Summary

- Spider-Man saved theater business in Q4 2021.

- Quarterly cash burn should be limited.

- Q1 may not be as strong if Omicron lingers.

When we look back at the history of US markets in 2021, one of the top names that will be remembered is AMC Entertainment (AMC). The theater chain became an investor favorite and meme stock that pushed shares dramatically higher. If not for massive dilution and multiple high interest rate debt offerings, the company would have easily gone bankrupt during the pandemic. While the year didn't look like it was going to end well for AMC, a superhero appeared that may help short term sentiment.

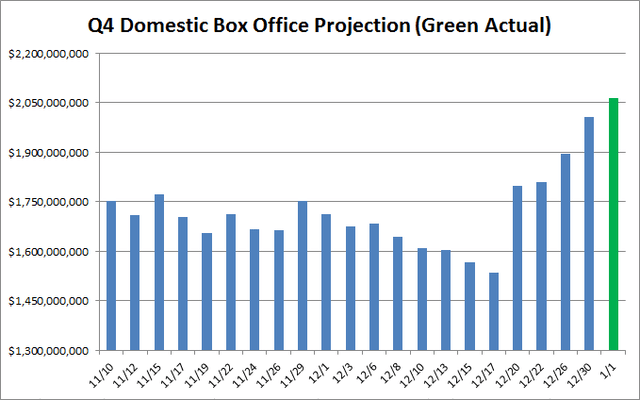

As I had detailed throughout the quarter and into mid-December, the domestic box office was not looking good. AMC needed $2 billion in box office grosses to get its adjusted cash burn metric to be positive. With just two weeks left in the quarter, projections had the domestic box office under $1.54 billion if the Q4 to date run rate held. I said previously that it would all come down toSpider-Man: No Way Home, and the movie definitely saved the day as the chart below shows.

For Q4, total grosses according to the site above came in over $2.06 billion. That should help to limit AMC's overall cash burn in the quarter, and maybe even gives the company a chance at being slightly cash flow positive. It may all come down to timing, however, as more than $775 million of the total quarterly domestic box office gross came in the last 15 days. Throw in the holidays, and some sizable cash inflows or outflows may not have happened until early January, which would impact Q4's figures.

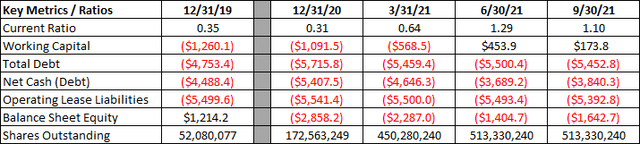

Depending on how some of the balance sheet items finished the year, it will be interesting to see if the company's working capital balance turns negative. AMC remains in a large net debt situation as the table below shows, only having been saved by massive dilution and high interest rate debt deals. For this company to get its financial situation in order, shareholders will need to approve an increase to the share count so that more capital can be raised through equity. Dollar values below are in millions.

While Q4 may have been saved by the late quarter moviegoer surge, it remains to be seen how the current quarter will fare. Not only is it a slightly shorter period, but there aren't any real blockbuster releases scheduled for the quarter. If you get a rough winter with a lot of bad weather, people will not head to the theaters, and of course we still have the Omicron variant rearing its ugly head currently. Things will likely get better for theaters once we enter the spring, but we could be in for a rough couple of months before that. This past weekend was a bit weaker than the first weekend in October, so Q1 is off to a slower start than its Q4 counterpart.

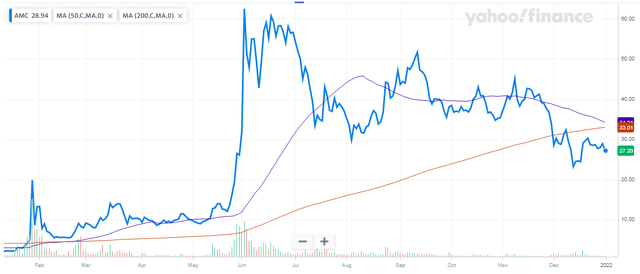

As for AMC shares, they enter the new year in a very interesting place. The overall valuation on a price to sales basis remains up dozens of times from its pre-pandemic levels. As a result, most street analysts see the stock as being dramatically overvalued. The other issue for the stock is that it is about to see the dreaded technical death cross as seen in the chart below, as the 50-day moving average (purple line) breaks below the 200-day (orange line). Declining trend lines could provide resistance for the stock, as shares have not been able to close back above the 50-day since they last broke below it.

In the end,Spider-Mancertainly saved the theater business in Q4, which will help AMC Entertainment to report a halfway decent quarter. I don't know if the late quarter surge will be enough to get the company to true cash flow positive territory, but things certainly could have been a lot worse. Q1 is likely to be a little weaker both seasonally and due to Omicron, but things should improve as the year progresses. In the long run, the company will need some fresh capital to shore up a terrible balance sheet.