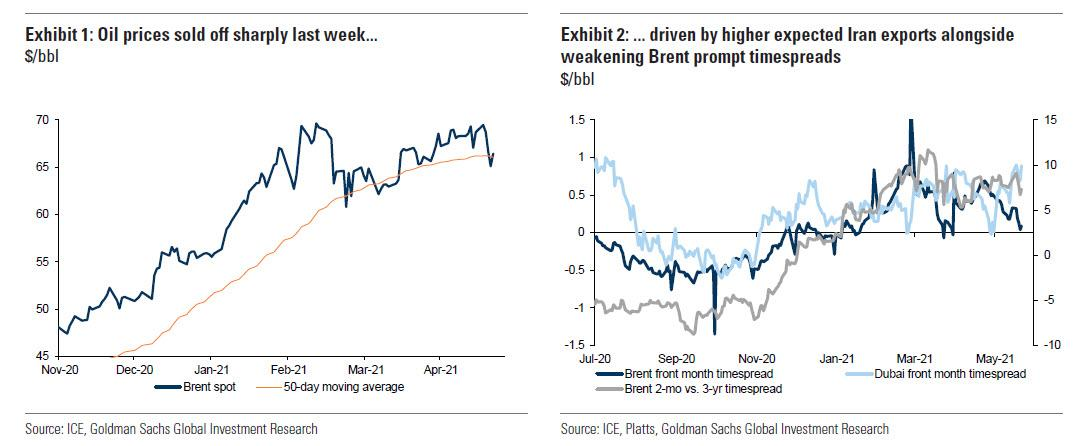

Toward the end of Q1, Goldman Sachs along with virtually every other major bank, predicted that oil had nowhere else to go but up, with bank after bank hiking their oil forecast. It also top-ticked the market, as Goldman's Damien Courvalin writes in a note published on Sunday discussing "the path to higher oil prices", in which he admits that despite the bank's "balls to the wall" bullish stance on crude, "the oil rally has given way to sideways volatility since March, due to concerns over vaccination pace, EM Covid waves and the return of Iranian barrels, with the latter pushing Brent prices down from $70 to $65/bbl last week." Or, as the bank calculates, "last week’s large sell-off was equivalent to bringing forward by 3 months a 1 mb/d increase in global production, leaving the market likely pricing the return of Iranian barrels by late summer."

After such a retracement, the Goldman commodities strategist predicts that while the market is now "pricing a return of Iranian barrels by late summer" it is again "underestimating the upcoming demand rebound, too pessimistic a view on both accounts." Which, of course, is someone that is bullish on oil would say.

Anyway, here is Courvalin's math explaining why the market is too pessimistic in his view:

