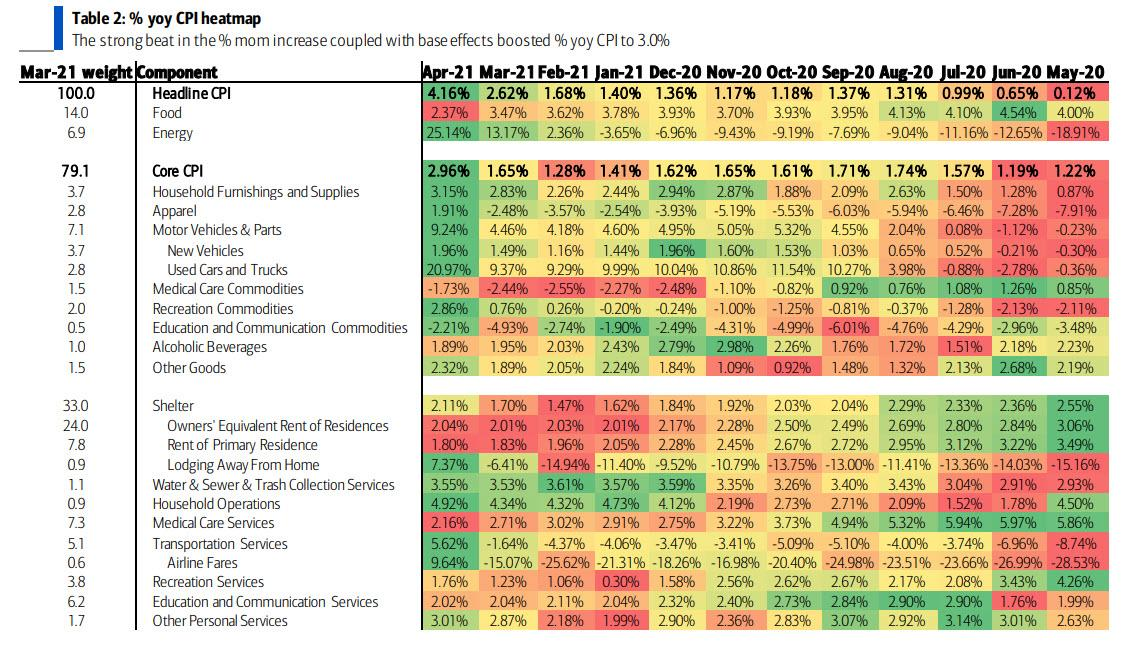

As BOfA economist Alexander Lin writes, the "eye-popping" April CPI report was a "massive surprise" as core CPI strongly rose 0.9% (0.92% unrounded) sequentially, which was the largest gain since 1981 and blew away consensus forecasts of 0.3% (for a full range of shocked reactions from traders and strategistssee this).

However, in some potentially mitigating details, BofA reveals that near-term inflation pressures were driven bygoods shortages and the reopening "and that was certainly the case this month as these two themes accounted for at least 70bp of the rise in core."

