This S&P 500 pullback is unlikely to be very deep.

The stock market’s bears finally have broken through and several factors have combined to spark this setback in stock prices.

First, retail investors are losing interest in stocks. Remember the retail frenzy as the Reddit crowd whipped up enthusiasm for meme stocks? Remember how flash mobs drove up selected issues with call-option buying which forced market-makers to hedge by buying the underlying stocks?

That’s mostly gone. In the short run, there was a lot of hand-wringing about the call buying as a sign of excessive speculation. My longer-term view is a rising equity call/put ratio is a sign of bullish momentum and rising call/put ratios were coincidental with equity bull phases. In the past, a decline of the 50-day moving average (dma) of the call/put ratio below the 200-day moving average has signaled pauses in bullish advances in the past.

Bad news from overseas on the pandemic front may have also contributed to the risk-off tone. Taiwan announced limits on crowds, following Singapore’s move to restrict foreign workers, in a wave of new restrictions in Asian countries trying to stamp out small outbreaks after months of keeping COVID-19 contained.

The new curbs prompted fears that economic growth could stall out, which led to stock selloffs in both countries this week. Low vaccination rates as well are contributing to concerns that their populations could be vulnerable if faster-spreading variants take hold.

The burst of stock-market gains and push to new highs early on Monday was reversed during the session, causing a spike in the number of stocks suffering a buying climax. This is triggered when a stock hits a 52-week high then reverses to close below the prior day’s close, potentially a sign of exhaustion among buyers.

Our Backtest Engine shows that this is the sixth-largest number of climaxes in a single day since the inception of the SPDR S&P 500 ETF TrustSPY,-2.12%.Every time more than 95 stocks suffered a buying climax, the S&P 500SPX,-2.14%showed a loss over the next one-to-two months. There were few losses over the next six-12 months, and they were relatively small.

Equally disturbing is the performance of the bellwether growth-cyclical PHLX Semiconductor IndexSOX,-4.20%.This index has now violated both absolute- and relative rising trend lines that stretched back a year.

Putting it all together, these are all signs that the bears are taking control of the tape.

Where’s the bottom?

This S&P 500 pullback is unlikely to be very deep. A logical support level is the 50-day moving average, at about 4050, which represents a peak-to-trough downside risk of -4.4% and just 1% down from current levels.

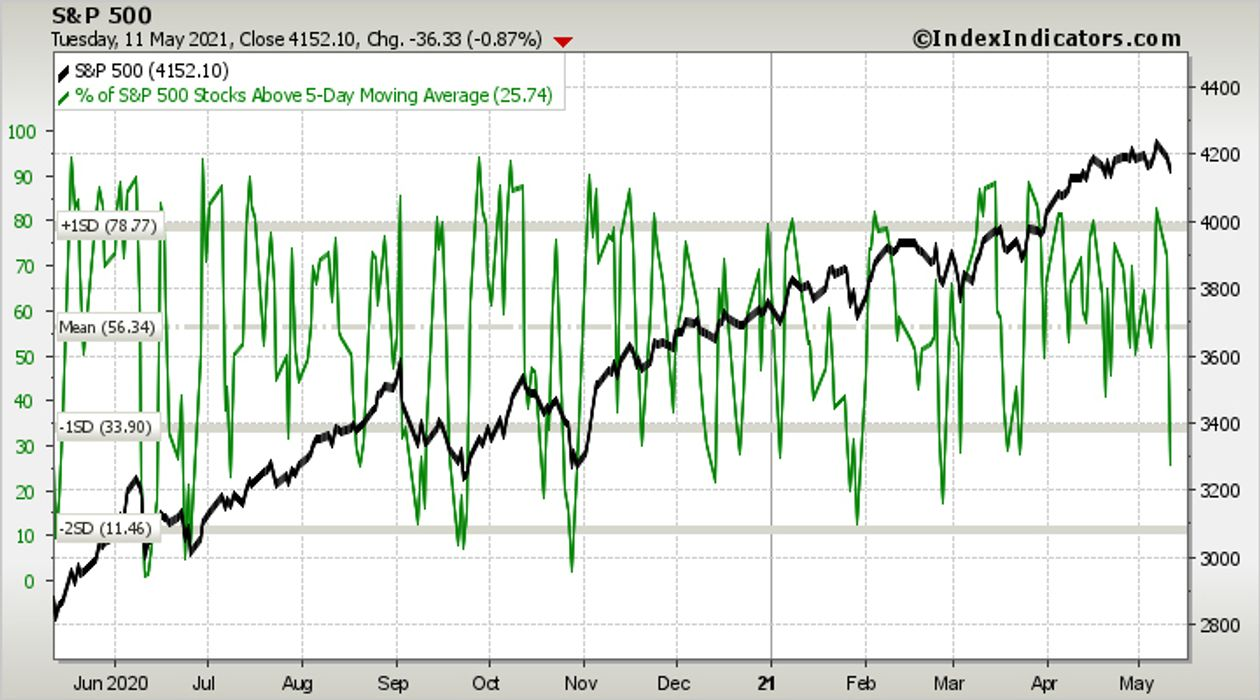

Some of my bottoming indicators are already starting to come into place. The five-day RSI is flashing an oversold reading, which is the first sign of a bottoming process. The CBOE Volatility IndexVIX,-1.01%(VIX) has spiked above its upper Bollinger Band, which is also a short-term oversold indicator for the stock market.

However, the term structure of the VIX is not inverted, indicating fear. Markets need panic to set in for a durable bottom to be made. As well, the NYSE McClellan Oscillator (NYMO) has not flashed an oversold condition yet.

While the S&P 500 is holding up relatively well and being supported by the relative strength of value stocks, growth stocks show considerably more downside risk. Despite violating its 50-day moving average and violating an important relative support zone, the NASDAQ 100NDX,-2.62%is not showing any signs of a durable bottom ahead. The percentage of Nasdaq stocks above their 50-day moving average is not oversold, and neither is the NASDAQ McClellan Oscillator (NAMO). The most logical support level for NASDAQ 100 is the 200-day moving average at about 12,500.

The market was already oversold as of Tuesday’s close. Wednesday’s skid will undoubtedly stretch short-term readings further. In all likelihood, the market will bounce on Thursday, but how it holds the strength will be a test for both bulls and bears in the coming days. The primary trend is still up, and the risk/reward of trying to profit from a countertrend correction in a bull market is unfavorable.

Cam Hui writes the investment blogHumble Student of the Markets. He is a former equity portfolio manager and sell-side analyst.