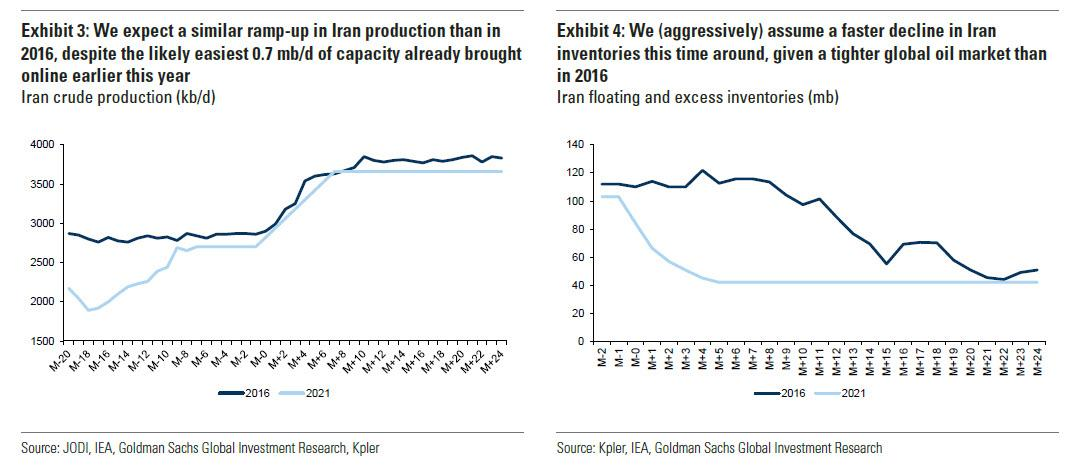

- On Iran, while comments suggest significant progress has indeed been made, the timelinen is still uncertain asaccording to press reports, negotiations appear focused on an agreement on the conditions for reinstating the JCPOA, implying a lag (or potential impasse) in lifting US secondary oil sanctions, or conditions that could limit the size of such a restart.

