- A failure to deliver occurs when a short seller doesn't actually have the asset that they're selling short.

- There have been as many as 43 million FTDs in APE in a single day since it started trading.

- Nobody's quite sure why there have been so many FTDs associate with APE and AMC stock.

What Is Failure to Deliver?

In trading, failure to deliver (FTD) occurs when one of the parties in a transaction fails to fulfill its obligations by the settlement date. This can apply to stocks, futures, options, and other assets.

On the buyer side of the trade, FTD implies the lack of money to proceed with the order. On the sell side of the trade, it implies not owning the asset to be sold.

FTD is particularly connected to naked short selling, which has been illegal since the 2008 financial crisis. Naked short selling involves short selling a certain asset that you don't own or haven't borrowed. These nonexistent shares are often called "phantom shares."

This can have a negative consequence on the liquidity of the shorted asset, as well as diluting its share price.

In general, traders and retail investors closely watch gailure-to-deliver data. Many shareholders suspect that certain companies have been the target of predatory short-selling practices, such as naked shorting, which have hurt the performance of their stocks.

The SEC releases failure-to-deliver data for the first half of a given month at the end of that month. And it releases data for the second half of the given month around the 15th day of the following month.

Latest APE and AMC Failure-to-Deliver Data

AMC Preferred Equity (APE) went public on August 22. Since then, its associated failure-to-deliver have been drawing attention. Data for the six trading days between August 24 and August 31 indicates that there were 129,525,091 FTDs during that time period.

During the same period, AMC Entertainment's (AMC) stock recorded 6,294,387 FTDs.

To get a sense of how high these numbers are, Tesla's(TSLA) stock posted 183,594 FTDs in the same period, and fellow meme stock GameStop (GME) posted only 265,736 FTDs.

It's worth noting that, if a short seller intends to deliver an asset as soon as delivery restrictions are removed, the SEC grants them 35 calendar days following the settlement day in which to close out the position by purchasing the non-delivered securities.

Therefore, after this 35 calendar-day period, there's the possibility that the share prices of these securities will increase as deliveries are made.

But keep in mind that this technicality can only be considered in cases of relevant surges in FTDs – usually exceeding 1 million.

On August 24, APEs registered a whopping 43,438,257 FTDs. That's about $305 million worth when multiplied by the trading session's share price of $7.02. In the following days, the FTD count for APE did not go below 5.6 million.

During the same period, AMC shares also registered more than 1.3 million FTDs on three occasions, on August 24, 25, and 30.

The Bottom Line

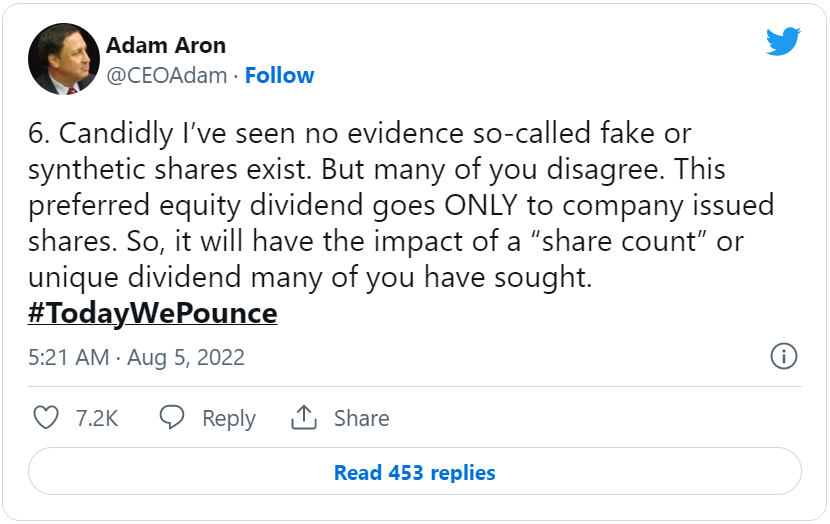

According to AMC CEO Adam Aron, one of the reasons AMC Preferred Equities were created was to shed light on short sellers' use of synthetic shares.

According to many retail investors who bet on AMC, the main factors preventing new short squeezes are fraud and a lack of transparency about trading structures in the U.S. financial market.

A disclaimer on the SEC website says, "Fails-to-deliver can occur for a number of reasons on both long and short sales." The SEC also reveals that "fails-to-deliver are not necessarily the result of short selling, and are not evidence of abusive short selling or 'naked' short selling."

Even though the debut of APEs in the stock market has caused high trading volumes and euphoria among retail investors, it's still unclear what could be behind such high numbers of FTDs, compared to the stock market as a whole.