Expectations about inflation’s short-term impact on growth- and value stocks have no historical basis

Don’t look to the latest inflation figures to help you time the U.S. stock market’s near-term ups and downs.

That’s worth keeping in mind because, based on recent experience, you’d be excused for thinking that inflation plays a powerful role in the stock market’s shorter-term gyrations. During the inflation scare between mid-April and mid-May, for example, value stocks outperformed growth stocks — just as conventional wisdom would expect. Since mid-May, inflation worries have receded and value stocks have lagged.

It doesn’t always work out this neatly. In fact, I could find no noteworthy historical relationship between inflation’s short-term trend and the performance of either the stock market as a whole or the relative performance of value- and growth stocks.

To search for such correlations, I started by analyzing monthly inflation, interest rates and stock market data from Yale University finance professor Robert Shiller going back to 1871. I calculated the correlation coefficients between inflation and the S&P 500 over different short-term periods extending from the trailing one month to trailing 12 months.

I largely came up empty. Consider the extent to which changes in the CPI explain or predict simultaneous changes in the S&P 500 (as measured by a statistic known as r-squared). Regardless of the time horizon between one- and 12 months, the CPI (or its predecessor) since 1871 has been able to predict no more than 4% of the S&P 500’s gyrations. (Note carefully that, when measuring these correlations, I focused on the S&P 500’s inflation-adjusted total return so as not to bias my calculations.)

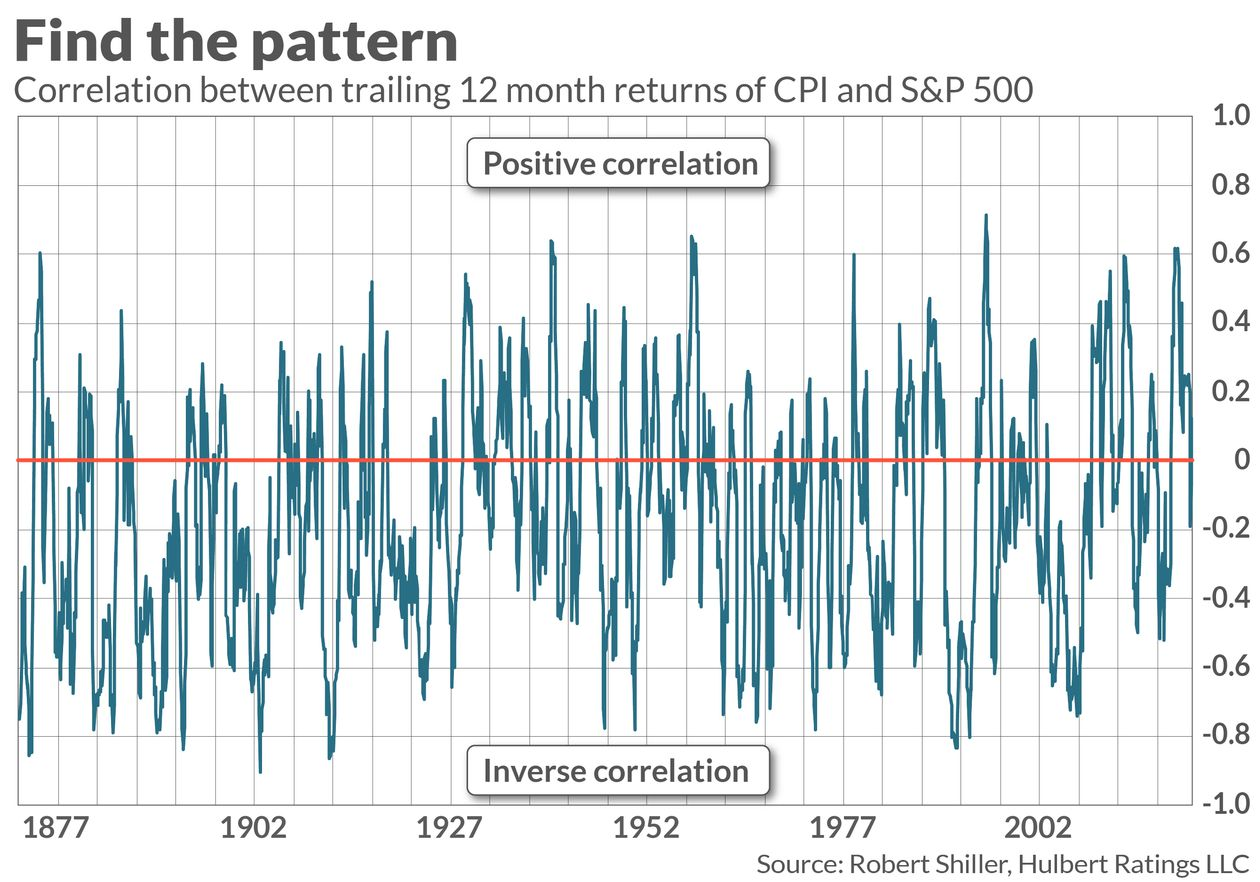

One of the reasons for the absence of a strong correlation is that the stock market has a love-hate relationship with inflation. When investors are more worried about economic weakness, or even deflation, higher inflation is sometimes seen as a good thing. At other times inflation and stocks are inversely correlated.

This fluctuating correlation is illustrated in the chart below, which tracks the correlation coefficient between the CPI and the S&P 500’s inflation-adjusted total return over the trailing 12 months. Notice the absence of any consistent relationship.

As a double-check on this surprising conclusion, I reran my analysis focusing on interest rates rather than the CPI. That’s revealing because interest rates reflect not only recent changes in inflation but also expected future inflation. The correlations between short-term movements in interest rates and the stock market were even weaker than when I focused on inflation.

Value vs. growth when inflation and interest rates rise

What about value’s performance relative to growth? Surely it historically has followed the same pattern we’ve seen over the past couple of months?

Not so. To reach that counterintuitive conclusion, I analyzed the monthly returns of U.S. value and growth stocks since 1926, courtesy of data from Dartmouth College finance professor Ken French. (Specifically, the value stock portfolio contained the 30% of the U.S. market with the lowest book/market ratios, while the growth stock portfolio contained the 30% with the highest such ratios.) When focusing on all trailing time periods from one- to 12 months, I found no statistically significant correlation between inflation and the relative performance of value and growth stocks.

Even more surprising is what emerged when focusing on the relationship between interest rates and value’s performance relative to growth: I found an inverse correlation. That is just the opposite of what we saw over the past couple of months, and the opposite of what conventional wisdom teaches us about how value stocks should perform in a rising interest rate environment.

My analysis doesn’t suggest that investors should now do the opposite, betting on value when previously they bet on growth, or vice versa. The point of this analysis is that there’s an unsteady and often insignificant historical relationship between inflation and interest rates, on the one hand, and the stock market and value’s performance relative to growth, on the other.

Short-term stock-market timers need to look elsewhere for stronger clues as to where the market is headed.