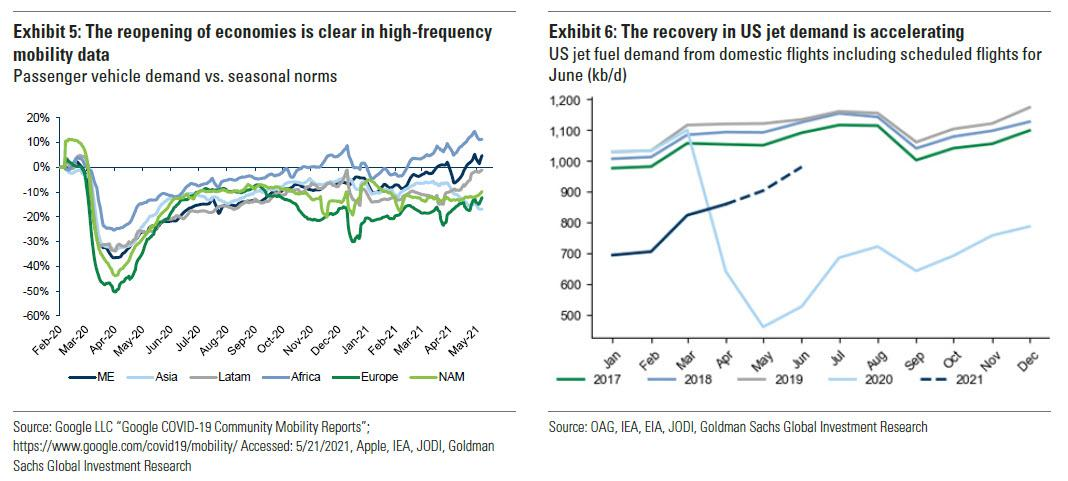

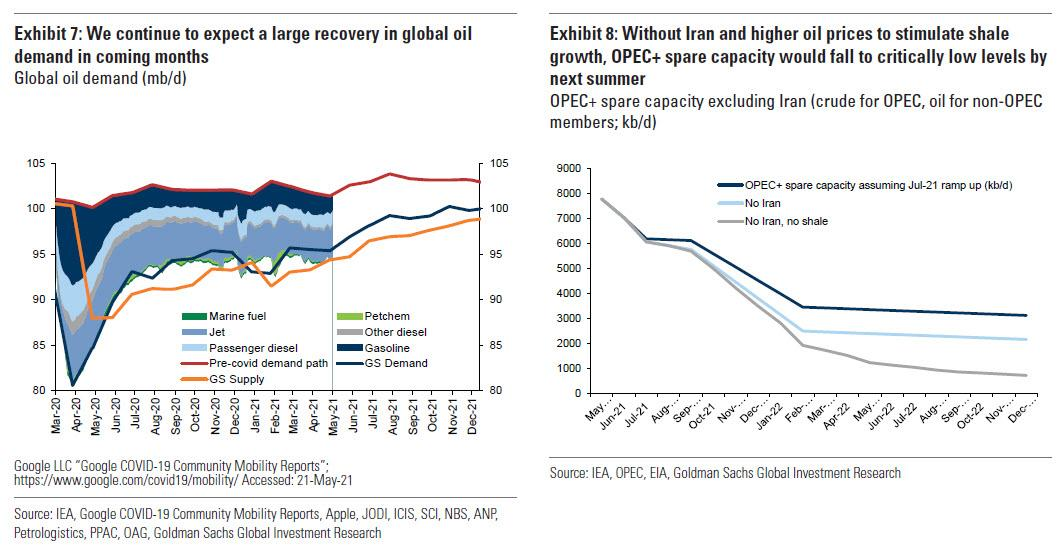

- On demand, Goldman says that the recovery in DM mobility and travel is on track to exceed its expectations, helping offset the recent hit to South Asia and Latin America demand: "Mobility is rapidly increasing in the US and Europe, as vaccinations accelerate and lockdowns are lifted, with freight and industrial activity also surging. This DM recovery is in fact larger than we had assumed, helping offset the recent hit to demand and the likely slower recovery in South Asia and Latin America."

