Story Highlights

FAANG stocks have failed to hold their own amid the recent barrage of market chaos. Despite their recent slides, many analysts remain incredibly upbeat on the following three FAANG stocks, even as recession risks surge.

FAANG stocks have been unable to steer clear of the market hailstorm that’s hit the tech sector. Though high-flying hyper-growth stocks have dragged stocks lower in the first half, the fallen FAANG stocks still appear like great long-term holds, even as rates and recession risks rise by the month.

Many may be quick to conclude that FAANG is dead. And although the acronym may be in need of an update following the epic blow-up of Meta (META) and Netflix (NFLX) in the first half, I’d argue that the broader basket needs more time to demonstrate its resilience.

As America’s top tech titans brace themselves for an economic slowdown, investors and analysts have been quick to temper expectations. Given their tremendous resilience, I’d argue it’s likely that it’s the FAANG stocks that could provide leadership as markets look to rebound.

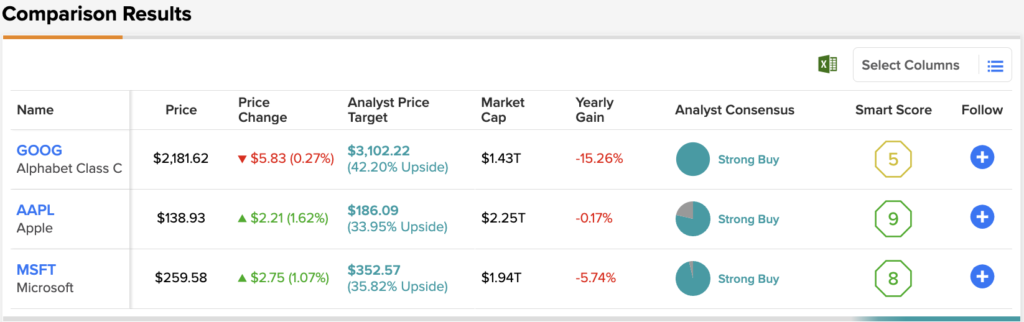

In this piece, we usedTipRanks’ Comparison tool to have a closer look at three Strong-Buy-rated FAANG stocks.

Alphabet (GOOGL)

Alphabet is a wonderful tech company that you can never count out. The company caused a bit of a stir when it reported a mild earnings miss in its first quarter, with $24.62 per-share earnings, missing the $25.89 estimate.

In a market that doesn’t even reward earnings beats, you can bet that earnings misses will be met with tremendous selling pressure. Though Alphabet’s rare quarterly flop may be viewed as the beginning of a disturbing trend, I’d argue that things weren’t nearly as ugly as they seemed under the hood.

The search and cloud businesses were remarkably strong. Internet video behemoth YouTube acted as a major drag for the quarter, thanks in part to significant competition for user engagement and the reopening of the economy. Indeed, many shut-in consumers have been going out, rather than spending hours on custom-tailored videos served up by the YouTube algorithm.

Though lockdown tailwinds are unlikely to return, even as new COVID variants do, I view YouTube as a powerful platform that could recover ahead of an economic slowdown.

YouTube isn’t just a magnificent entertainment platform. It’s one that could be a lot more recession-resilient than skeptics think.

As the economy slows down, consumers won’t be in a hurry to spend considerable sums anymore. Many may ditch their paid subscriptions, and start going out less to curb their monthly spending. As they do, people could spend more time engaging with YouTube’s free, ad-based platform.

Though YouTube subscriptions could decline, I view the ad business as one that could take off as free entertainment tiers get a chance to shine.

There’s nothing wrong with YouTube. Softness in the first quarter seems like more of a road bump than the beginning of an insidious trend. As YouTube bounces back, while search and cloud continue powering higher, GOOG stock makes for an exciting dip-buy. At writing, the stock trades at 5.3 times sales and 19.8 times trailing earnings.

Wall Street is upbeat, with the average Alphabet price target of $3,116.90, implying a 43.32% upside.

Apple (AAPL)

Apple is another high-quality FAANG stock that investors don’t seem to be giving the benefit of the doubt. Despite clocking in a solid Q1 earnings beat, the cautious guide startled investors. There are supply-side constraints that not even Apple can navigate through without enduring a bit of pain.

Still, as Apple moves past such issues in the second half, there are reasons to believe that demand could stay strong, as wealthier consumers continue to spend on the latest and greatest Apple devices and services. It’s encouraging that Apple fans tend to have a bit more disposable income than more cost-conscious Android users.

Apple’s strong brand may help it dampen the downside in a recession. However, it’s an innovation that could help Apple shrug off a coming 2023 economic slide. The much-anticipated mixed-reality headset is rumored to launch in early 2023.

As you may remember, Apple unveiled the first iPhone in the face of the Great Financial Crisis. Looking back, the market crash of 2008 is just a small blip. Could Apple’s big headset launch induce upside such that the 2022 plunge will be dwarfed in a few years’ time? I’d argue it’s likely.

Wall Street is staying bullish, with the average Apple price target of $186.09, implying a 34.0% upside.

Microsoft (MSFT)

Last, but not least, we have enterprise juggernaut Microsoft, which bucked the trend, with a strong recent quarter along with optimistic guidance. How has Microsoft been able to pivot so effectively where its FAANG peers have fallen?

Microsoft doesn’t just have excellent managers running the show under CEO Satya Nadella. Enterprise spending has been incredibly robust, and it could stay this way as the consumer begins to get sluggish. Microsoft’s Azure business has been virtually unstoppable amid the digital transformation.

As the company looks to take its Xbox gaming business to new highs, count me as unsurprised if Microsoft becomes a dominant software player in the metaverse. Yes, the metaverse remains abstract, but Microsoft has the tools it needs to make a smooth transition.

At writing, Microsoft trades at 27.1 times trailing earnings and 10.1 times sales. It’s the second-priciest FAANG stock on a price-to-earnings basis. However, given its relative resilience, the stock doesn’t seem all that pricey.

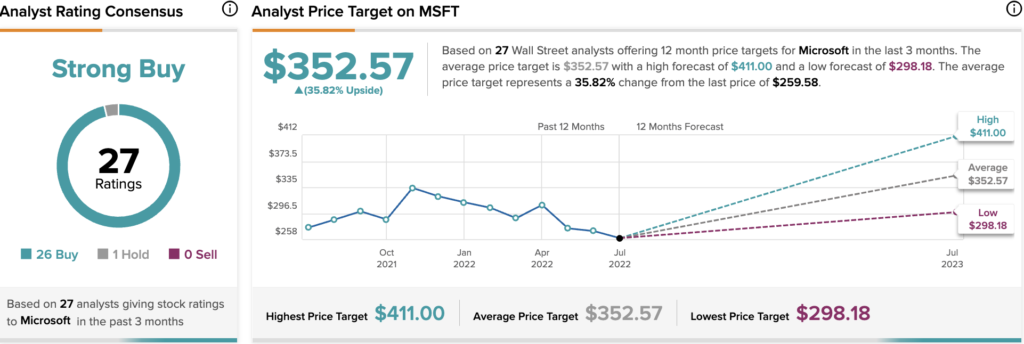

Wall Street is extremely bullish, with the average Microsoft price target of $352.57, implying a 35.9% upside.

Conclusion

FAANG stocks still seem like great buys, even though they’ve faded alongside the broader market. At this juncture, analysts expect most from Alphabet over the year ahead. Personally, I find it hard to pick just one of the three Strong Buy-rated FAANG stars.