The IPO market's run of small issuers continued this past week with two healthcare micro-caps, joined by five SPACs. The pipeline was fairly active with initial filings from three IPOs and two SPACs.

Meihua International Medical Technologies (MHUA) downsized and priced at the midpoint to raise $36 million at a $236 million market cap.The first China-based issuer to IPO in the US in months, Meihua provides disposable medical devices to hospitals, pharmacies, medical institutions, and medical equipment companies primarily in China. The company is profitable and growing, though it is affected by tightening regulatory environment. Meihua finished down 18%.

Biotech Blue Water Vaccines (BWV) priced at the midpoint to raise $20 million at a $105 million market cap. Blue Water is focused on the research and development of transformational vaccines to prevent infectious diseases worldwide. Its lead program, BWV-101, is licensed from the University of Oxford and is being developed as a transformational novel universal influenza vaccine. Blue Water was the latest small issuer to soar in its debut, finishing up 538%.

Five SPACs went public led by media and entertainment-focused PowerUp Acquisition (PWUPU), which raised $250 million.

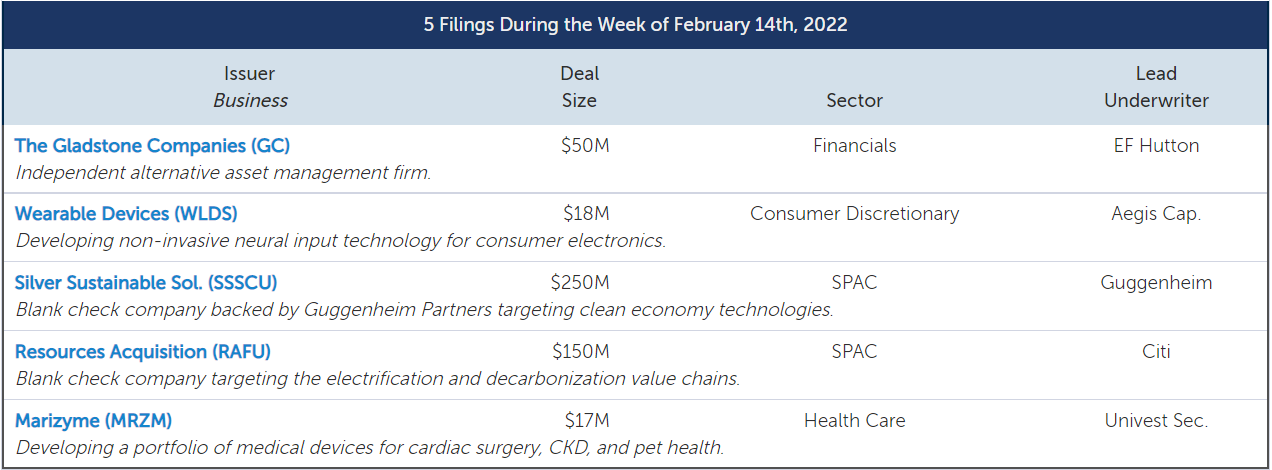

Three IPOs submitted initial filings. Alternative asset manager The Gladstone Companies (GC) filed to raise $50 million. Neural input tech developer Wearable Devices (WLDS) filed to raise $18 million, and OTC-listed medical device developer Marizyme (MRZM) filed to raise $17 million.

For SPACs, Guggenheim-backed Silver Sustainable Solutions (SSSCU) filed to raise $250 million, and decarbonization-focused Resources Acquisition (RAFU) filed to raise $150 million.

IPO Market Snapshot

The Renaissance IPO Indices are market cap weighted baskets of newly public companies. As of 2/17/2022, the Renaissance IPO Index was down 20.7% year-to-date, while the S&P 500 was down 7.9%. Renaissance Capital's IPO ETF (NYSE: IPO) tracks the index, and top ETF holdings include Uber Technologies (UBER) and Snowflake (SNOW). The Renaissance International IPO Index was down 10.8% year-to-date, while the ACWX was down 1.8%. Renaissance Capital’s International IPO ETF (NYSE: IPOS) tracks the index, and top ETF holdings include Volvo Car Group and Kuaishou.