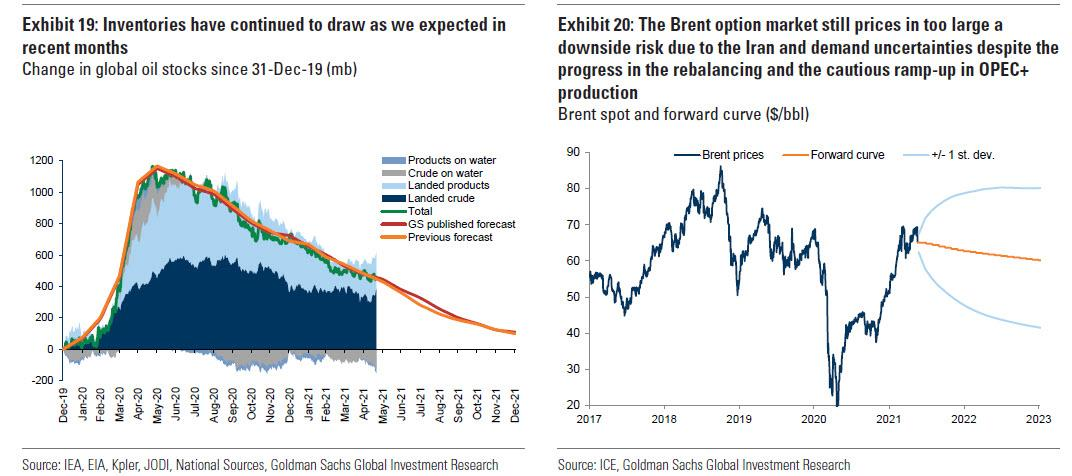

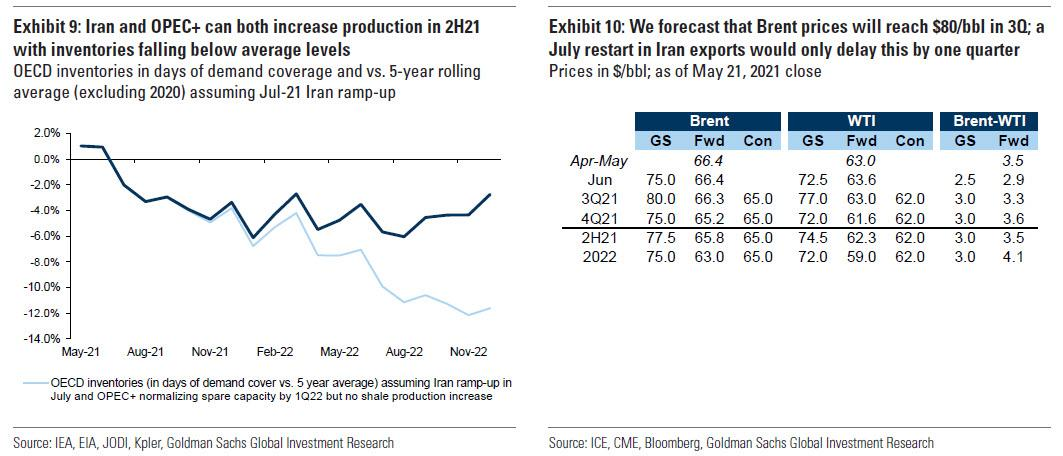

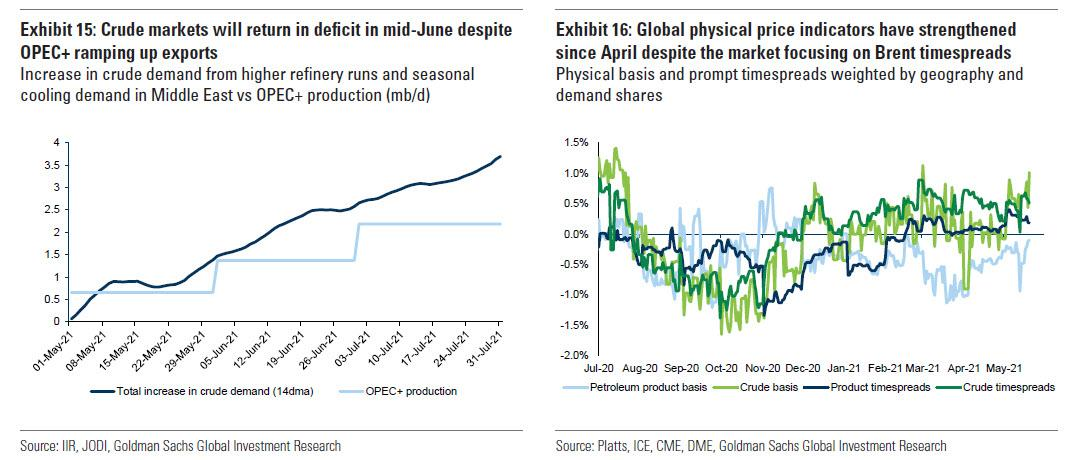

- On supply, Goldman is lowering its non-OPEC+ production forecasts to account for still depressed activity levels and a slower expected rebound from shale. Given the current global deficit of 1.8 mb/d in 2Q21, Goldman believes that this demand impulse will not only absorb remaining excess inventories and a potential July ramp-up in Iran supply...

- ... but still require a cumulative additional 2.8 mb/d increase in OPEC+ production by Dec-21 (requiring an early exit from their April 2020 agreement).

Putting these three together, Goldman assures its clients that the "case for higher oil prices therefore remains intact given the large vaccine-driven increase in demand in the face of inelastic supply."

Assuming this is accurate, Courvalin's next argument is that the path to higher prices is the key uncertainty and to address this, he runs scenarios on Goldman's updated supply-demand balance, adjusting the OPEC+ and shale responses to various timings of Iran's potential export recovery:"Even aggressively assuming a restart in July, we estimate that Brent prices would still reach $80/bbl in 4Q21, with our new base case for an October restart still supporting our $80/bbl forecast for this summer."

Goldman's conclusion is some humble... " despite the global market deficit coming in line with our forecasts in recent months, we under-estimated the weight of such demand and Iran uncertainties, keeping prices trading below our $75/bbl 2Q21 fair value" before trying to convince the market that it will be right, damn it: "With growing evidence of the demand rebound, and imminent clarification on the likelihood of an Iranian return,we now see a clearer path for the next leg higher in oil prices, with the sell-off offering opportunities to position for the rally to $80/bbl."

To be sure, this is not the first time Goldman has had outrageous predictions about oil prices, with the current forecast nowhere near Goldman's $200/bbl prediction from the summer of 2008. On the other hand, with prices across all goods and services already surging, there will be nobody more relieved if Goldman is wrong on this one, than Joe Biden...