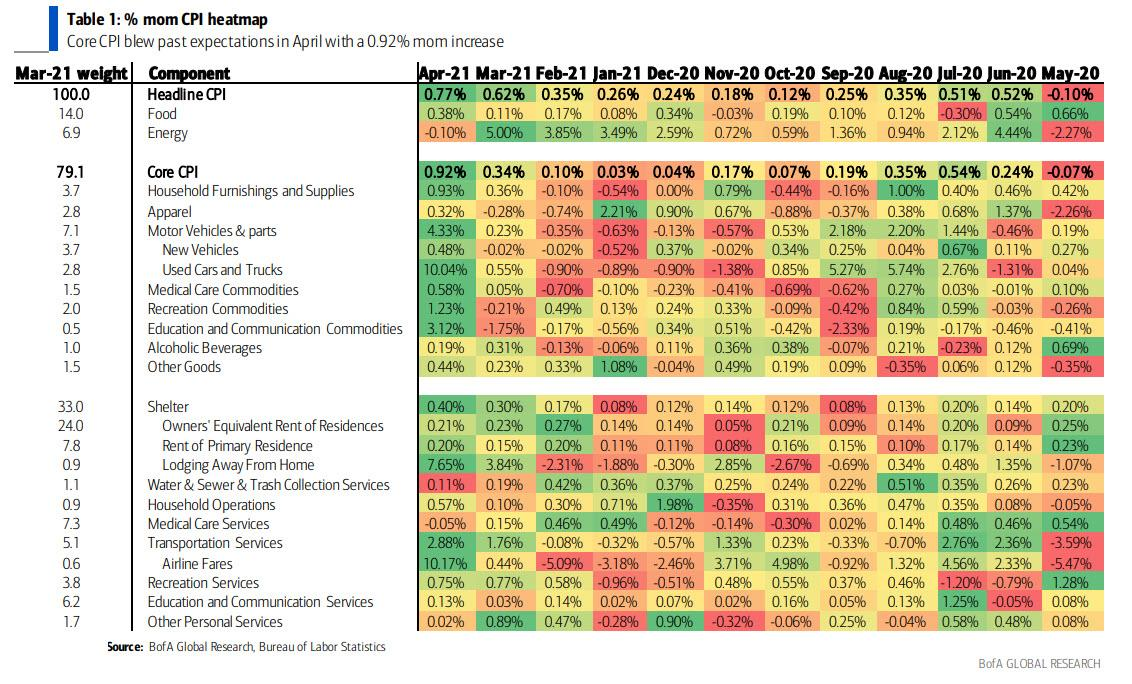

- First on shortages, auto prices jumped 4.3% mom with particular strength in used cars, which posted a record increase of 10.0% mom. Despite this historic increase, there is likely further upside in the pipeline with Manheim wholesale used cars rising another 8.2% in April, which builds on the 11% increase from Jan through March.

- Household furnishings & supplies also jumped 0.9% mom, with strength in other goods like recreation (+1.2%) and education & communication (+3.1%).

- Related to the reopening, lodging away from home rose 7.6% mom and transportation services jumped 2.9%.

- In transportation services, airline fares leapt 10.2% mom and car & truck rental leasing surged 16.2% mom, which follows an already impressive 11.7% gain in March.

- The gains in lodging and airfares were both record highs,but prices remain 17.7% and 4.9% lower than pre-pandemic levels which means scope for further significant price increases in coming months.

- In leasing, rental car companies have been impacted by the production cuts in the auto sector as well, which has forced them to build back their fleets with used cars as travel recovers.

- Motor vehicle insurance prices also rose 2.5% mom, which could reflect more people getting back on the roads.

Meanwhile, Lin argues that more persistent sources of inflation were tamer. Rents and OER both came in at 0.2% mom, which while in line with the recent trend, is about to change as we discussed in "And Now Rents Are Soaring Too." Furthermore, as Joseph Carson notes, housing prices are up 18% in the past 12 months, a record increase andnine times the increase in owners' rent. "The old CPI included house prices. Inserting house prices in place of non-market owner rents,reported inflation would have been twice the 4.2% gain."

Meanwhile, medical care inflation was flat as the boost from stimulus around the turn of the year faded. Within healthcare, insurance was a big drag, contracting 1.0% mom. Professional services also inched down -0.2% mom, while hospital rose 0.3% mom.

A visual summary of the data looks like this, first on a M/M basis, where the base effect has no impact as it is sequential...

So with inflation soaring, will anything change and will the Fed be forced to tighten sooner? According to BofA, not at all: "the Fed is likely to continue to reiterate the message of transitory one-off price increases versus more persistent inflation, with this report a shining example of these dynamics. However, a key question going forward is whether this transitory strength will ultimately feed into the latter. This would be accomplished through rising long term inflation expectations—keep an eye out on survey- and market-based measures."