Even after a poor performance in 2021, investors may find reasons to invest in DIS this month.

Despite Disney's poor performance in recent months, it's possible to find reasons to invest in the stock in April. Investors can take advantage of the current drop in the company's share price to get an even better deal.

Having declined since last year, Disney's stock has spooked some investors. But we believe that some points like past returns, the company's 2022 performance, and its price being below its market peers are details that everyone should pay attention to in the coming weeks.

Here are three reasons you should consider buying DIS in April.

1. Historical Data Points to a Good Month

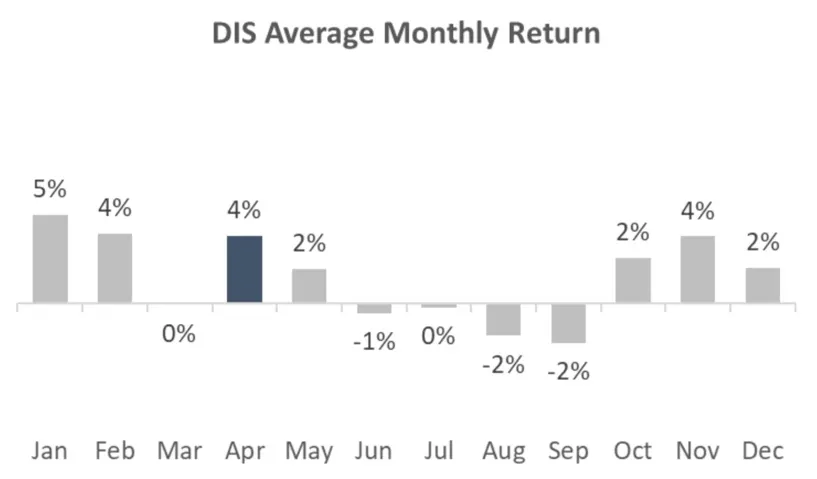

To understand the dynamics of the company, we calculated the average DIS returns for each month. The result is the following graph:

Looking at the stock since its IPO, DIS performs best in months near the end and beginning of each year. Even so, April is one of the only months through October that DIS shows a positive average return.

Moreover, April is the third month of the year in which the company sees the highest average returns. But investors should be aware that the past may often not represent what will happen in the future.

2. End-of-Year Results Should Lift DIS

For long-term investors, buying Disney stock now, when the company is on a downswing, might be a good option. This is because the company has several plans to further increase its profits and has been meeting its long-term goals announced at Investor Day 2020.

Most of Disney's revenue in 2022 should occur in the last quarters of the fiscal year, when most of its anticipated films will be released. Also, over time, the theme parks should continue to increase their visitor numbers, returning to pre-COVID levels later this year.

3. DIS Is Cheap Compared to Its Peers

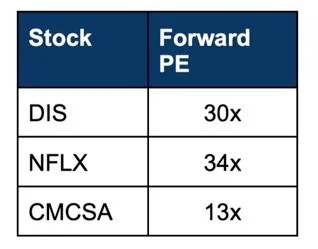

Trading at a forward P/E (Sept. 22) of 30.4 times, Disney is at lower multiples than some of its peers. That includes Netflix, which has had a drastic drop in recent months and still trades at higher multiples than Disney.

The devaluation of the stock in 2021 and early 2022 also opens up an opportunity to buy DIS at lower values than it had been trading at in recent years. Since the beginning of the year, the stock is already down about 14%.

In addition, DIS is far from its 52-weeks high of $192. Should the stock return to the same levels, this would mean an appreciation of more than 40% from the current price of $135.