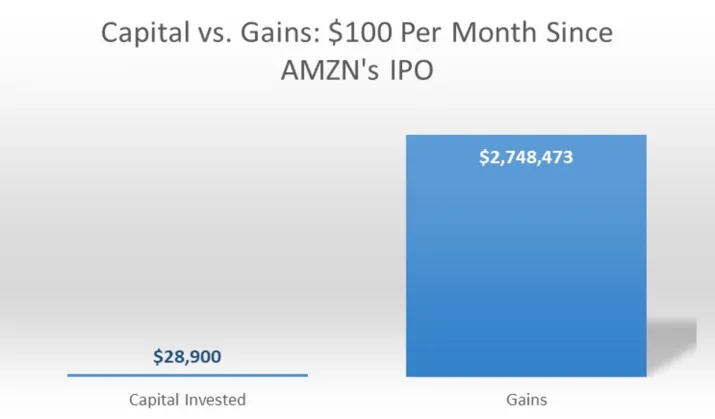

Regarding the first point above, it is interesting to note that the overwhelming majority of the hypothetical portfolio’s value today would have come from gains, not from capital invested. The following graph breaks down how much each variable would have contributed to the $2.78 million balance.

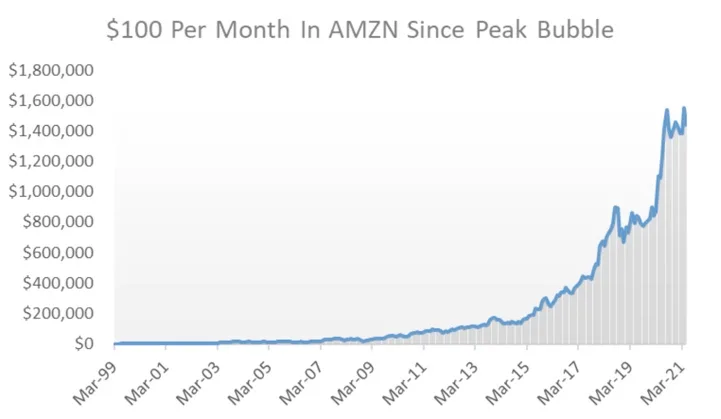

On the third bullet point, notice how methodical investing smooths out the undesirable effects of buying at a peak, given enough time. The following chart depicts $100 monthly investments since the very peak of the dot-com bubble for Amazon stock, in March 1999.

In other words: even terrible timing would have still led a continuous automatic investment in AMZN to grow to $1.4 million in the past 22 years. Not bad at all.

The Amazon Maven’s take

To say that one should have started to invest $100 per month in AMZN at the IPO is pointless now. But I still believe that the exercise above teaches at least one lesson in methodical and patient investing, compared to obsession over timing a trade right and holding it for a short period.

I am skeptical that a $100-per-month investment in Amazon stock starting today will lead to multi-million-dollar balances in 20-25 years. But in my view, using a similar strategy, whether with AMZN or shares of higher-growth companies, is one of the best ways to accumulate wealth in the long haul.